Answered step by step

Verified Expert Solution

Question

1 Approved Answer

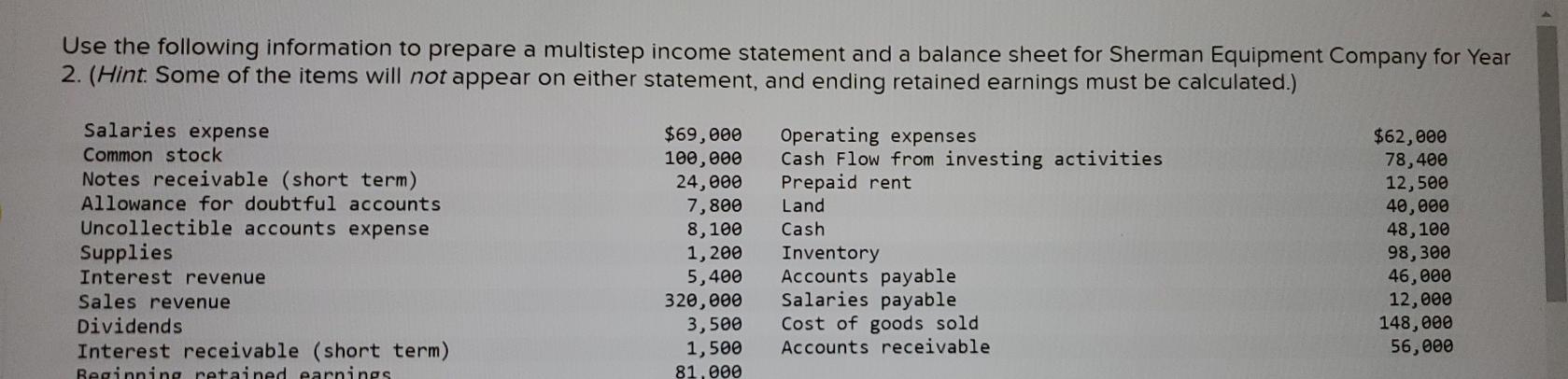

Use the following information to prepare a multistep income statement and a balance sheet for Sherman Equipment Company for Year 2. (Hint. Some of the

