Use the following information to complete Oscar and Omara Olivas 2020 federal income tax return. If information is missing, use reasonable assumptions to fill in the gaps.

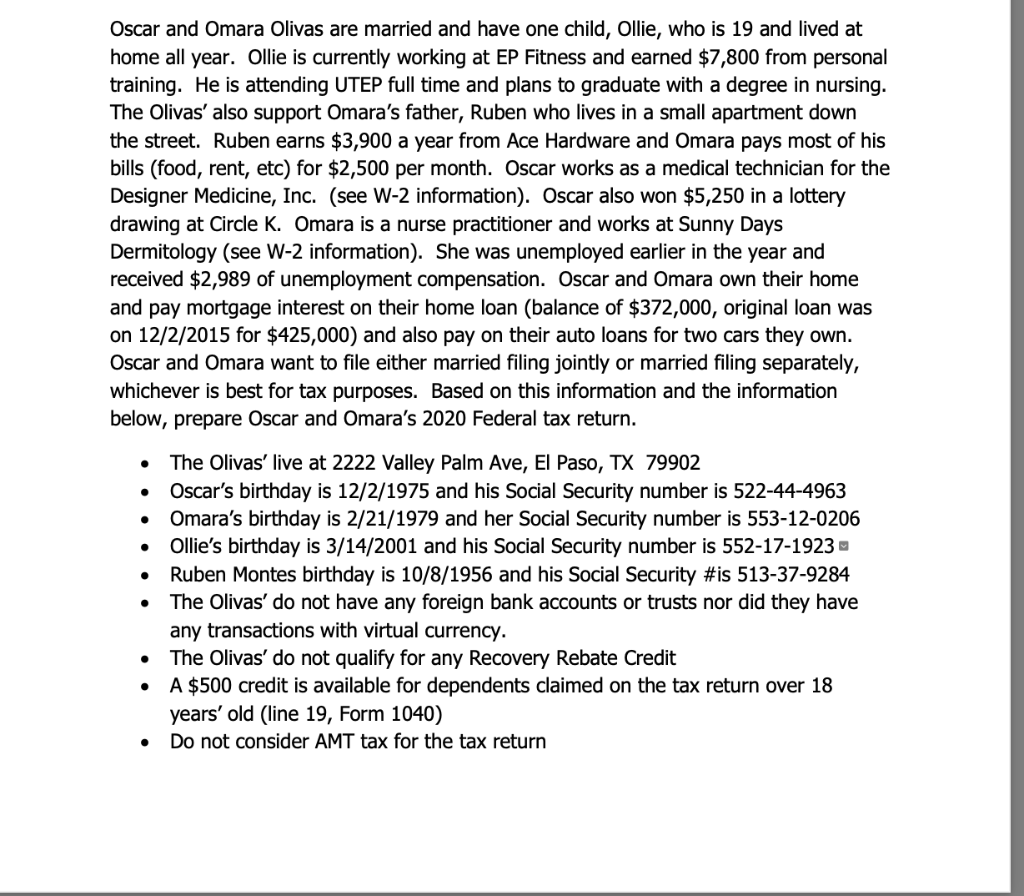

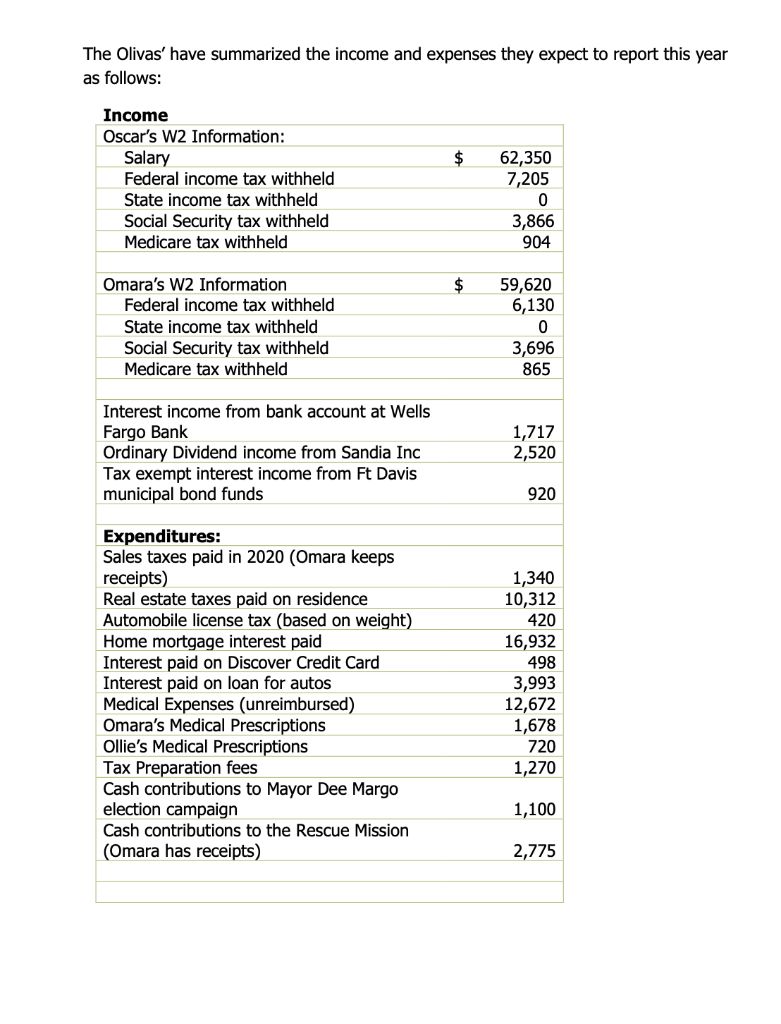

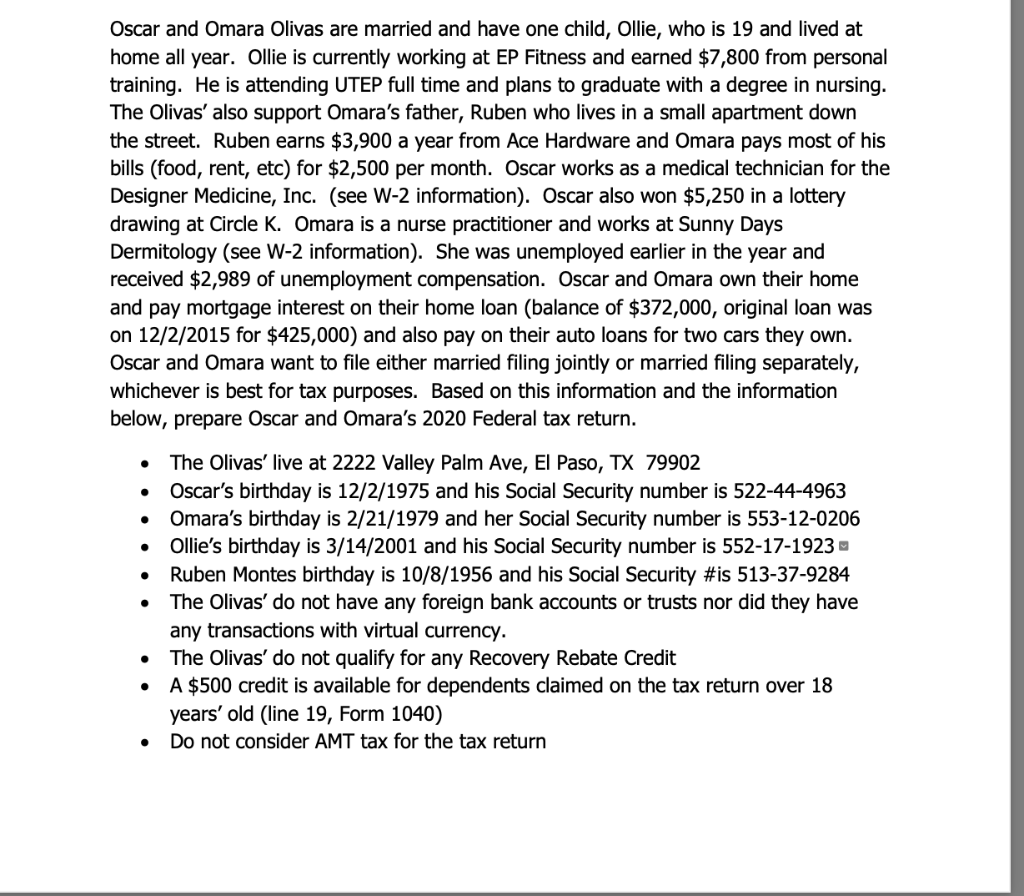

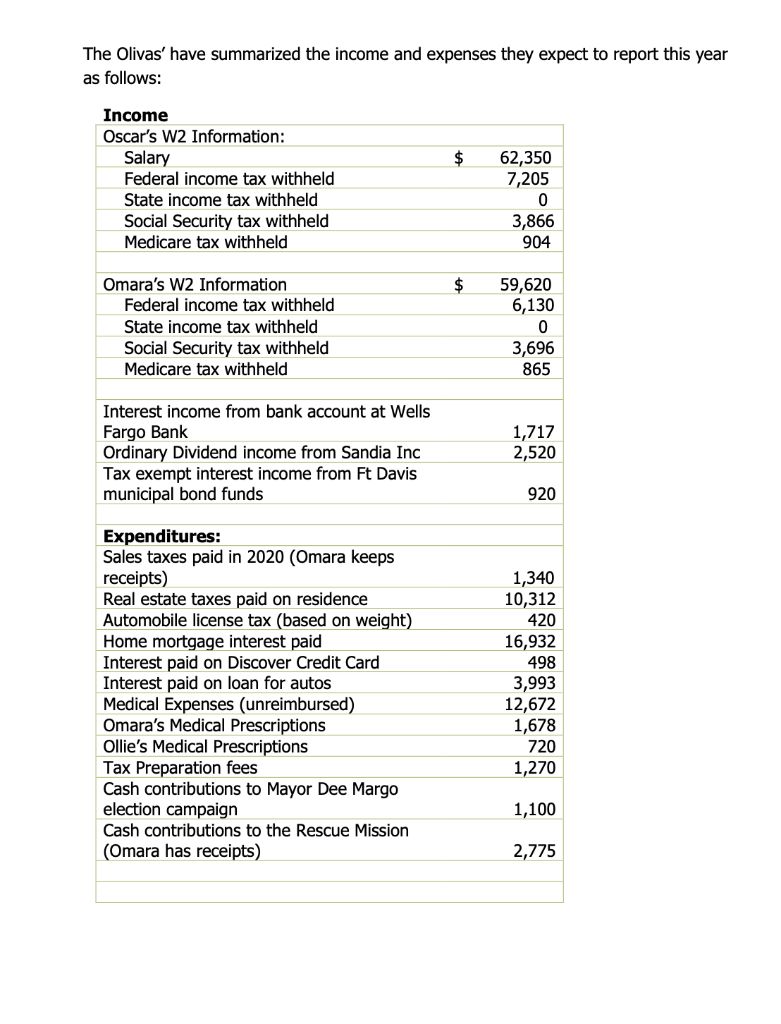

Oscar and Omara Olivas are married and have one child, Ollie, who is 19 and lived at home all year. Ollie is currently working at EP Fitness and earned $7,800 from personal training. He is attending UTEP full time and plans to graduate with a degree in nursing. The Olivas' also support Omara's father, Ruben who lives in a small apartment down the street. Ruben earns $3,900 a year from Ace Hardware and Omara pays most of his bills (food, rent, etc) for $2,500 per month. Oscar works as a medical technician for the Designer Medicine, Inc. (see W-2 information). Oscar also won $5,250 in a lottery drawing at Circle K. Omara is a nurse practitioner and works at Sunny Days Dermitology (see W-2 information). She was unemployed earlier in the year and received $2,989 of unemployment compensation. Oscar and Omara own their home and pay mortgage interest on their home loan (balance of $372,000, original loan was on 12/2/2015 for $425,000) and also pay on their auto loans for two cars they own. Oscar and Omara want to file either married filing jointly or married filing separately, whichever is best for tax purposes. Based on this information and the information below, prepare Oscar and Omara's 2020 Federal tax return. . The Olivas' live at 2222 Valley Palm Ave, El Paso, TX 79902 Oscar's birthday is 12/2/1975 and his Social Security number is 522-44-4963 Omara's birthday is 2/21/1979 and her Social Security number is 553-12-0206 Ollie's birthday is 3/14/2001 and his Social Security number is 552-17-1923 Ruben Montes birthday is 10/8/1956 and his Social Security #is 513-37-9284 The Olivas' do not have any foreign bank accounts or trusts nor did they have any transactions with virtual currency. The Olivas' do not qualify for any Recovery Rebate Credit A $500 credit is available for dependents claimed on the tax return over 18 years' old (line 19, Form 1040) Do not consider AMT tax for the tax return The Olivas' have summarized the income and expenses they expect to report this year as follows: $ Income Oscar's W2 Information: Salary Federal income tax withheld State income tax withheld Social Security tax withheld Medicare tax withheld 62,350 7,205 0 3,866 904 $ Omara's W2 Information Federal income tax withheld State income tax withheld Social Security tax withheld Medicare tax withheld 59,620 6,130 0 3,696 865 Interest income from bank account at Wells Fargo Bank Ordinary Dividend income from Sandia Inc Tax exempt interest income from Ft Davis municipal bond funds 1,717 2,520 920 Expenditures: Sales taxes paid in 2020 (Omara keeps receipts) Real estate taxes paid on residence Automobile license tax (based on weight) Home mortgage interest paid Interest paid on Discover Credit Card Interest paid on loan for autos Medical Expenses (unreimbursed) Omara's Medical Prescriptions Ollie's Medical Prescriptions Tax Preparation fees Cash contributions