Answered step by step

Verified Expert Solution

Question

1 Approved Answer

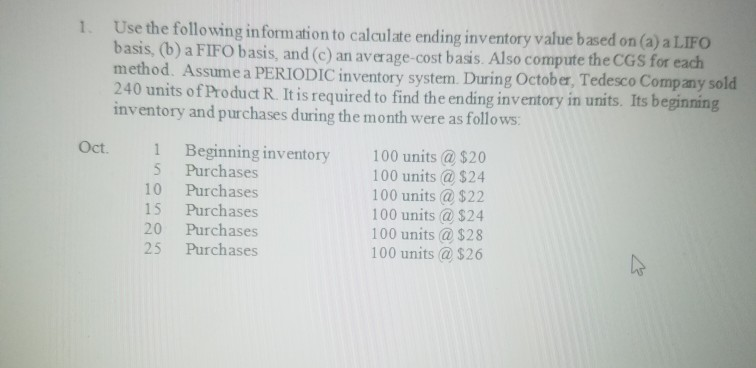

Use the following information to calculate ending inventory value based on (a) a LIFO basis, (b) a FIFO basis, and (c) an average-cost basis. Also

Use the following information to calculate ending inventory value based on (a) a LIFO basis, (b) a FIFO basis, and (c) an average-cost basis. Also compute the CGS for each method. Assume a PERIODIC inventory system. During October, Tedesco Company sold 240 units of Product R. It is required to find the ending inventory in units. Its beginning inventory and purchases during the month were as follows: Oct. 1 5 10 15 20 25 Beginning inventory Purchases Purchases Purchases Purchases Purchases 100 units @ $20 100 units @ $24 100 units @ $22 100 units @ $24 100 units @ $28 100 units @ $26

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started