Use the following information to answer the question(s) below. Galt Industries has 50 million shares outstanding and a market capitalization of $1.25 billion. It

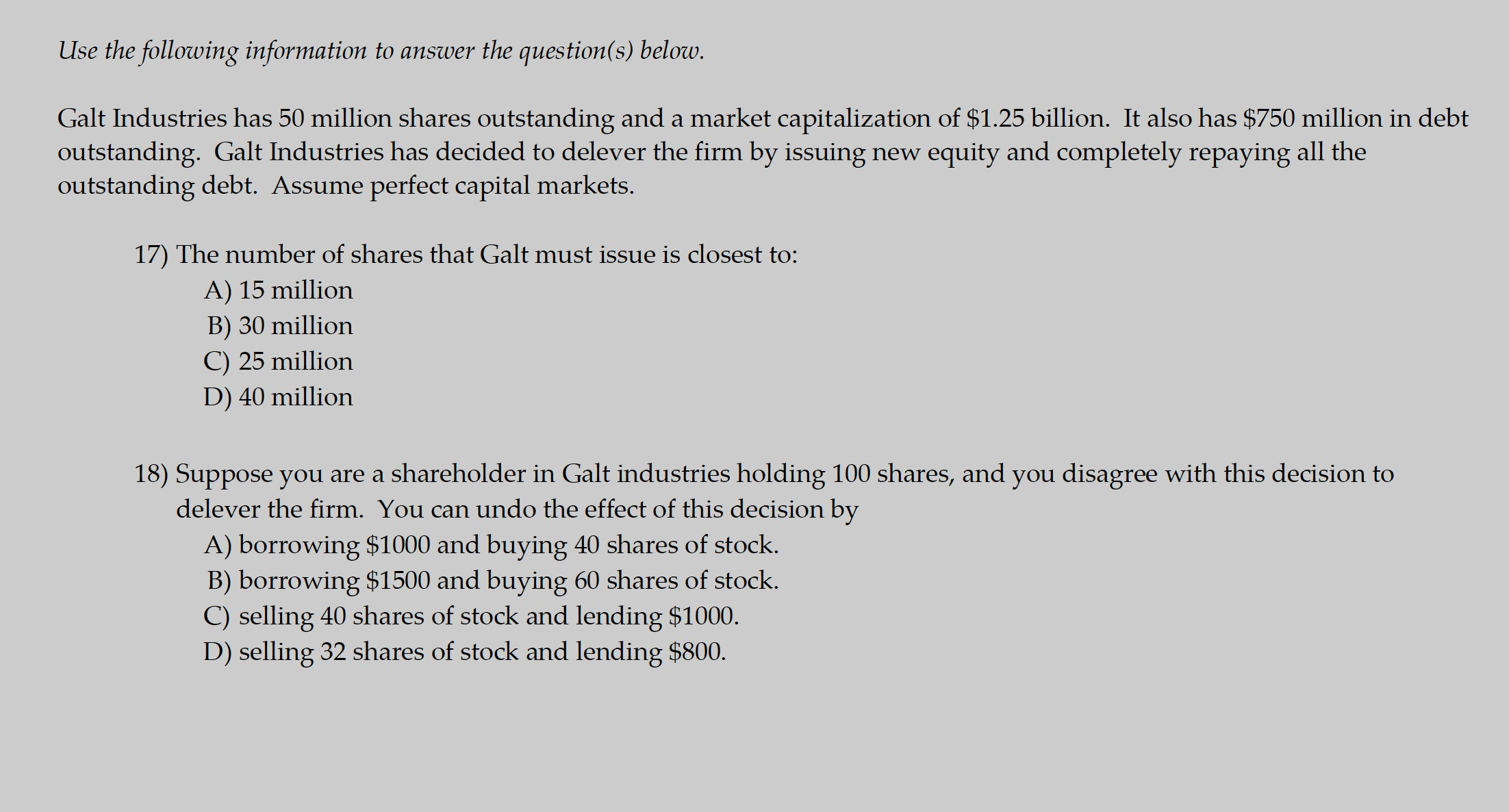

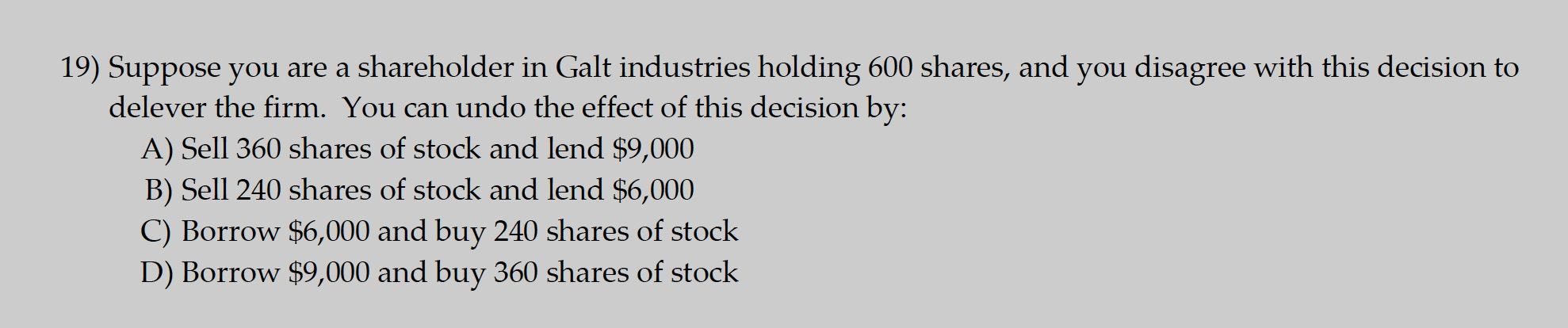

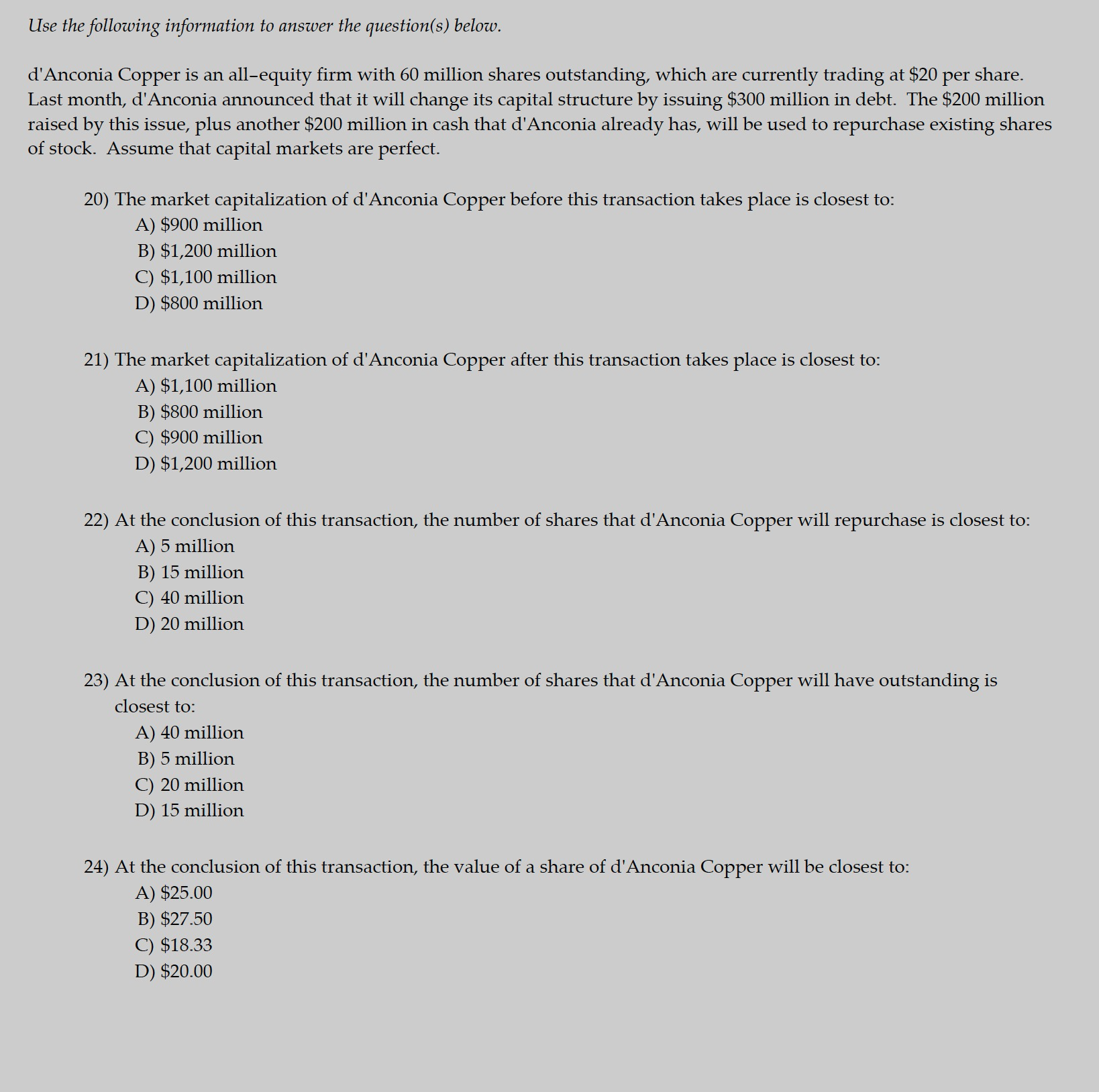

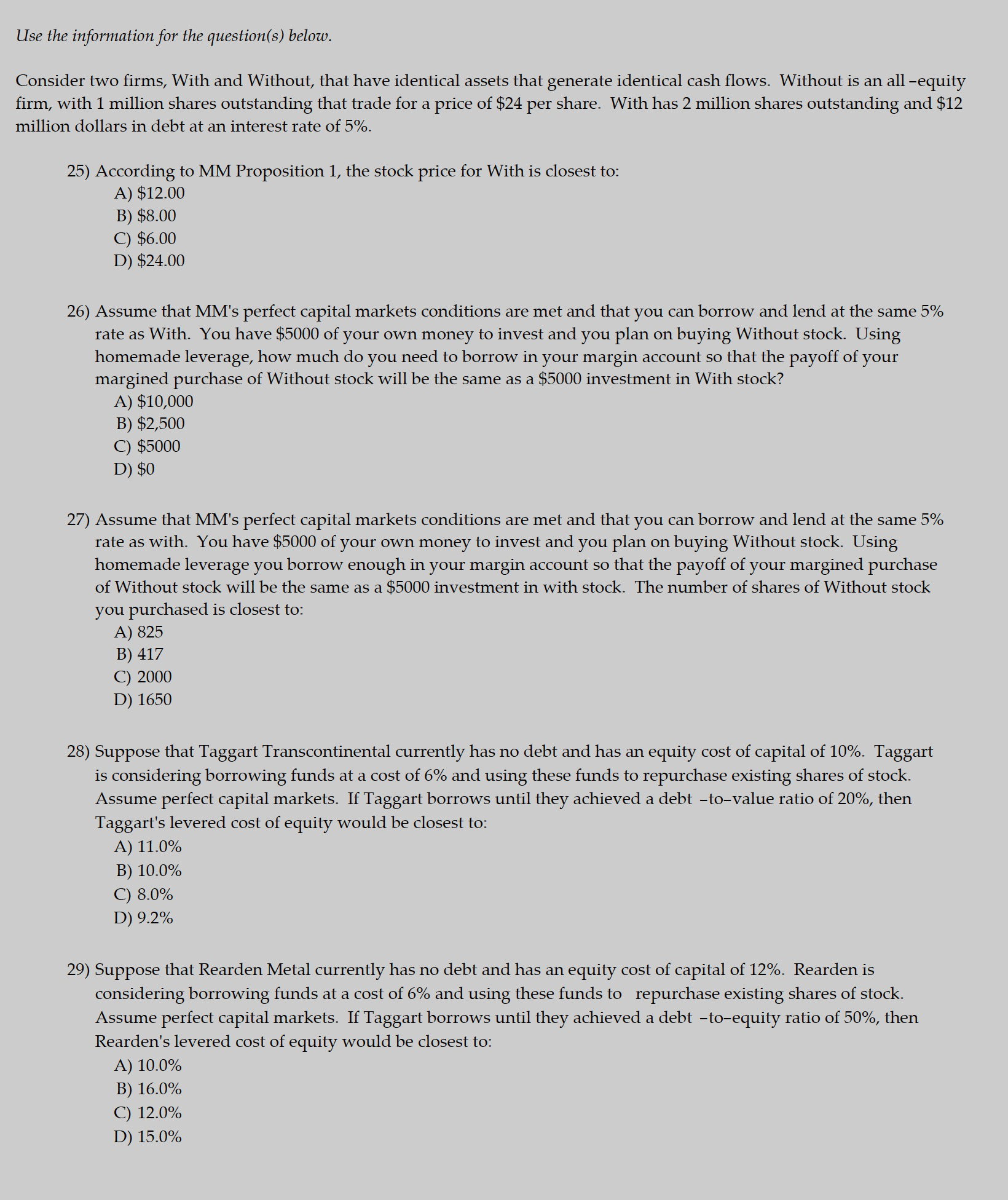

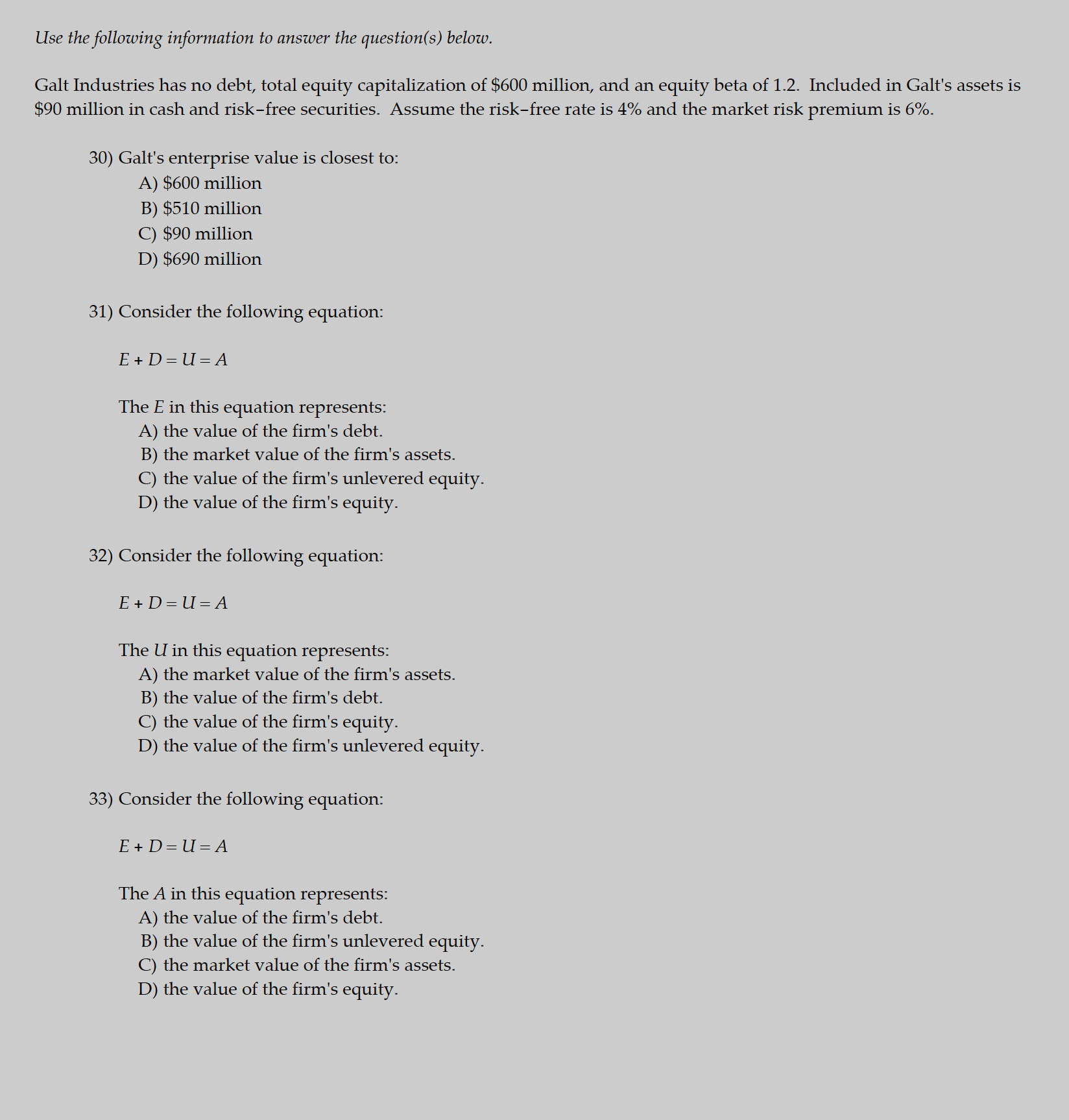

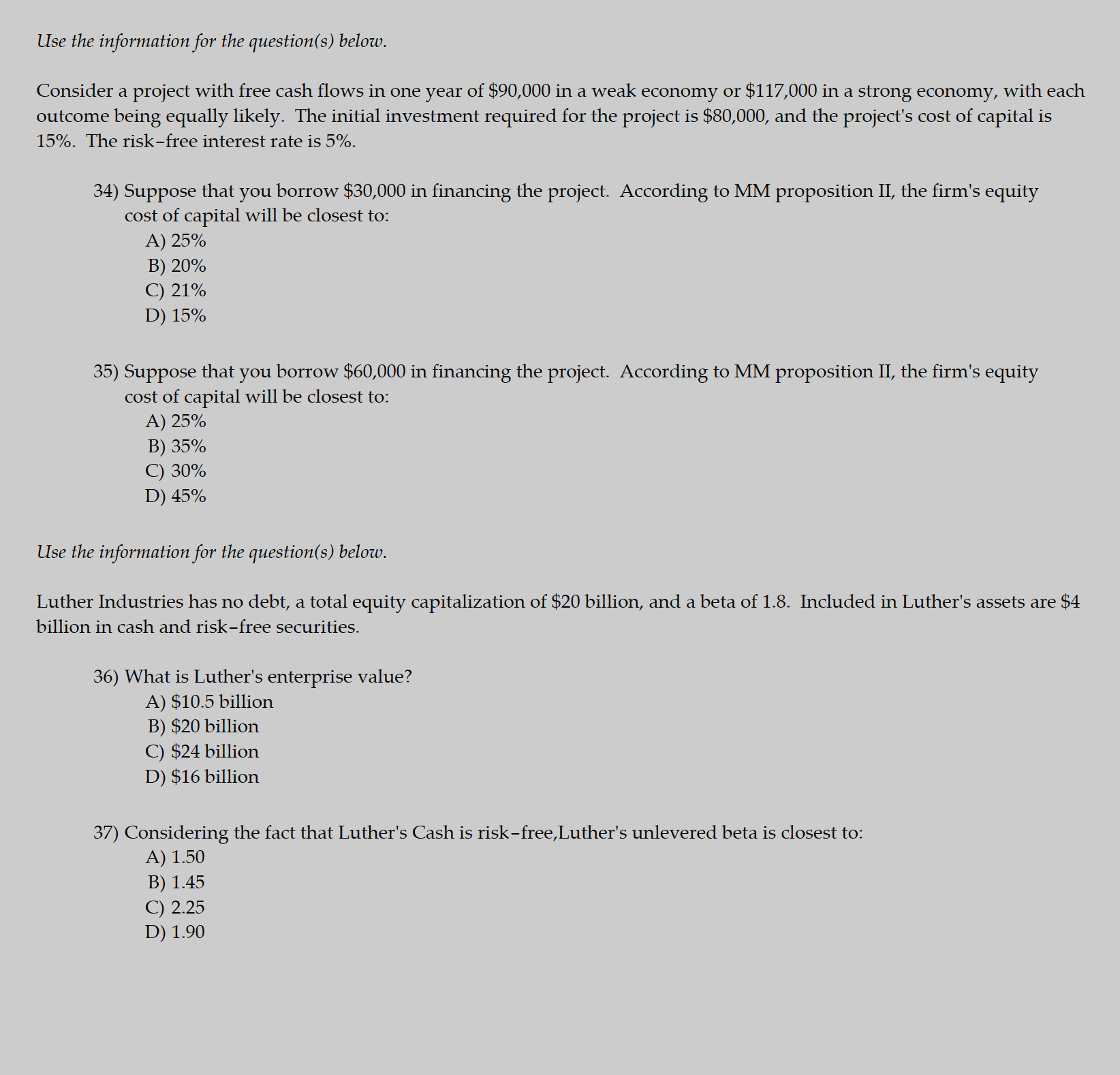

Use the following information to answer the question(s) below. Galt Industries has 50 million shares outstanding and a market capitalization of $1.25 billion. It also has $750 million in debt outstanding. Galt Industries has decided to delever the firm by issuing new equity and completely repaying all the outstanding debt. Assume perfect capital markets. 17) The number of shares that Galt must issue is closest to: A) 15 million B) 30 million C) 25 million D) 40 million 18) Suppose you are a shareholder in Galt industries holding 100 shares, and you disagree with this decision to delever the firm. You can undo the effect of this decision by A) borrowing $1000 and buying 40 shares of stock. B) borrowing $1500 and buying 60 shares of stock. C) selling 40 shares of stock and lending $1000. D) selling 32 shares of stock and lending $800. 