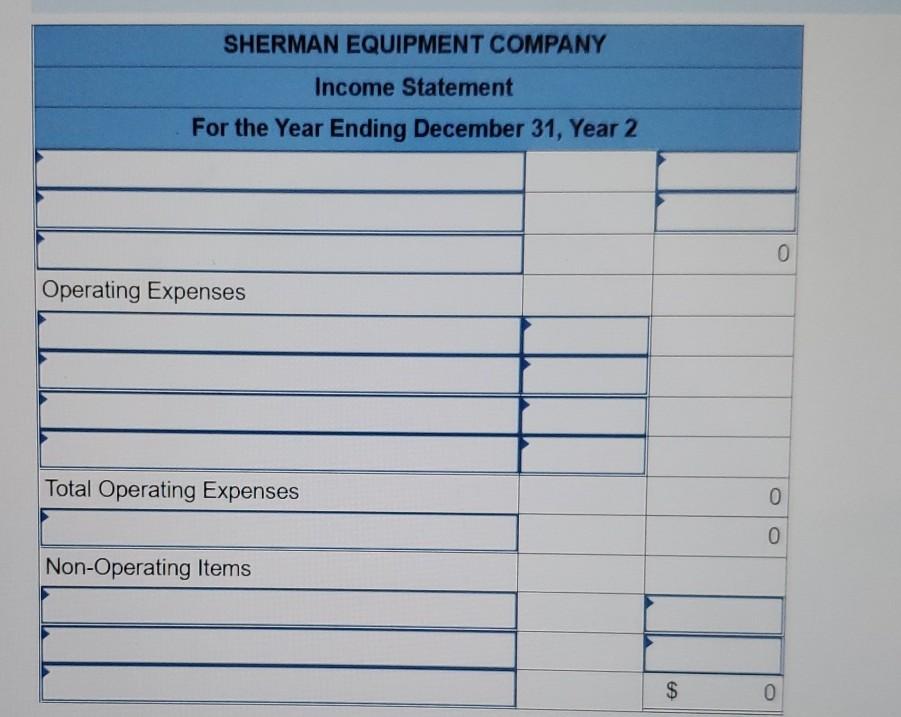

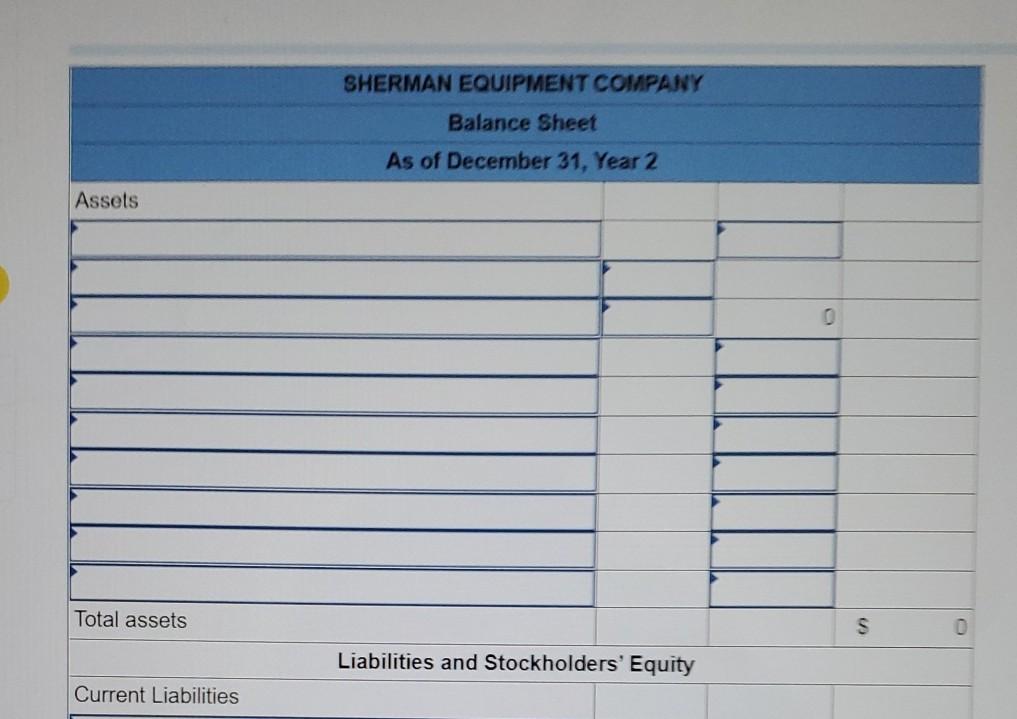

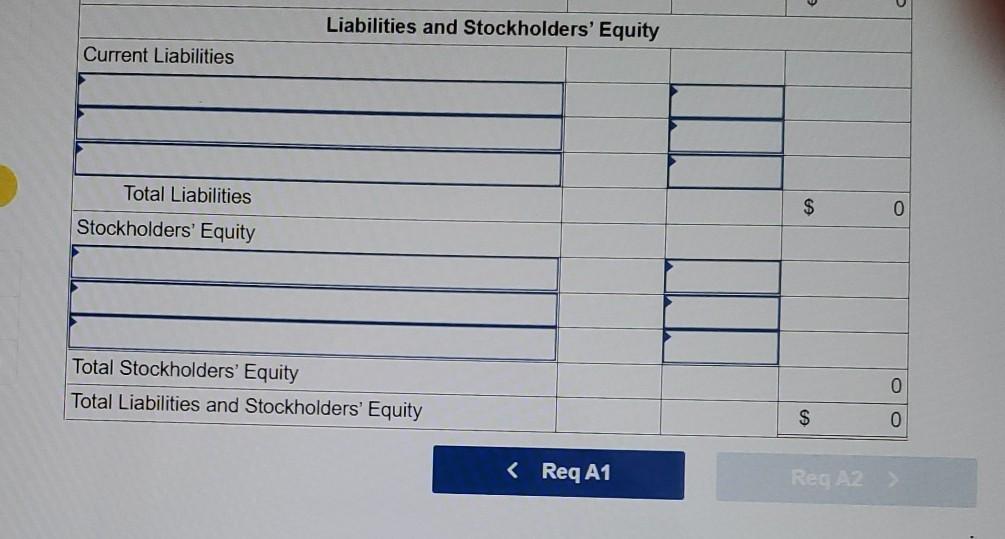

Use the following information to prepare a multistep income statement and a balance sheet for Sherman Equipment Company for Year 2. (Hint. Some of the items will not appear on either statement, and ending retained earnings must be calculated.) Salaries expense Common stock Notes receivable (short term) Allowance for doubtful accounts Uncollectible accounts expense Supplies Interest revenue Sales revenue Dividends Interest receivable (short term) Beginning retained earnings $69,000 100,000 24,000 7,800 8,100 1,200 5,400 320,000 3,500 1,500 81,000 Operating expenses Cash Flow from investing activities Prepaid rent Land Cash Inventory Accounts payable Salaries payable Cost of goods sold Accounts receivable $62,000 78,400 12,500 40,000 48, 100 98,300 46,000 12,000 148,000 56,000 SHERMAN EQUIPMENT COMPANY Income Statement For the Year Ending December 31, Year 2 0 O Operating Expenses Total Operating Expenses 0 0 Non-Operating Items $ 0 SHERMAN EQUIPMENT COMPANY Balance Sheet As of December 31, Year 2 Assets 0 Total assets S Liabilities and Stockholders' Equity Current Liabilities Liabilities and Stockholders' Equity Current Liabilities Total Liabilities $ 0 Stockholders' Equity Total Stockholders' Equity Total Liabilities and Stockholders' Equity 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started