Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the following information to calculate Microsoft Corporations ROE, ROA and Financial Leverage, Profit Margin and Asset Turnover, Gross Profit Margin, Operating Expense Margins, Fixed

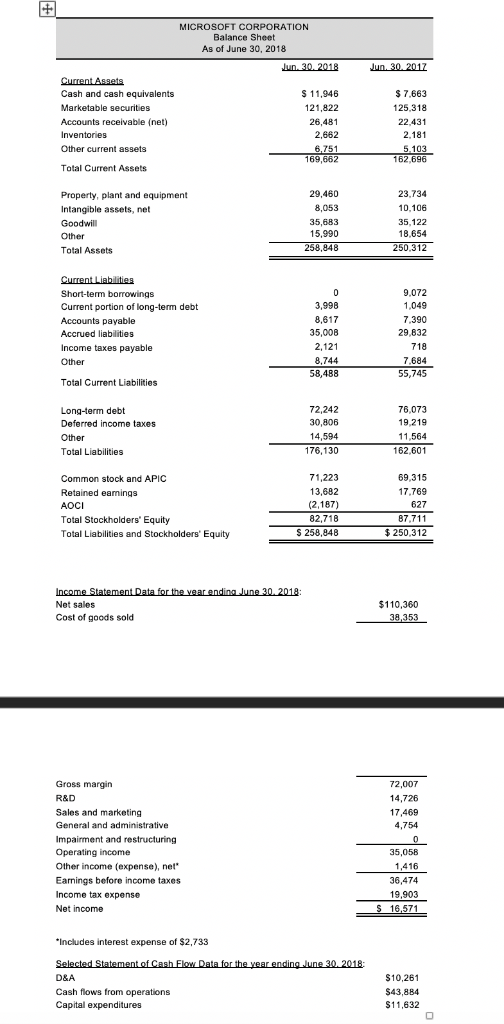

Use the following information to calculate Microsoft Corporations ROE, ROA and Financial Leverage, Profit Margin and Asset Turnover, Gross Profit Margin, Operating Expense Margins, Fixed Asset Turnover, Times Interest Earned, EBITDA Coverage, Cash from Operations to Total Debt, Free Cash from Operations to Total Debt, Current Ratio, Quick Ratio, Liabilities to Equity, and Total Debt-to-Equity. Also calculate the changes in the liquidity ratios from 2017 to 2018. Kindly show work.

MICROSOFT CORPORATION Balance Sheet As of June 30, 2018 Cash and cash equivalents Marketable securities Accounts receivable (net) Property, plant and equipment Intangible assets, net Short-term borrowings Current portion of long-term debt Accounts payable Accrued liabilities Income taxes payable Total Current Liabilities Long-term debt Deferred income taxes Common stock and APIC Retained eamings Total Stockholders' Equity Total Liabilities and Stockholders Equity $110,360 Cost of goods sold Gross margin Sales and marketing General and administrative Operating income Other income (expense), net' Earnings before income taxes Income tax expense Net income Includes interest expense of $2,733 Cash flows from operations Capital expenditures S10,261 $43,884 S11,632Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started