19) Suppose you are a shareholder in Galt industries holding 600 shares, and you disagree with this decision to delever the firm. You can undo the effect of this decision by: A) Sell 360 shares of stock and lend $9,000 B) Sell 240 shares of stock and lend $6,000 C) Borrow $6,000 and buy 240 shares of stock D) Borrow $9,000 and buy 360 shares of stock Use the following information to answer the question(s) below. d'Anconia Copper is an all-equity firm with 60 million shares outstanding, which are currently trading at $20 per share. Last month, d'Anconia announced that it will change its capital structure by issuing $300 million in debt. The $200 million raised by this issue, plus another $200 million in cash that d'Anconia already has, will be used to repurchase existing shares of stock. Assume that capital markets are perfect. 20) The market capitalization of d'Anconia Copper before this transaction takes place is closest to: A) $900 million B) $1,200 million C) $1,100 million D) $800 million 21) The market capitalization of d'Anconia Copper after this transaction takes place is closest to: A) $1,100 million B) $800 million C) $900 million D) $1,200 million 22) At the conclusion of this transaction, the number of shares that d'Anconia Copper will repurchase is closest to: A) 5 million B) 15 million C) 40 million D) 20 million 23) At the conclusion of this transaction, the number of shares that d'Anconia Copper will have outstanding is closest to: A) 40 million B) 5 million C) 20 million D) 15 million 24) At the conclusion of this transaction, the value of a share of d'Anconia Copper will be closest to: A) $25.00 B) $27.50 C) $18.33 D) $20.00 Use the information for the question(s) below. Consider two firms, With and Without, that have identical assets that generate identical cash flows. Without is an all-equity firm, with 1 million shares outstanding that trade for a price of $24 per share. With has 2 million shares outstanding and $12 million dollars in debt at an interest rate of 5%. 