Answered step by step

Verified Expert Solution

Question

1 Approved Answer

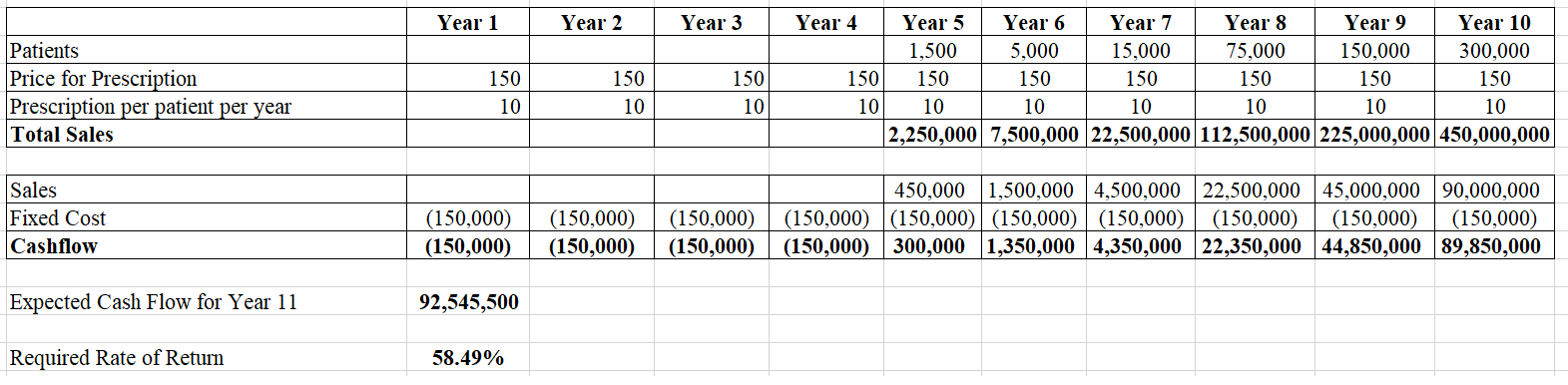

Use the following information to answer the question: Using the forecast of cash flows and the required rate of return, value this firm. (This is

Use the following information to answer the question:

Using the forecast of cash flows and the required rate of return, value this firm. (This is an uneven growth, valuation problem).

Year 1 Year 2 Year 3 Year 4 150 Patients Price for Prescription Prescription per patient per year Total Sales 150 10 150 10 150 10 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 1,500 5,000 15,000 75,000 150,000 300,000 150 150 150 150 150 150 10 10 10 10 10 10 2,250,000 7,500,000 22,500,000 112,500,000/225,000,000 450,000,000 10 Sales Fixed Cost Cashflow (150,000) (150,000) (150,000) (150,000) (150,000) (150,000) 450,000 1,500,000 4,500,000 22,500,000 45,000,000 90,000,000 (150,000) (150,000) (150,000) (150,000) (150,000) (150,000) (150,000) (150,000) 300,000 1,350,000 4,350,000 22,350,000 44,850,000 89,850,000 Expected Cash Flow for Year 11 92,545,500 Required Rate of Return 58.49%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started