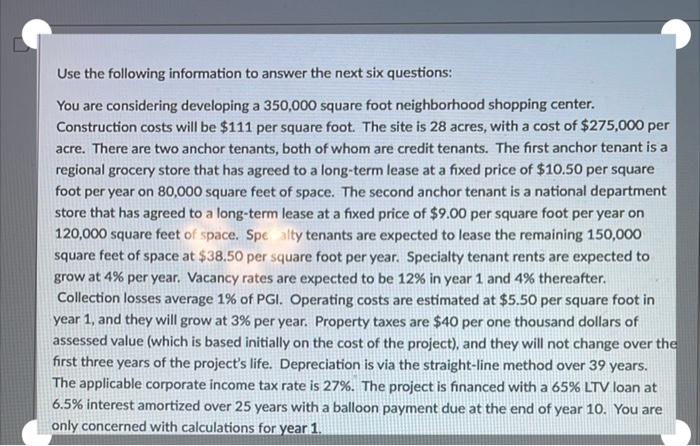

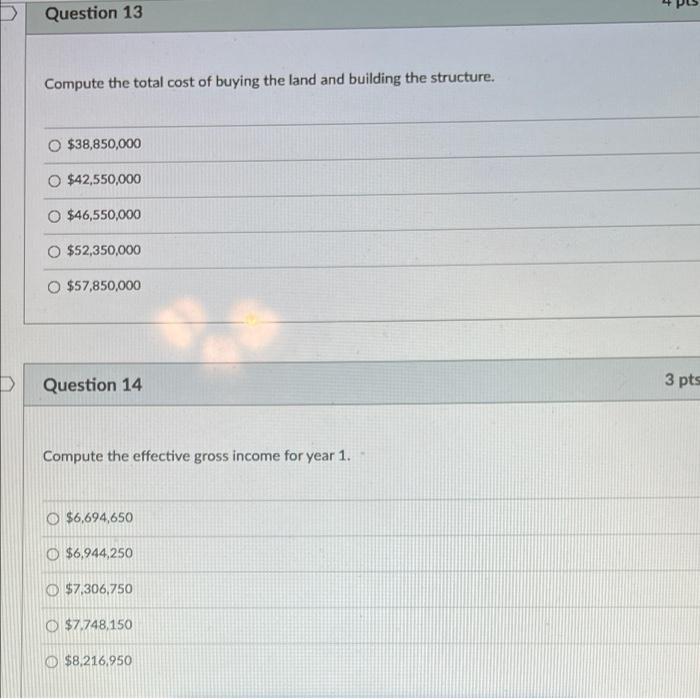

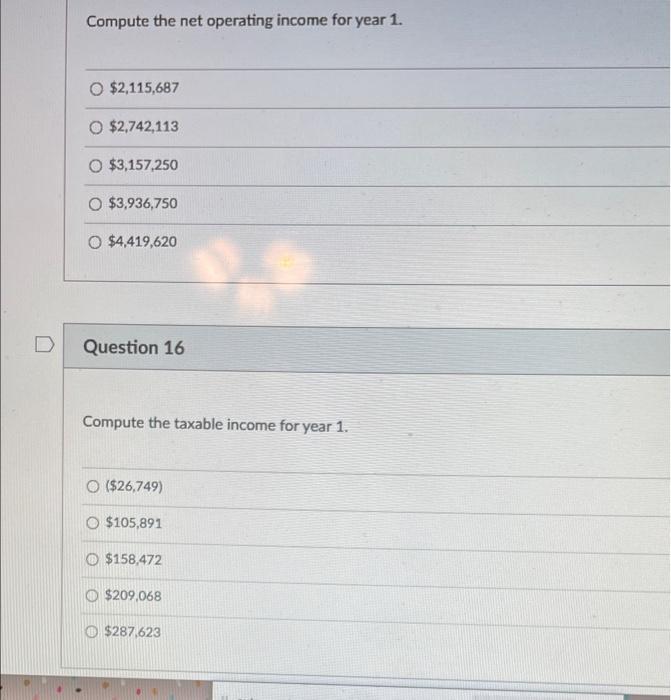

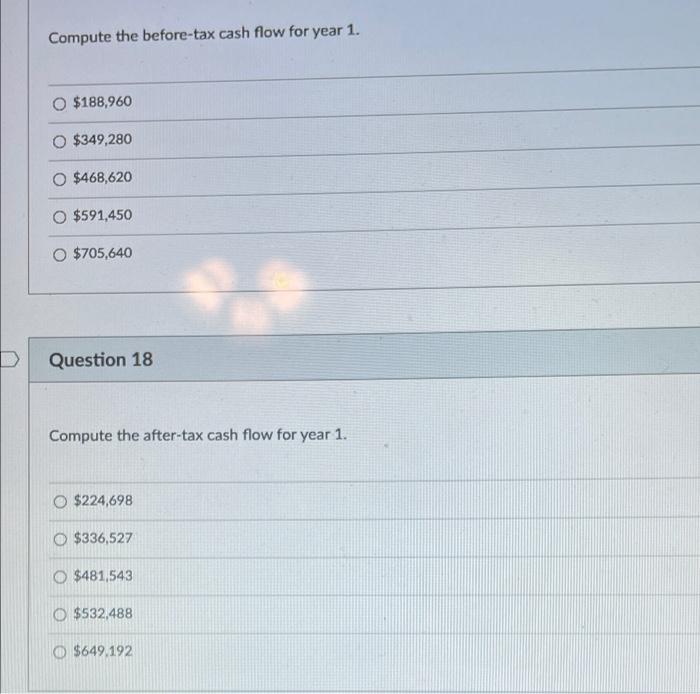

Use the following information to answer the next six questions: a You are considering developing a 350,000 square foot neighborhood shopping center. Construction costs will be $111 per square foot. The site is 28 acres, with a cost of $275,000 per acre. There are two anchor tenants, both of whom are credit tenants. The first anchor tenant is a regional grocery store that has agreed to a long-term lease at a fixed price of $10.50 per square foot per year on 80,000 square feet of space. The second anchor tenant is a national department store that has agreed to a long-term lease at a fixed price of $9.00 per square foot per year on 120,000 square feet of space. Spe alty tenants are expected to lease the remaining 150,000 square feet of space at $38.50 per square foot per year. Specialty tenant rents are expected grow at 4% per year. Vacancy rates are expected to be 12% in year 1 and 4% thereafter. Collection losses average 1% of PGI. Operating costs are estimated at $5.50 per square foot in year 1, and they will grow at 3% per year. Property taxes are $40 per one thousand dollars of assessed value (which is based initially on the cost of the project), and they will not change over the first three years of the project's life. Depreciation is via the straight-line method over 39 years. The applicable corporate income tax rate is 27%. The project is financed with a 65% LTV loan at 6.5% interest amortized over 25 years with a balloon payment due at the end of year 10. You are only concerned with calculations for year 1 4 D Question 13 Compute the total cost of buying the land and building the structure. O $38,850,000 0 $42,550,000 O $46,550,000 O $52,350,000 O $57,850,000 D Question 14 3 pts Compute the effective gross income for year 1. $6,694,650 O $6,944,250 $7,306,750 O $7.748,150 $8,216,950 Compute the net operating income for year 1. $2,115,687 $2,742,113 O $3,157,250 $3,936,750 $4,419,620 Question 16 Compute the taxable income for year 1. O ($26,749) O $105,891 O $158,472 $209,068 $287,623 Compute the before-tax cash flow for year 1. $188,960 O $349,280 $468,620 O $591,450 O $705,640 Question 18 Compute the