25) According to MM Proposition 1, the stock price for With is closest to: A) $12.00 B) $8.00 C) $6.00 D) $24.00 26) Assume that MM's perfect capital markets conditions are met and that you can borrow and lend at the same 5% rate as With. You have $5000 of your own money to invest and you plan on buying Without stock. Using homemade leverage, how much do you need to borrow in your margin account so that the payoff of your margined purchase of Without stock will be the same as a $5000 investment in With stock? A) $10,000 B) $2,500 C) $5000 D) $0 27) Assume that MM's perfect capital markets conditions are met and that you can borrow and lend at the same 5% rate as with. You have $5000 of your own money to invest and you plan on buying Without stock. Using homemade leverage you borrow enough in your margin account so that the payoff of your margined purchase of Without stock will be the same as a $5000 investment in with stock. The number of shares of Without stock you purchased is closest to: A) 825 B) 417 C) 2000 D) 1650 28) Suppose that Taggart Transcontinental currently has no debt and has an equity cost of capital of 10%. Taggart is considering borrowing funds at a cost of 6% and using these funds to repurchase existing shares of stock. Assume perfect capital markets. If Taggart borrows until they achieved a debt -to-value ratio of 20%, then Taggart's levered cost of equity would be closest to: A) 11.0% B) 10.0% C) 8.0% D) 9.2% 29) Suppose that Rearden Metal currently has no debt and has an equity cost of capital of 12%. Rearden is considering borrowing funds at a cost of 6% and using these funds to repurchase existing shares of stock. Assume perfect capital markets. If Taggart borrows until they achieved a debt -to-equity ratio of 50%, then Rearden's levered cost of equity would be closest to: A) 10.0% B) 16.0% C) 12.0% D) 15.0% Use the following information to answer the question(s) below. Galt Industries has no debt, total equity capitalization of $600 million, and an equity beta of 1.2. Included in Galt's assets is $90 million in cash and risk-free securities. Assume the risk-free rate is 4% and the market risk premium is 6%. 