Question

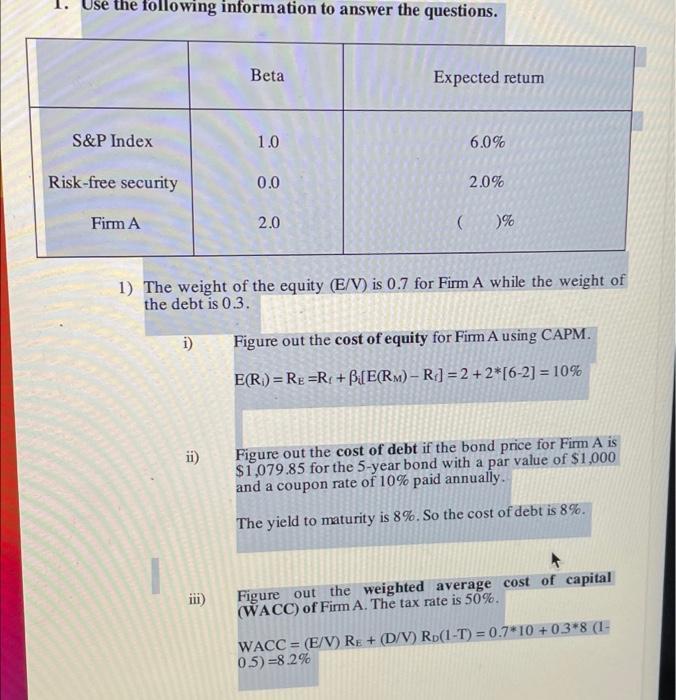

Use the following information to answer the questions. Betal Expected retum S&P Index 1.0 6.0% Risk-free security 0.0 2.0% Firm A 2.0 ()% 1)

Use the following information to answer the questions. Betal Expected retum S&P Index 1.0 6.0% Risk-free security 0.0 2.0% Firm A 2.0 ()% 1) The weight of the equity (E/V) is 0.7 for Firm A while the weight of the debt is 0.3. i) Figure out the cost of equity for Firm A using CAPM. E(R) RE=R+BE(RM)-R]=2+2*[6-2]=10% ii) Figure out the cost of debt if the bond price for Firm A is $1,079.85 for the 5-year bond with a par value of $1,000 and a coupon rate of 10% paid annually. The yield to maturity is 8%. So the cost of debt is 8%. iii) Figure out the weighted average cost of capital (WACC) of Firm A. The tax rate is 50%. WACC (E/V) RE+ (D/V) RD(1-T)=0.7*10+0.3*8 (1- 0.5)=8.2%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles Volume II

Authors: Larson Kermit, Jensen Tilly

14th Canadian Edition

71051570, 0-07-105150-3, 978-0071051576, 978-0-07-10515, 978-1259066511

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App