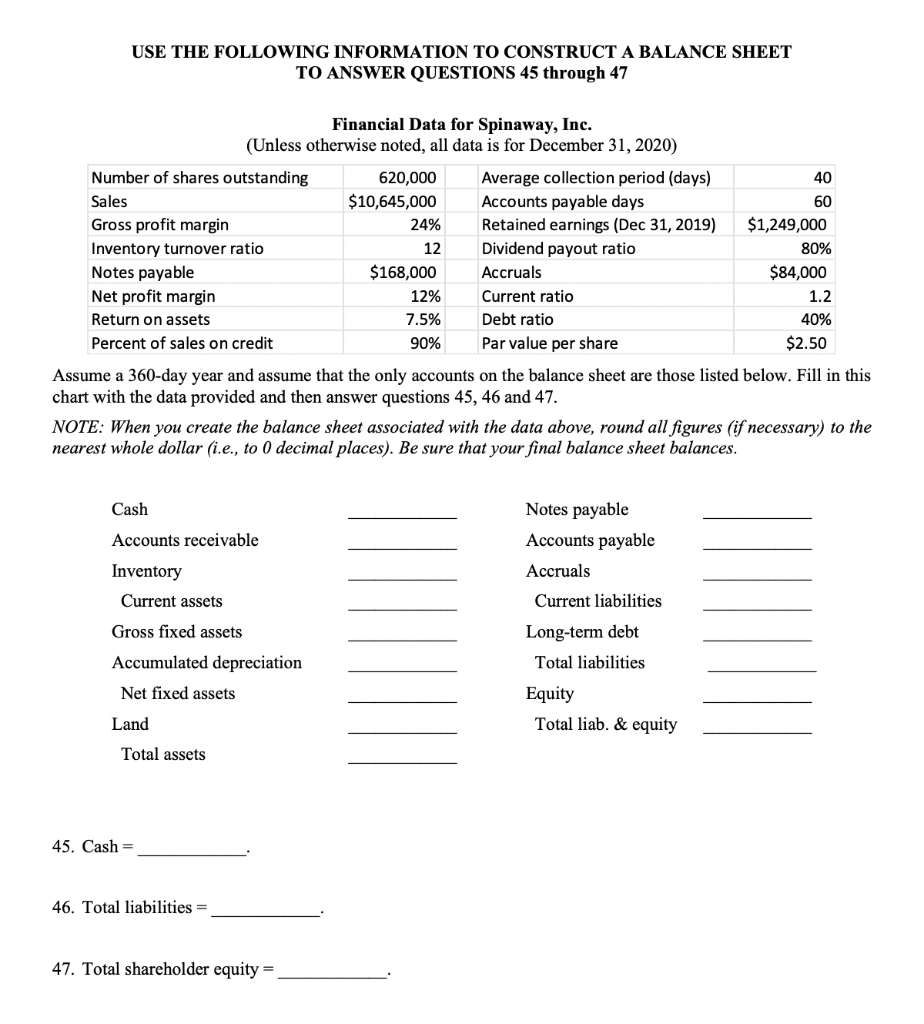

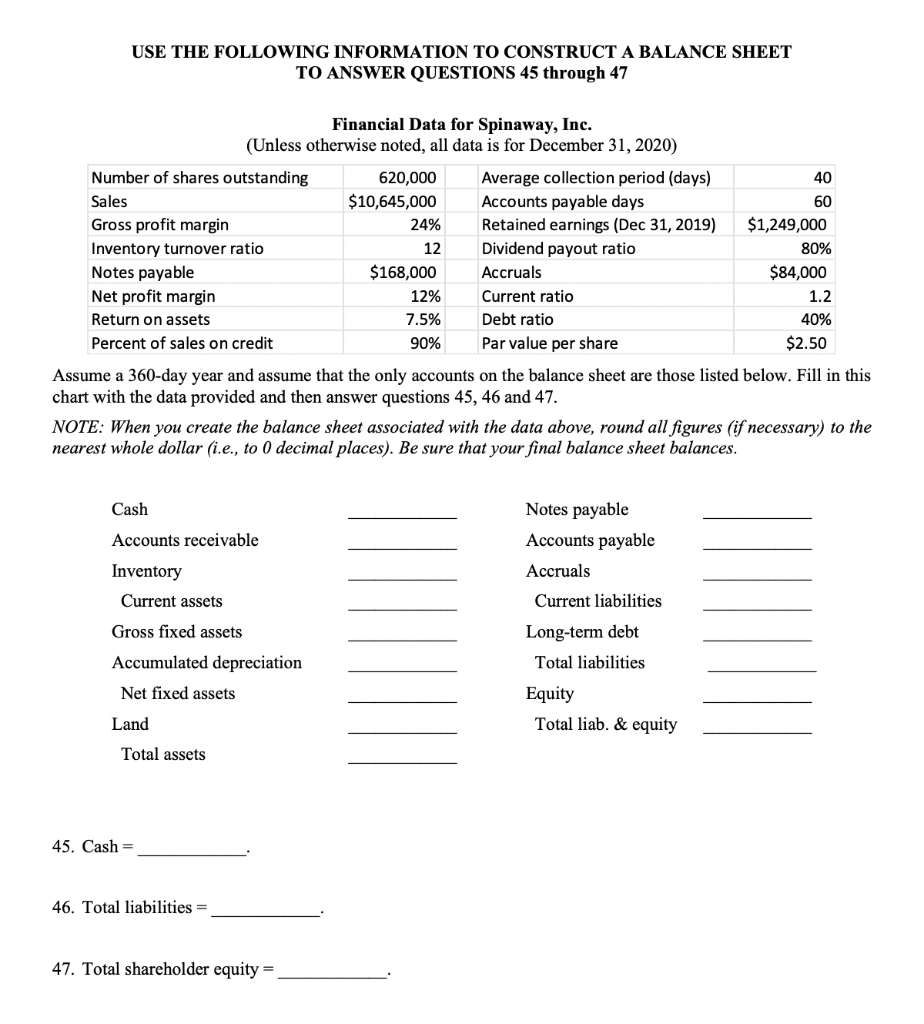

USE THE FOLLOWING INFORMATION TO CONSTRUCT A BALANCE SHEET TO ANSWER QUESTIONS 45 through 47 Financial Data for Spinaway, Inc. (Unless otherwise noted, all data is for December 31, 2020) Number of shares outstanding 620,000 Average collection period (days) 40 60 Sales $10,645,000 Accounts payable days Gross profit margin 24% Retained earnings (Dec 31, 2019) $1,249,000 Inventory turnover ratio 12 Dividend payout ratio 80% Notes payable $168,000 Accruals $84,000 Net profit margin 12% Current ratio 1.2 Return on assets 7.5% Debt ratio 40% Percent of sales on credit 90% Par value per share $2.50 Assume a 360-day year and assume that the only accounts on the balance sheet are those listed below. Fill in this chart with the data provided and then answer questions 45, 46 and 47. NOTE: When you create the balance sheet associated with the data above, round all figures (if necessary) to the nearest whole dollar (i.e., to 0 decimal places). Be sure that your final balance sheet balances. Cash Notes payable Accounts receivable Accounts payable Inventory Accruals Current assets Current liabilities Gross fixed assets Long-term debt Accumulated depreciation Total liabilities Net fixed assets Equity Land Total liab. & equity Total assets 45. Cash= 46. Total