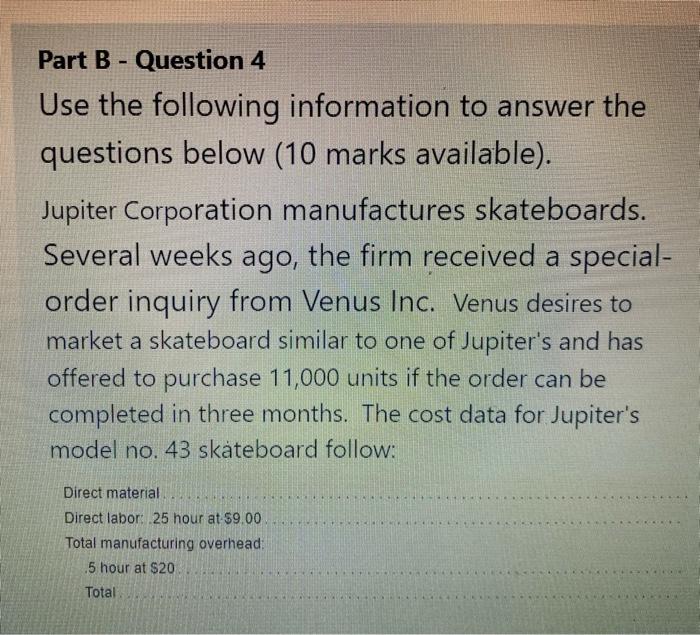

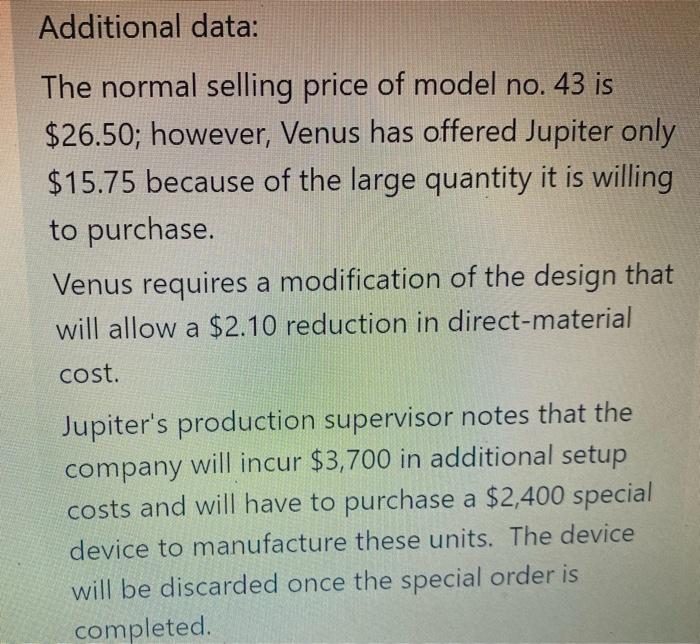

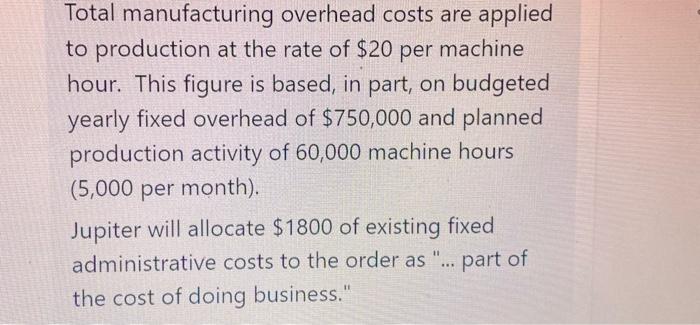

Use the following information to answer the questions below ( 10 marks available). Jupiter Corporation manufactures skateboards. Several weeks ago, the firm received a specialorder inquiry from Venus Inc. Venus desires to market a skateboard similar to one of Jupiter's and has offered to purchase 11,000 units if the order can be completed in three months. The cost data for Jupiter's model no. 43 skateboard follow: The normal selling price of model no. 43 is $26.50; however, Venus has offered Jupiter only $15.75 because of the large quantity it is willing to purchase. Venus requires a modification of the design that will allow a $2.10 reduction in direct-material cost. Jupiter's production supervisor notes that the company will incur $3,700 in additional setup costs and will have to purchase a $2,400 special device to manufacture these units. The device will be discarded once the special order is Total manufacturing overhead costs are applied to production at the rate of $20 per machine hour. This figure is based, in part, on budgeted yearly fixed overhead of $750,000 and planned production activity of 60,000 machine hours (5,000 per month). Jupiter will allocate $1800 of existing fixed administrative costs to the order as "... part of the cost of doing business." Part B - Question 4A Assume that the present sales will not be affected. Should the order be accepted from a financial point of view (i.e., is it profitable)? Why? Show calculations. (8 marks available) Part B - Question 4B Assume that Jupiter's current production activity consumes 70 percent of planned machine-hour activity. Can the company accept the order and meet Venus's deadline? (4 marks available) Use the following information to answer the questions below ( 10 marks available). Jupiter Corporation manufactures skateboards. Several weeks ago, the firm received a specialorder inquiry from Venus Inc. Venus desires to market a skateboard similar to one of Jupiter's and has offered to purchase 11,000 units if the order can be completed in three months. The cost data for Jupiter's model no. 43 skateboard follow: The normal selling price of model no. 43 is $26.50; however, Venus has offered Jupiter only $15.75 because of the large quantity it is willing to purchase. Venus requires a modification of the design that will allow a $2.10 reduction in direct-material cost. Jupiter's production supervisor notes that the company will incur $3,700 in additional setup costs and will have to purchase a $2,400 special device to manufacture these units. The device will be discarded once the special order is Total manufacturing overhead costs are applied to production at the rate of $20 per machine hour. This figure is based, in part, on budgeted yearly fixed overhead of $750,000 and planned production activity of 60,000 machine hours (5,000 per month). Jupiter will allocate $1800 of existing fixed administrative costs to the order as "... part of the cost of doing business." Part B - Question 4A Assume that the present sales will not be affected. Should the order be accepted from a financial point of view (i.e., is it profitable)? Why? Show calculations. (8 marks available) Part B - Question 4B Assume that Jupiter's current production activity consumes 70 percent of planned machine-hour activity. Can the company accept the order and meet Venus's deadline? (4 marks available)