Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the following information to post the adjusting entries to the spreadsheet only (no journal entries) for the year ended December 31, 2020 1.

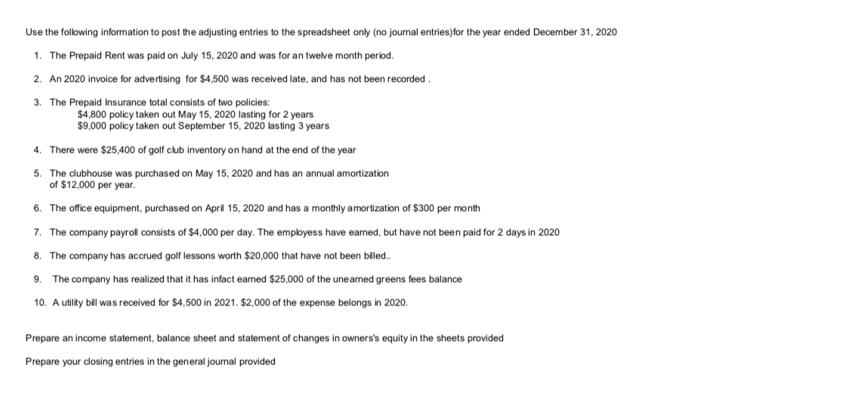

Use the following information to post the adjusting entries to the spreadsheet only (no journal entries) for the year ended December 31, 2020 1. The Prepaid Rent was paid on July 15, 2020 and was for an twelve month period. 2. An 2020 invoice for advertising for $4,500 was received late, and has not been recorded 3. The Prepaid Insurance total consists of two policies: $4,800 policy taken out May 15, 2020 lasting for 2 years $9,000 policy taken out September 15, 2020 lasting 3 years 4. There were $25,400 of golf club inventory on hand at the end of the year 5. The clubhouse was purchased on May 15, 2020 and has an annual amortization of $12,000 per year. 6. The office equipment, purchased on April 15, 2020 and has a monthly amortization of $300 per month 7. The company payroll consists of $4,000 per day. The employess have earned, but have not been paid for 2 days in 2020 8. The company has accrued golf lessons worth $20,000 that have not been billed.. 9. The company has realized that it has infact earned $25,000 of the uneared greens fees balance 10. A utility bill was received for $4,500 in 2021. $2,000 of the expense belongs in 2020. Prepare an income statement, balance sheet and statement of changes in owners's equity in the sheets provided Prepare your closing entries in the general journal provided CASH A/R GOLF CLUBS PREPAID INS PREPAID RENT CLUBHOUSE ACCUM AMORT-CLUBHOUSE OFFICE EQUIPMENT ACCUM AMORT-OFFICE EQPT A/P SALARIES PAYABLE UNEARNED GREENS FEES WIERD WOOD, CAPITAL WIERD WOOD, WITHDRAWAL GREENS FEES EARNED GOLF LESSONS EARNED AMORTIZATION EXP-CLUBHOUSE AMORTIZATION EXP-OFF. EQUIP. SALARIES EXPENSE INSURANCE EXPENSE RENT EXPENSE GOLF CLUBS EXPENSE ADVERTISING EXPENSE UTILITIES EXPENSE UNADJUSTED TRIAL BALANCE DECEMBER 31, 2020 DR CR 60,000 60,000 13,800 18,000 150,000 36,000 25.525 66,500 75,600 9,775 36,450 551,650 0 0 125,450 85.000 120,350 145.850 75,000 551,650 ADJUSTMENTS DR CR ADJUSTED TRIAL BALANCE DECEMBER 31, 2020 DR CR INCOME STATEMENT DR CR STATEMENT OF CHANGES & BALANCE SHEET DR CR

Step by Step Solution

★★★★★

3.59 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started