to Mayor Dee Margo election campaign Cash contributions to the Rescue Mission (Omara has receipts) 1,340 10,312 420 16,932 498 3,993 12,672 1,678 720 1,270 1,100 2,775 Oscar and Omara Olivas are married and have one child, Ollie, who is 19 and lived at home all year. Ollie is currently working at EP Fitness and earned $7,800 from personal training. He is attending UTEP full time and plans to graduate with a degree in nursing. The Olivas' also support Omara's father, Ruben who lives in a small apartment down the street. Ruben earns $3,900 a year from Ace Hardware and Omara pays most of his bills (food, rent, etc) for $2,500 per month. Oscar works as a medical technician for the Designer Medicine, Inc. (see W-2 information). Oscar also won $5,250 in a lottery drawing at Circle K. Omara is a nurse practitioner and works at Sunny Days Dermitology (see W-2 information). She was unemployed earlier in the year and received $2,989 of unemployment compensation. Oscar and Omara own their home and pay mortgage interest on their home loan (balance of $372,000, original loan was on 12/2/2015 for $425,000) and also pay on their auto loans for two cars they own. Oscar and Omara want to file either married filing jointly or married filing separately, whichever is best for tax purposes. Based on this information and the information below, prepare Oscar and Omara's 2020 Federal tax return. . The Olivas' live at 2222 Valley Palm Ave, El Paso, TX 79902 Oscar's birthday is 12/2/1975 and his Social Security number is 522-44-4963 Omara's birthday is 2/21/1979 and her Social Security number is 553-12-0206 