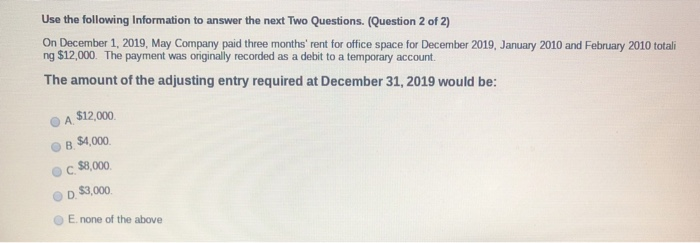

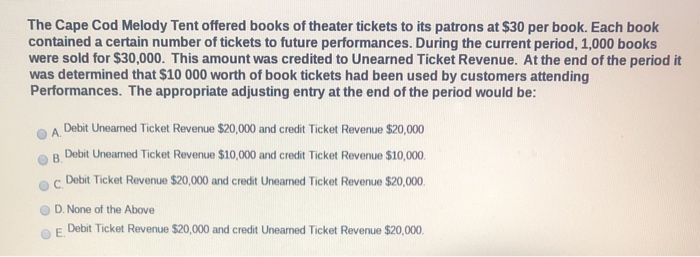

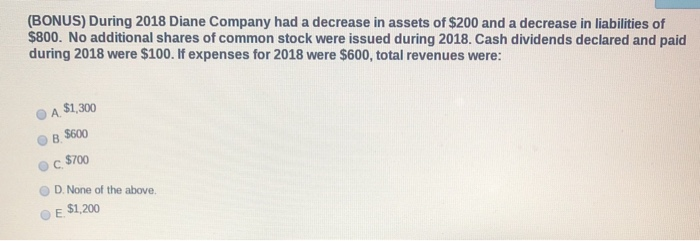

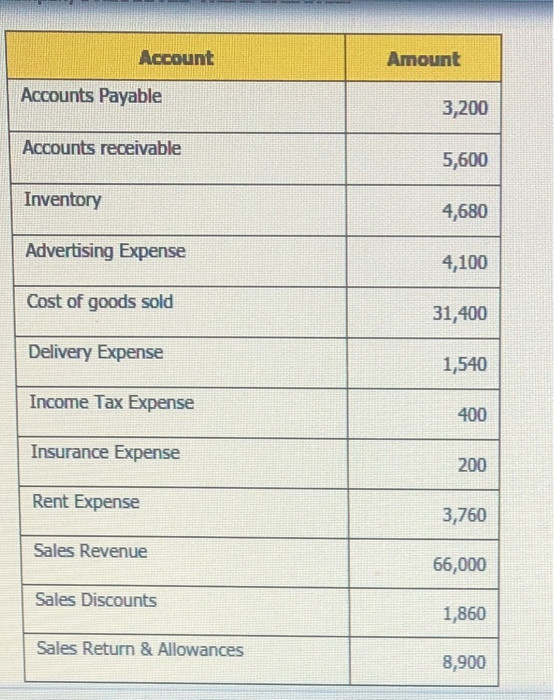

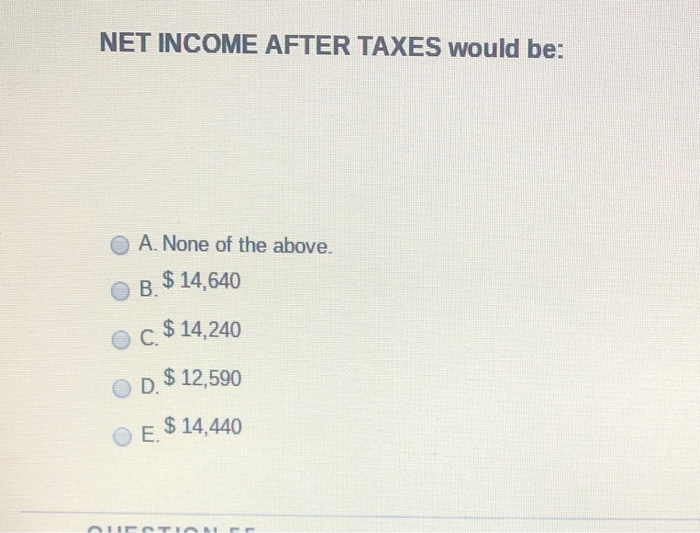

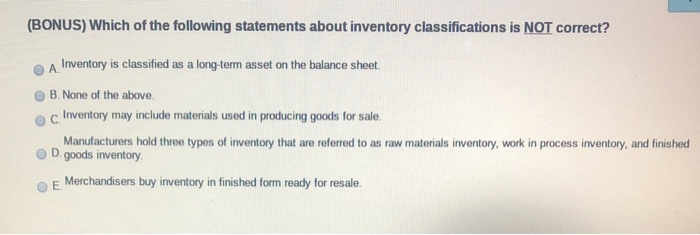

Use the following Information to answer the next Two Questions. (Question 2 of 2) On December 1, 2019, May Company paid three months' rent for office space for December 2019, January 2010 and February 2010 totali ng $12,000. The payment was originally recorded as a debit to a temporary account The amount of the adjusting entry required at December 31, 2019 would be: $12,000 B. $4,000 C $8,000 $3,000 D E.none of the above The Cape Cod Melody Tent offered books of theater tickets to its patrons at $30 per book. Each book contained a certain number of tickets to future performances. During the current period, 1,000 books were sold for $30,000. This amount was credited to Unearned Ticket Revenue. At the end of the period it was determined that $10 000 worth of book tickets had been used by customers attending Performances. The appropriate adjusting entry at the end of the period would be: A . Debit Unearned Ticket Revenue $20,000 and credit Ticket Revenue $20,000 Debit Unearned Ticket Revenue $10,000 and credit Ticket Revenue $10,000. c. Debit Ticket Revenue $20,000 and credit Unearned Ticket Revenue $20,000. D. None of the Above E Debit Ticket Revenue $20,000 and credit Unearned Ticket Revenue $20,000 (BONUS) During 2018 Diane Company had a decrease in assets of $200 and a decrease in liabilities of $800. No additional shares of common stock were issued during 2018. Cash dividends declared and paid during 2018 were $100. If expenses for 2018 were $600, total revenues were: A $1,300 B $600 C $700 D. None of the above. E $1,200 Account Amount Accounts Payable 3,200 Accounts receivable 5,600 Inventory 4,680 Advertising Expense 4,100 Cost of goods sold 31,400 Delivery Expense 1,540 Income Tax Expense 400 Insurance Expense 200 Rent Expense 3,760 Sales Revenue 66,000 Sales Discounts 1,860 Sales Return & Allowances 8,900 NET INCOME AFTER TAXES would be: A. None of the above. B. $ 14,640 C. $ 14,240 D. $ 12,590 E. $ 14,440 LIETIAM (BONUS) Which of the following statements about inventory classifications is NOT correct? Inventory is classified as a long-term asset on the balance sheet. B. None of the above c Inventory may include materials used in producing goods for sale. Manufacturers hold three types of inventory that are referred to as raw materials inventory, work in process inventory, and finished D.goods inventory E Merchandisers buy inventory in finished form ready for resale