Furnival has a dist illation plant that produ ces three joint produ ct s, P. Q and

Question:

Furnival has a dist illation plant that produ ces three joint produ ct s, P. Q and R.

in the proportions. 10:5:5. After the spl it off point the produ cts can be sold for industrial use or they can be taken to the mixing plant for blending and ref ining . The latter proc edure is normally followed .

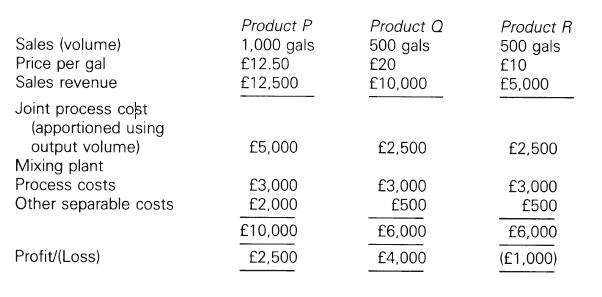

For a typica l week. in which all the output is processed in the mixing plant. the following Profit and Loss Account can be prepared :

The joint process costs are 25% fixed and 75% variable, whereas the mixing plant costs are 10% fixed and 90% variable and all the 'other separable costs' are variable.

If the products had been sold at the split-off point the selling price per gallon would have been :

There are only 45 hours available per week in the mixing plant. Typically 30 hours are taken up with the processing of products P, Q and R (10 hours for each product line) and 15 hours are used for other work that generates (on average) a profit of £200 per hour after being charged with a proportionate share of the plant's costs (including fixed costs). The manager of the mixing plant considers that he could sell all the plant's processing time externally at a price that would provide this rate of profit.

It has been suggested:

(i) that , since product R regularly makes a loss, it should be sold off at the split-off point.

(ii) that it might be possible advantageously to change the mix of products achieved in the distillation plant. It is possible to change the output proportions to 7:8 :5 at a cost of £1 for each additional gallon of Q produced by the distillation plant.

You are required to compare the costs and benefits for each of the above proposals. Use your analysis, to suggest any improvements that seem profitable and set out the weekly Profit and Loss Account for the improved plan, in a manner which you consider will assist the management with further problems of this type .

Step by Step Answer: