Answered step by step

Verified Expert Solution

Question

1 Approved Answer

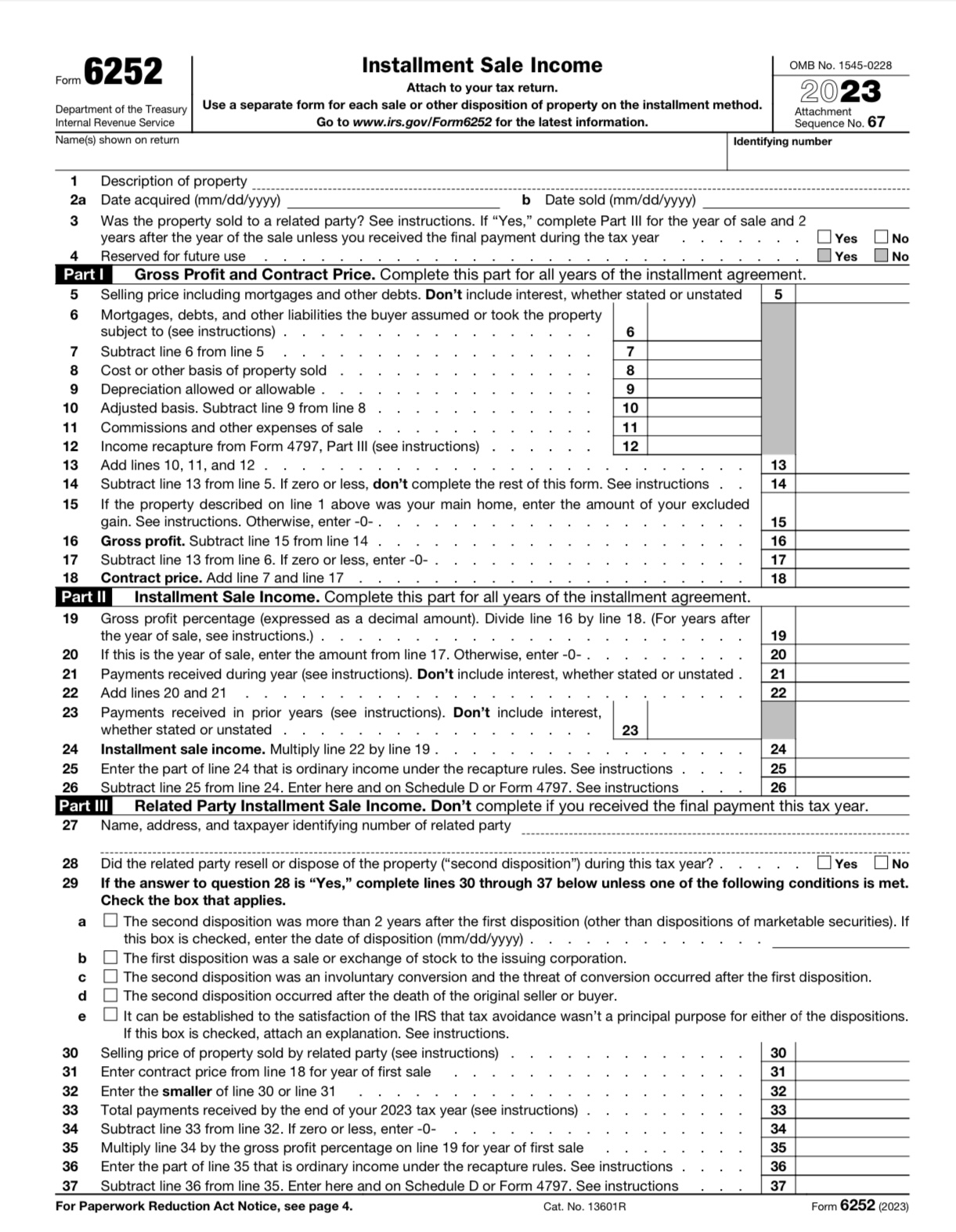

Use the following information to complete Form 6 2 5 2 . Part II Installment Sale Income. Complete this part for all years of the

Use the following information to complete Form

Part II Installment Sale Income. Complete this part for all years of the installment agreement.

Part III Related Party Installment Sale Income. Don't complete if you received the final payment this tax year.

Name, address, and taxpayer identifying number of related party

Did the related party resell or dispose of the property second disposition" during this tax year? Yes No

If the answer to question is "Yes," complete lines through below unless one of the following conditions is met.

Check the box that applies.

a The second disposition was more than years after the first disposition other than dispositions of marketable securities If

this box is checked, enter the date of disposition

b The first disposition was a sale or exchange of stock to the issuing corporation.

c The second disposition was an involuntary conversion and the threat of conversion occurred after the first disposition.

d The second disposition occurred after the death of the original seller or buyer.

e It can be established to the satisfaction of the IRS that tax avoidance wasn't a principal purpose for either of the dispositions.

If this box is checked, attach an explanation. See instructions.John Wong purchases an apartment complex on January for $ He allocates $ to the cost of land and deducts MACRS depreciation totaling $

John sells the apartment on January for $ The buyer assumes the existing mortgage of $ and pays $ down. The buyer agrees to pay $ per year for two years plus interest.

John incurs selling expenses of $

His social security number is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started