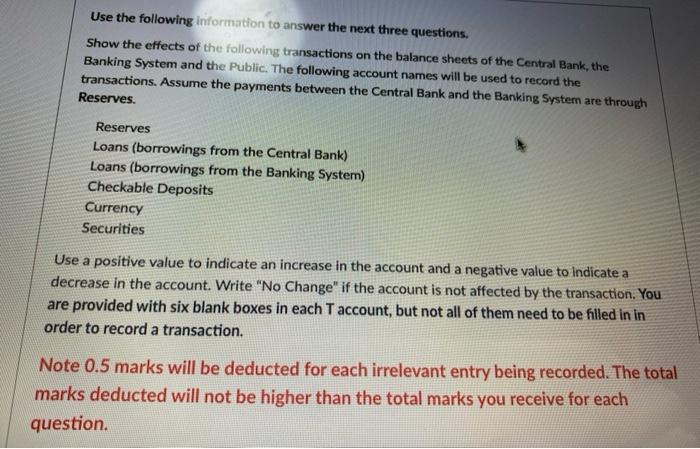

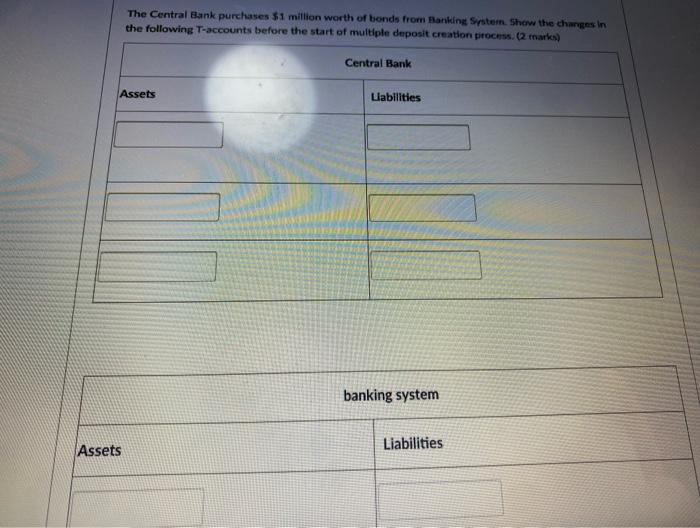

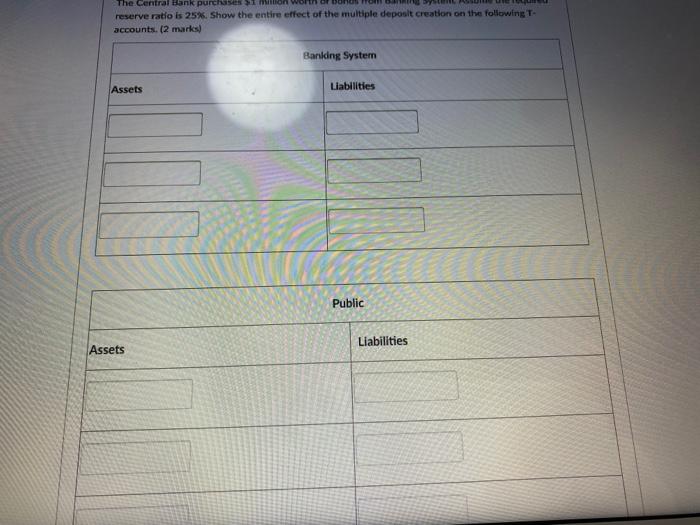

Use the following information to answer the next three questions. Show the effects of the following transactions on the balance sheets of the Central Bank, the Banking System and the Public. The following account names will be used to record the transactions. Assume the payments between the Central Bank and the Banking System are through Reserves. Reserves Loans (borrowings from the Central Bank) Loans (borrowings from the Banking System) Checkable Deposits Currency Securities Use a positive value to indicate an increase in the account and a negative value to indicate a decrease in the account. Write "No Change" if the account is not affected by the transaction. You are provided with six blank boxes in each T account, but not all of them need to be filled in in order to record a transaction. Note 0.5 marks will be deducted for each irrelevant entry being recorded. The total marks deducted will not be higher than the total marks you receive for each question. The Central Bank purchases $1 million worth of bonds from Banking Stem Show the changes in the following T-accounts before the start of multiple deposit creation process. (2 marks) Central Bank Assets Llabilities banking system Assets Liabilities The Central Bank purchases on reserve ratio is 25%. Show the entire effect of the multiple deposit creation on the following T- accounts. (2 marks) Banking System Assets Liabilities Public Liabilities Assets Use the following information to answer the next three questions. Show the effects of the following transactions on the balance sheets of the Central Bank, the Banking System and the Public. The following account names will be used to record the transactions. Assume the payments between the Central Bank and the Banking System are through Reserves. Reserves Loans (borrowings from the Central Bank) Loans (borrowings from the Banking System) Checkable Deposits Currency Securities Use a positive value to indicate an increase in the account and a negative value to indicate a decrease in the account. Write "No Change" if the account is not affected by the transaction. You are provided with six blank boxes in each T account, but not all of them need to be filled in in order to record a transaction. Note 0.5 marks will be deducted for each irrelevant entry being recorded. The total marks deducted will not be higher than the total marks you receive for each question. The Central Bank purchases $1 million worth of bonds from Banking Stem Show the changes in the following T-accounts before the start of multiple deposit creation process. (2 marks) Central Bank Assets Llabilities banking system Assets Liabilities The Central Bank purchases on reserve ratio is 25%. Show the entire effect of the multiple deposit creation on the following T- accounts. (2 marks) Banking System Assets Liabilities Public Liabilities Assets