30) Galt's enterprise value is closest to: A) $600 million B) $510 million C) $90 million D) $690 million 31) Consider the following equation: E + D = U = A The E in this equation represents: A) the value of the firm's debt. B) the market value of the firm's assets. C) the value of the firm's unlevered equity. D) the value of the firm's equity. 32) Consider the following equation: E + D = U = A The U in this equation represents: A) the market value of the firm's assets. B) the value of the firm's debt. C) the value of the firm's equity. D) the value of the firm's unlevered equity. 33) Consider the following equation: E + D=U = A The A in this equation represents: A) the value of the firm's debt. B) the value of the firm's unlevered equity. C) the market value of the firm's assets. D) the value of the firm's equity. Use the information for the question(s) below. Consider a project with free cash flows in one year of $90,000 in a weak economy or $117,000 in a strong economy, with each outcome being equally likely. The initial investment required for the project is $80,000, and the project's cost of capital is 15%. The risk-free interest rate is 5%. 34) Suppose that you borrow $30,000 in financing the project. According to MM proposition II, the firm's equity cost of capital will be closest to: A) 25% B) 20% C) 21% D) 15% 35) Suppose that you borrow $60,000 in financing the project. According to MM proposition II, the firm's equity cost of capital will be closest to: A) 25% B) 35% C) 30% D) 45% Use the information for the question(s) below. Luther Industries has no debt, a total equity capitalization of $20 billion, and a beta of 1.8. Included in Luther's assets are $4 billion in cash and risk-free securities. 36) What is Luther's enterprise value? A) $10.5 billion B) $20 billion C) $24 billion D) $16 billion 37) Considering the fact that Luther's Cash is risk-free,Luther's unlevered beta is closest to: A) 1.50 B) 1.45 C) 2.25 D) 1.90

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The number of shares that Galt must issue is closest to A 15 million To find the number of shares that Galt must issue to repay all the outstanding debt we need to divide the debt by the price per sha...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started