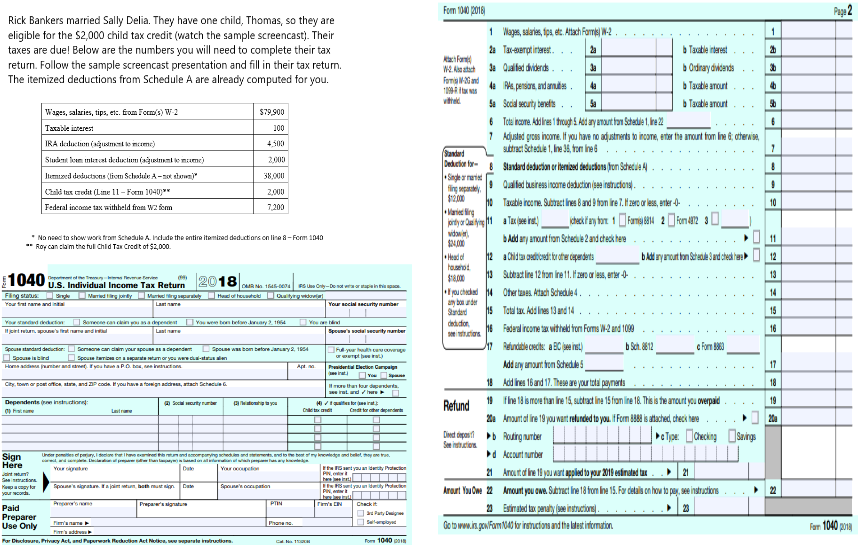

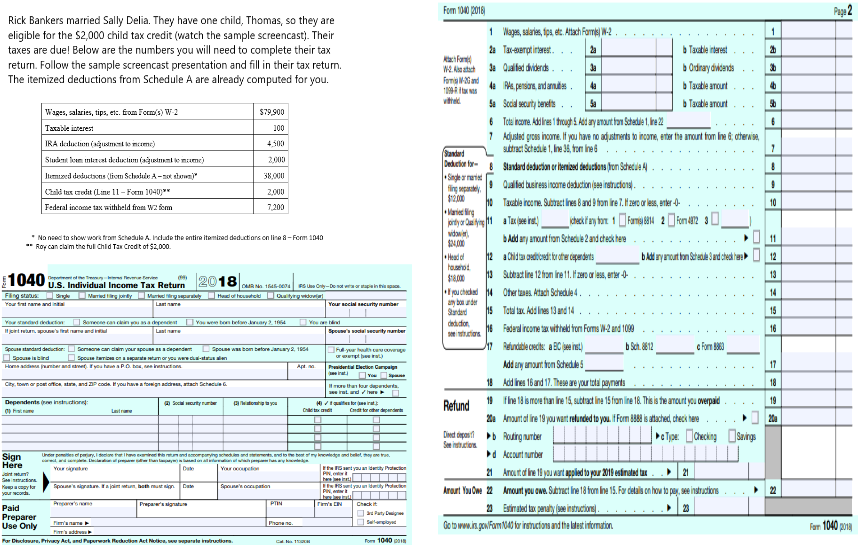

USE THE FOLLOWING INFORMATION TO FILL OUT THE FOLLOWING FORM.

Form 1040 2018 Rick Bankers married Sally Delia. They have one child, Thomas, so they are eligible for the S2,000 child tax credit (watch the sample screencast). Their taxes are due! Below are the numbers you will need to complete their tax return. Follow the samplescreencast presentation and fll in their tax return. The itemized deductions fram Schedule A are already computed for you. Taxable inberest Tavable amourt Tavable amourt Wages, alries, tips, et:.from Ecs W1 79900 Tarale icnerest Adused gross inome. If you have no adjustments to inme,er the aourt fom ine&otherwise surt "'nItal ikt1UCI"", (KIRd".ml krtame.. 3,00 38,001 2,000 7.200 Federal income tax withheld from W cm vdaw Heado 800 8-Fom 1040 wor fram Schesub A rcdade Ror can lam tre tul Chid Ta Credt ot $2,000. a nae tos the entine iteminad dadctars onl U.S. Individual Income Tax Return atal tax. Add lines 13 and 14 ederal ircome ax witheld fron Forms W-2 and 1099 Add any anaunt ronSchedl Add ines 16 and 17.These are your tota 19 fine 13 ismove than ine 15 subtradtline 15 fram ine 18 Tris is the amourtyou overpaid 2a Anount ne 19 you wamt relunded to you f Fom 888is atached, check here 2a d Account urber Here Ancur.f Iine 18 you want appied to ypour 201 estinatd a2 Paid Use Only Goto www.irx gow Fom 40 vor irsuctons and the ltst nmaion a 1040p Form 1040 2018 Rick Bankers married Sally Delia. They have one child, Thomas, so they are eligible for the S2,000 child tax credit (watch the sample screencast). Their taxes are due! Below are the numbers you will need to complete their tax return. Follow the samplescreencast presentation and fll in their tax return. The itemized deductions fram Schedule A are already computed for you. Taxable inberest Tavable amourt Tavable amourt Wages, alries, tips, et:.from Ecs W1 79900 Tarale icnerest Adused gross inome. If you have no adjustments to inme,er the aourt fom ine&otherwise surt "'nItal ikt1UCI"", (KIRd".ml krtame.. 3,00 38,001 2,000 7.200 Federal income tax withheld from W cm vdaw Heado 800 8-Fom 1040 wor fram Schesub A rcdade Ror can lam tre tul Chid Ta Credt ot $2,000. a nae tos the entine iteminad dadctars onl U.S. Individual Income Tax Return atal tax. Add lines 13 and 14 ederal ircome ax witheld fron Forms W-2 and 1099 Add any anaunt ronSchedl Add ines 16 and 17.These are your tota 19 fine 13 ismove than ine 15 subtradtline 15 fram ine 18 Tris is the amourtyou overpaid 2a Anount ne 19 you wamt relunded to you f Fom 888is atached, check here 2a d Account urber Here Ancur.f Iine 18 you want appied to ypour 201 estinatd a2 Paid Use Only Goto www.irx gow Fom 40 vor irsuctons and the ltst nmaion a 1040p