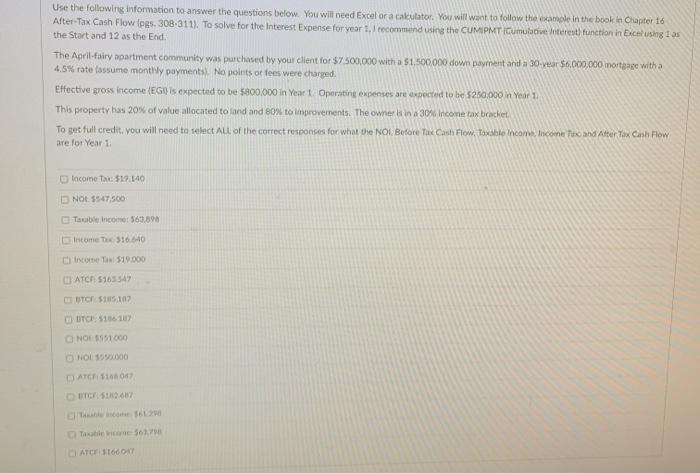

Use the following information to answer the questions below. You will need Excel or a cakulator. You will want to follow the sample in the book in Chapter 16 After Tax Cash Flow (pes. 308-311). To solve for the Interest Expense for year 1. I recommend using the CUMPMTICumulative boterest) function in Excelsingius the Start and 12 as the End. The April-fairy apartment community was purchased by your client for $7.500.000 with a $1.500.000 down payment and a 30.ver $6.000.000 mortgage with a 4.5% rate assume monthly payments No polnts or fees were charged. Effective gross income (EG is expected to be $300.000 in Year 1. Operating expenses are expected to be $280,000 in Year 1 This property has 20% of value allocated to land and 80% to improvements. The owner is in a 30%. Income tax bracket To get full credit, you will need to select All of the correct responses for what the NOI, Before Tax Cash Flow, Table incana Income Too and After Tax Cinh Flow are for Year 1 lacome T 519 140 3 NOE: 5547.500 Tanco 563.890 Income To 516.40 CT 519.000 ATC 5163547 UTC 51015.107 UTCH 1 NOUS5.00 ATC 10 Taxi 5017 ATC 516601 Use the following information to answer the questions below. You will need Excel or a cakulator. You will want to follow the sample in the book in Chapter 16 After Tax Cash Flow (pes. 308-311). To solve for the Interest Expense for year 1. I recommend using the CUMPMTICumulative boterest) function in Excelsingius the Start and 12 as the End. The April-fairy apartment community was purchased by your client for $7.500.000 with a $1.500.000 down payment and a 30.ver $6.000.000 mortgage with a 4.5% rate assume monthly payments No polnts or fees were charged. Effective gross income (EG is expected to be $300.000 in Year 1. Operating expenses are expected to be $280,000 in Year 1 This property has 20% of value allocated to land and 80% to improvements. The owner is in a 30%. Income tax bracket To get full credit, you will need to select All of the correct responses for what the NOI, Before Tax Cash Flow, Table incana Income Too and After Tax Cinh Flow are for Year 1 lacome T 519 140 3 NOE: 5547.500 Tanco 563.890 Income To 516.40 CT 519.000 ATC 5163547 UTC 51015.107 UTCH 1 NOUS5.00 ATC 10 Taxi 5017 ATC 516601