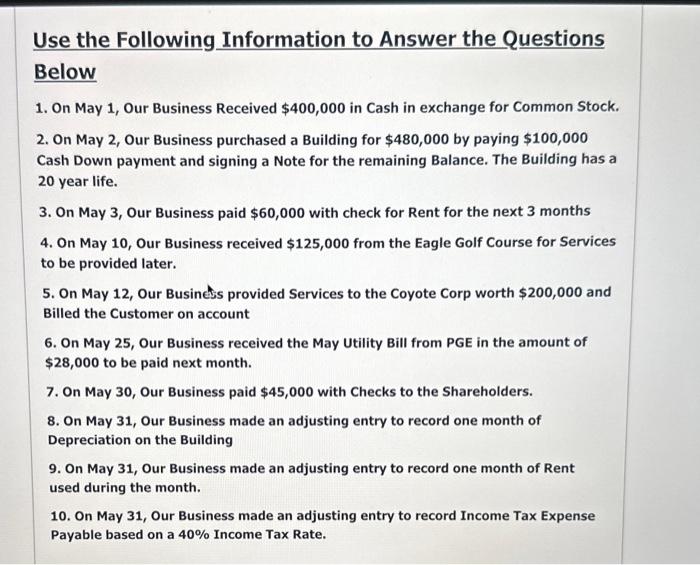

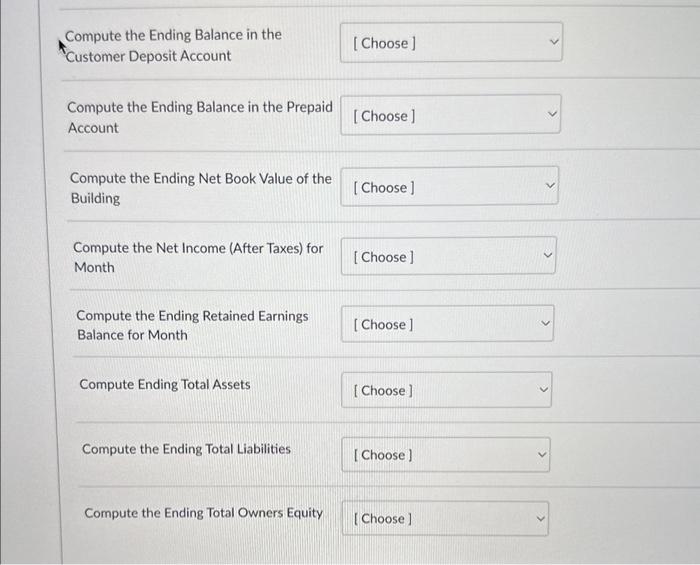

Use the Following Information to Answer the Questions Below 1. On May 1, Our Business Received $400,000 in Cash in exchange for Common Stock. 2. On May 2, Our Business purchased a Building for $480,000 by paying $100,000 Cash Down payment and signing a Note for the remaining Balance. The Building has a 20 year life. 3. On May 3, Our Business paid $60,000 with check for Rent for the next 3 months 4. On May 10, Our Business received $125,000 from the Eagle Golf Course for Services to be provided later. 5. On May 12, Our Busincts provided Services to the Coyote Corp worth $200,000 and Billed the Customer on account 6. On May 25, Our Business received the May Utility Bill from PGE in the amount of $28,000 to be paid next month. 7. On May 30, Our Business paid $45,000 with Checks to the Shareholders. 8. On May 31, Our Business made an adjusting entry to record one month of Depreciation on the Building 9. On May 31, Our Business made an adjusting entry to record one month of Rent used during the month. 10. On May 31, Our Business made an adjusting entry to record Income Tax Expense Payable based on a 40% Income Tax Rate. Compute the Ending Balance in the "Customer Deposit Account Compute the Ending Balance in the Prepaid Account Compute the Ending Net Book Value of the Building Compute the Net Income (After Taxes) for Month Compute the Ending Retained Earnings Balance for Month Compute Ending Total Assets Compute the Ending Total Liabilities Compute the Ending Total Owners Equity Use the Following Information to Answer the Questions Below 1. On May 1, Our Business Received $400,000 in Cash in exchange for Common Stock. 2. On May 2, Our Business purchased a Building for $480,000 by paying $100,000 Cash Down payment and signing a Note for the remaining Balance. The Building has a 20 year life. 3. On May 3, Our Business paid $60,000 with check for Rent for the next 3 months 4. On May 10, Our Business received $125,000 from the Eagle Golf Course for Services to be provided later. 5. On May 12, Our Busincts provided Services to the Coyote Corp worth $200,000 and Billed the Customer on account 6. On May 25, Our Business received the May Utility Bill from PGE in the amount of $28,000 to be paid next month. 7. On May 30, Our Business paid $45,000 with Checks to the Shareholders. 8. On May 31, Our Business made an adjusting entry to record one month of Depreciation on the Building 9. On May 31, Our Business made an adjusting entry to record one month of Rent used during the month. 10. On May 31, Our Business made an adjusting entry to record Income Tax Expense Payable based on a 40% Income Tax Rate. Compute the Ending Balance in the "Customer Deposit Account Compute the Ending Balance in the Prepaid Account Compute the Ending Net Book Value of the Building Compute the Net Income (After Taxes) for Month Compute the Ending Retained Earnings Balance for Month Compute Ending Total Assets Compute the Ending Total Liabilities Compute the Ending Total Owners Equity