Ollie's birthday is 3/14/2001 and his Social Security number is 552-17-1923 Ruben Montes birthday is 10/8/1956 and his Social Security #is 513-37-9284 The Olivas' do not have any foreign bank accounts or trusts nor did they have any transactions with virtual currency. The Olivas' do not qualify for any Recovery Rebate Credit A $500 credit is available for dependents claimed on the tax return over 18 years' old (line 19, Form 1040) Do not consider AMT tax for the tax return The Olivas' have summarized the income and expenses they expect to report this year as follows: $ Income Oscar's W2 Information: Salary Federal income tax withheld State income tax withheld Social Security tax withheld Medicare tax withheld 62,350 7,205 0 3,866 904 $ Omara's W2 Information Federal income tax withheld State income tax withheld Social Security tax withheld Medicare tax withheld 59,620 6,130 0 3,696 865 Interest income from bank account at Wells Fargo Bank Ordinary Dividend income from Sandia Inc Tax exempt interest income from Ft Davis municipal bond funds 1,717 2,520 920 Expenditures: Sales taxes paid in 2020 (Omara keeps receipts) Real estate taxes paid on residence Automobile license tax (based on weight) Home mortgage interest paid Interest paid on Discover Credit Card Interest paid on loan for autos Medical Expenses (unreimbursed) Omara's Medical Prescriptions Ollie's Medical Prescriptions Tax Preparation fees Cash contributions to Mayor Dee Margo election campaign Cash contributions to the Rescue Mission (Omara has receipts) 1,340 10,312 420 16,932 498 3,993 12,672 1,678 720 1,270 1,100 2,775