Answered step by step

Verified Expert Solution

Question

1 Approved Answer

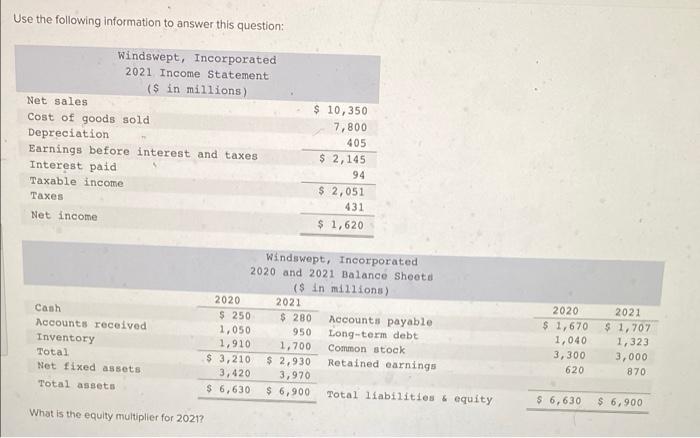

Use the following information to answer this question: Windswept, Incorporated 2021 Income Statement ($ in millions) Net sales $ 10,350 Cost of goods sold

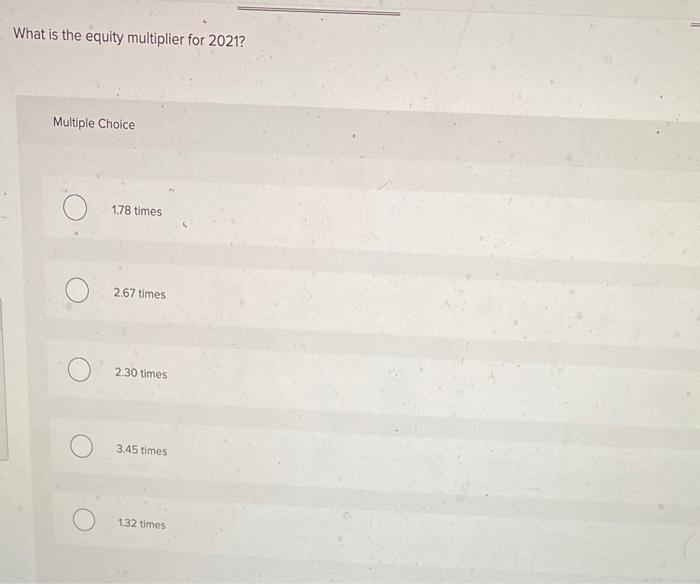

Use the following information to answer this question: Windswept, Incorporated 2021 Income Statement ($ in millions) Net sales $ 10,350 Cost of goods sold Depreciation Earnings before interest and taxes 7,800 405 $ 2,145 Interest paid Taxable income 94 $ 2,051 Taxes 431 Net income $ 1,620 Windswept, Incorporated 2020 and 2021 Balance Sheets ($ in millions) 2020 2021 2020 2021 Cash $ 280 $ 250 1,050 1,910 Accounts payable Long-term debt $ 1,670 $1,707 Accounts received 950 1,040 1,323 Inventory Total Net fixed assets 1,700 $ 2,930 3,970 $ 6,900 Common stock 3,300 3,000 $ 3,210 Retained earnings 620 870 3,420 Total assets $ 6,630 Total liabilities & equity $ 6,630 $ 6,900 What is the equity multiplier for 2021? What is the equity multiplier for 2021? Multiple Choice 1.78 times 2.67 times 2.30 times 3.45 times 1.32 times

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer Answer is Option 1 Expl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started