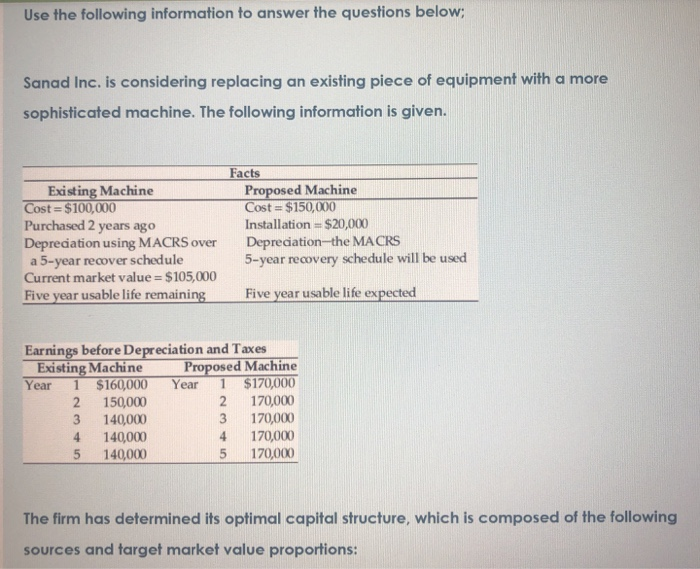

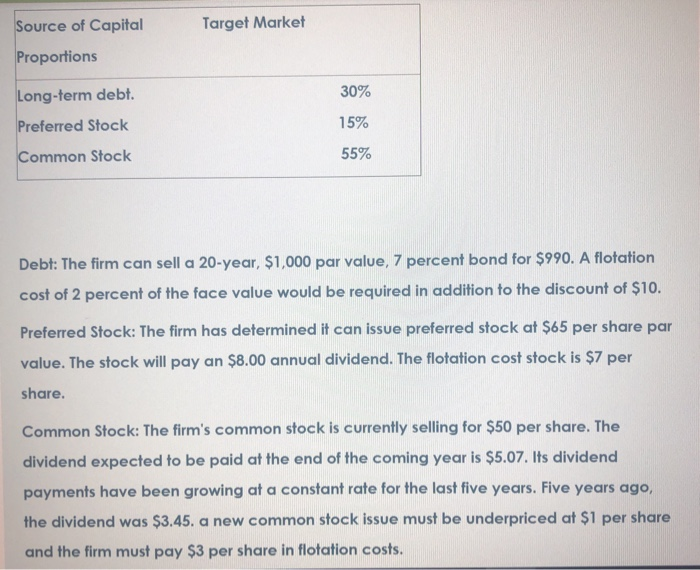

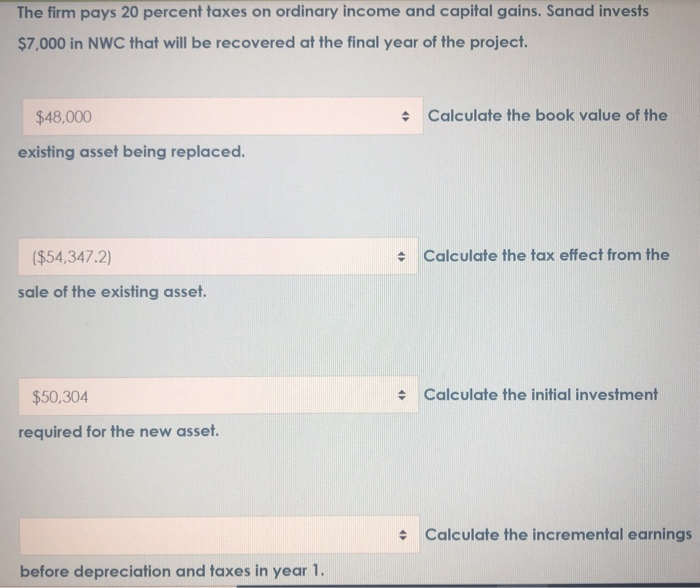

Use the following information to answer the questions below; Sanad Inc. is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given. Existing Machine Cost = $100,000 Purchased 2 years ago Depreciation using MACRS over a 5-year recover schedule Current market value = $105,000 Five year usable life remaining Facts Proposed Machine Cost = $150,000 Installation = $20,000 Depreciation-the MACRS 5-year recovery schedule will be used Five year usable life expected Earnings before Depreciation and Taxes Existing Machine Proposed Machine Year 1 $160,000 Year 1 $170,000 2 150,000 2 170,000 3 140,000 3 170,000 140,000 4 170,000 5 140,000 5 170,000 The firm has determined its optimal capital structure, which is composed of the following sources and target market value proportions: Source of Capital Target Market Proportions 30% Long-term debt Preferred Stock 15% Common Stock 55% Debt: The firm can sell a 20-year, $1,000 par value, 7 percent bond for $990. A flotation cost of 2 percent of the face value would be required in addition to the discount of $10. Preferred Stock: The firm has determined it can issue preferred stock at $65 per share par value. The stock will pay an $8.00 annual dividend. The flotation cost stock is $7 per share. Common Stock: The firm's common stock is currently selling for $50 per share. The dividend expected to be paid at the end of the coming year is $5.07. Its dividend payments have been growing at a constant rate for the last five years. Five years ago, the dividend was $3.45. a new common stock issue must be underpriced at $1 per share and the firm must pay $3 per share in flotation costs. The firm pays 20 percent taxes on ordinary income and capital gains. Sanad invests $7,000 in NWC that will be recovered at the final year of the project. $48,000 Calculate the book value of the existing asset being replaced. ($54,347.2) > Calculate the tax effect from the sale of the existing asset. $50,304 . Calculate the initial investment required for the new asset. Calculate the incremental earnings before depreciation and taxes in year 1. Use the following information to answer the questions below; Sanad Inc. is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given. Existing Machine Cost = $100,000 Purchased 2 years ago Depreciation using MACRS over a 5-year recover schedule Current market value = $105,000 Five year usable life remaining Facts Proposed Machine Cost = $150,000 Installation = $20,000 Depreciation-the MACRS 5-year recovery schedule will be used Five year usable life expected Earnings before Depreciation and Taxes Existing Machine Proposed Machine Year 1 $160,000 Year 1 $170,000 2 150,000 2 170,000 3 140,000 3 170,000 140,000 4 170,000 5 140,000 5 170,000 The firm has determined its optimal capital structure, which is composed of the following sources and target market value proportions: Source of Capital Target Market Proportions 30% Long-term debt Preferred Stock 15% Common Stock 55% Debt: The firm can sell a 20-year, $1,000 par value, 7 percent bond for $990. A flotation cost of 2 percent of the face value would be required in addition to the discount of $10. Preferred Stock: The firm has determined it can issue preferred stock at $65 per share par value. The stock will pay an $8.00 annual dividend. The flotation cost stock is $7 per share. Common Stock: The firm's common stock is currently selling for $50 per share. The dividend expected to be paid at the end of the coming year is $5.07. Its dividend payments have been growing at a constant rate for the last five years. Five years ago, the dividend was $3.45. a new common stock issue must be underpriced at $1 per share and the firm must pay $3 per share in flotation costs. The firm pays 20 percent taxes on ordinary income and capital gains. Sanad invests $7,000 in NWC that will be recovered at the final year of the project. $48,000 Calculate the book value of the existing asset being replaced. ($54,347.2) > Calculate the tax effect from the sale of the existing asset. $50,304 . Calculate the initial investment required for the new asset. Calculate the incremental earnings before depreciation and taxes in year 1