after-tax cash flow for year 1. O $224,698 $336,527 O $481,543 O $532,488 O $649,192 Use the following information to answer the next six questions: a You are considering developing a 350,000 square foot neighborhood shopping center. Construction costs will be $111 per square foot. The site is 28 acres, with a cost of $275,000 per acre. There are two anchor tenants, both of whom are credit tenants. The first anchor tenant is a regional grocery store that has agreed to a long-term lease at a fixed price of $10.50 per square foot per year on 80,000 square feet of space. The second anchor tenant is a national department store that has agreed to a long-term lease at a fixed price of $9.00 per square foot per year on 120,000 square feet of space. Spe alty tenants are expected to lease the remaining 150,000 square feet of space at $38.50 per square foot per year. Specialty tenant rents are expected grow at 4% per year. Vacancy rates are expected to be 12% in year 1 and 4% thereafter. Collection losses average 1% of PGI. Operating costs are estimated at $5.50 per square foot in year 1, and they will grow at 3% per year. Property taxes are $40 per one thousand dollars of assessed value (which is based initially on the cost of the project), and they will not change over the first three years of the project's life. Depreciation is via the straight-line method over 39 years. The applicable corporate income tax rate is 27%. The project is financed with a 65% LTV loan at 6.5% interest amortized over 25 years with a balloon payment due at the end of year 10. You are only concerned with calculations for year 1 4 D Question 13 Compute the total cost of buying the land and building the structure. O $38,850,000 0 $42,550,000 O $46,550,000 O $52,350,000 O $57,850,000 D Question 14 3 pts Compute the effective gross income for year 1. $6,694,650 O $6,944,250 $7,306,750 O $7.748,150 $8,216,950 Compute the net operating income for year 1. $2,115,687 $2,742,113 O $3,157,250 $3,936,750 $4,419,620 Question 16 Compute the taxable income for year 1. O ($26,749) O $105,891 O $158,472 $209,068 $287,623 Compute the before-tax cash flow for year 1. $188,960 O $349,280 $468,620 O $591,450 O $705,640 Question 18 Compute the after-tax cash flow for year 1. O $224,698 $336,527 O $481,543 O $532,488 O $649,192