Answered step by step

Verified Expert Solution

Question

1 Approved Answer

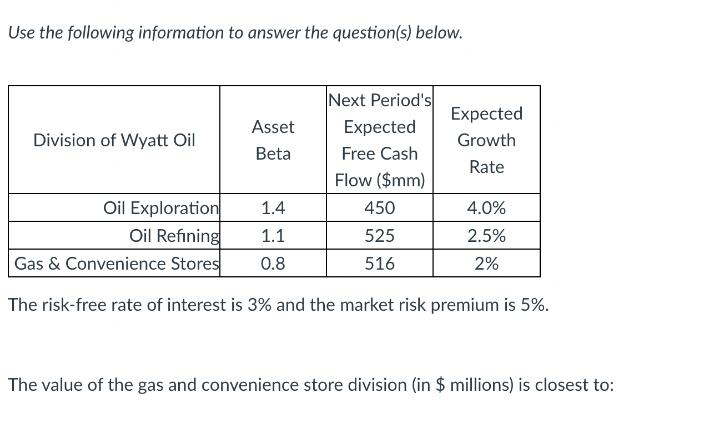

Use the following information to answer the question(s) below. Division of Wyatt Oil Asset Beta Next Period's Expected Free Cash Flow ($mm) 1.4 1.1

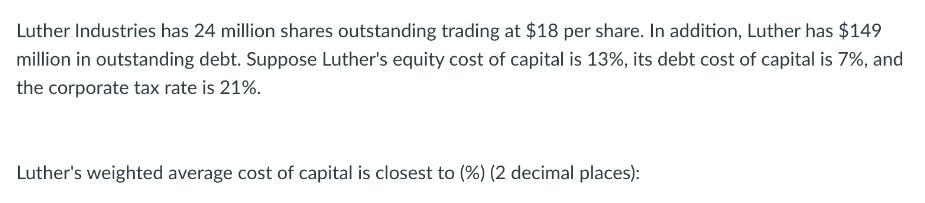

Use the following information to answer the question(s) below. Division of Wyatt Oil Asset Beta Next Period's Expected Free Cash Flow ($mm) 1.4 1.1 0.8 Oil Exploration Oil Refining Gas & Convenience Stores The risk-free rate of interest is 3% and the market risk premium is 5%. Expected Growth Rate 450 525 516 4.0% 2.5% 2% The value of the gas and convenience store division (in $ millions) is closest to: Luther Industries has 24 million shares outstanding trading at $18 per share. In addition, Luther has $149 million in outstanding debt. Suppose Luther's equity cost of capital is 13%, its debt cost of capital is 7%, and the corporate tax rate is 21%. Luther's weighted average cost of capital is closest to (%) (2 decimal places):

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the value of the gas and convenience store division use the discounted cash flow DCF me...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started