liabilities = 47. Total shareholder equity = USE THE FOLLOWING INFORMATION TO CONSTRUCT A BALANCE SHEET TO ANSWER QUESTIONS 45 through 47 Financial Data for Spinaway, Inc. (Unless otherwise noted, all data is for December 31, 2020) Number of shares outstanding 620,000 Average collection period (days) 40 60 Sales $10,645,000 Accounts payable days Gross profit margin 24% Retained earnings (Dec 31, 2019) $1,249,000 Inventory turnover ratio 12 Dividend payout ratio 80% Notes payable $168,000 Accruals $84,000 Net profit margin 12% Current ratio 1.2 Return on assets 7.5% Debt ratio 40% Percent of sales on credit 90% Par value per share $2.50 Assume a 360-day year and assume that the only accounts on the balance sheet are those listed below. Fill in this chart with the data provided and then answer questions 45, 46 and 47. NOTE: When you create the balance sheet associated with the data above, round all figures (if necessary) to the nearest whole dollar (i.e., to 0 decimal places). Be sure that your final balance sheet balances. Cash Notes payable Accounts receivable Accounts payable Inventory Accruals Current assets Current liabilities Gross fixed assets Long-term debt Accumulated depreciation Total liabilities Net fixed assets Equity Land Total liab. & equity Total assets 45. Cash= 46. Total liabilities = 47. Total shareholder equity =