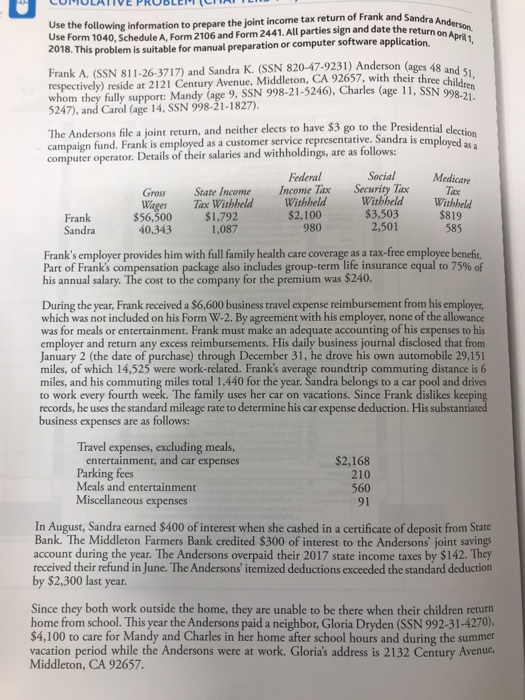

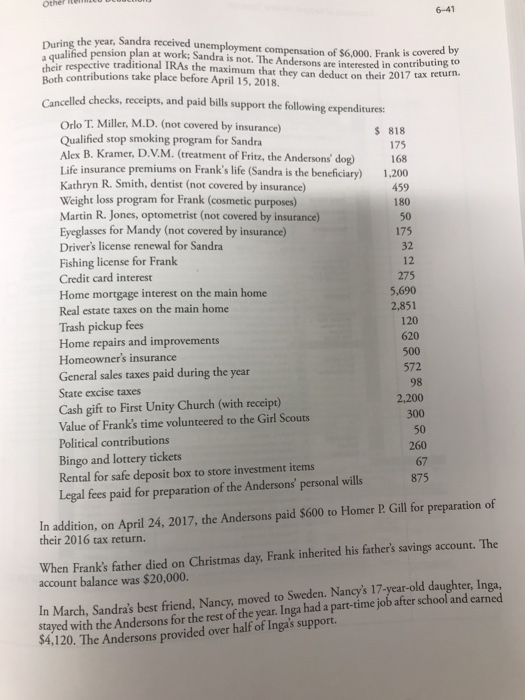

Use the following information to prepare the joint income tax return of Frank and Sandra Use Form 1040, Schedule A, Form 2106 and Form 2441. All parties sign and date Pril 18. This problem is suitable for manual preparation or computer software application. Frank respectively) reside at 2121 Century Avenue, Middleton, CA 92657, with their three whom they fully support: Mandy (age 9, SSN 998-21-5246), Charles (age 11, SS 5247), and Carol (age 14, SSN 998-21-1827) The Anderons flc a joint returm, and neither elects to have $3 go to the Presidenial elec campaign fund. Frank is employed as a customer service representative. Sandra is empl computer operator. Details of their salaries and withholdings, are as follows: Federal SocialMedicare Gross State Income Income Tax Security Tax Tax Withheld Withheld Wages Tax WithheldWithhelad $2,100 980 $1,792 1,087 $3,503 2,501 819 585 Frank $56,500 40,343 Frank's employer provides him with full family health care coverage as a tax-free employee benefit. Part of Frank's compensation his annual salary. The cost to the company for the premium was $240 ge also includes group-term, life insurance equal to 75%of During the year, Frank received a $6,600 business travel expense reimbursement from his employer, which was not included on his Form W-2. By agreement with his employer, none of the allowance was for meals or entertainment. Frank must make an adequate accounting of his expenses to his employer and return any excess reimbursements. His daily business journal disclosed that fro January 2 (the date of purchase) through December 31, he drove his own automobile 29,151 miles, of which 14,525 were work-related. Frank's average roundtrip commuting distance is miles, and his commuting miles total 1,440 for the year. Sandra belongs to a car pool and drives The family uses her car on vacations. Since Frank dislikes kee records, he uses the standard mileage rate to determine his car expense deduction. His substantiat business expenses are as follows: Travel expenses, excluding meals, entertainment, and car expenses $2,168 210 560 91 Parking fees Meals and entertainment eous In August, Sandra earned $400 of interest when she cashed in a certificate of deposit from State Bank. The Middleton Farmers Bank credited $300 of interest to the Andersons' joint savings account during the year. The Andersons overpaid their 2017 state income taxes by $142. They received their refund in June. The Andersons' itemized deductions exceeded the standard deduction by $2,300 last year. Since they both work outside the home, they are unable to be there when their children return home from school. This year the Andersons paid a neighbor, Gloria Dryden (SSN 992-31-4270) $4,100 to care for Mandy and Charles in her home after school hours and during the summer vacation period while the Andersons were at work. Gloria's address is 2132 Century Avenue, Middleton, CA 92657. Use the following information to prepare the joint income tax return of Frank and Sandra Use Form 1040, Schedule A, Form 2106 and Form 2441. All parties sign and date Pril 18. This problem is suitable for manual preparation or computer software application. Frank respectively) reside at 2121 Century Avenue, Middleton, CA 92657, with their three whom they fully support: Mandy (age 9, SSN 998-21-5246), Charles (age 11, SS 5247), and Carol (age 14, SSN 998-21-1827) The Anderons flc a joint returm, and neither elects to have $3 go to the Presidenial elec campaign fund. Frank is employed as a customer service representative. Sandra is empl computer operator. Details of their salaries and withholdings, are as follows: Federal SocialMedicare Gross State Income Income Tax Security Tax Tax Withheld Withheld Wages Tax WithheldWithhelad $2,100 980 $1,792 1,087 $3,503 2,501 819 585 Frank $56,500 40,343 Frank's employer provides him with full family health care coverage as a tax-free employee benefit. Part of Frank's compensation his annual salary. The cost to the company for the premium was $240 ge also includes group-term, life insurance equal to 75%of During the year, Frank received a $6,600 business travel expense reimbursement from his employer, which was not included on his Form W-2. By agreement with his employer, none of the allowance was for meals or entertainment. Frank must make an adequate accounting of his expenses to his employer and return any excess reimbursements. His daily business journal disclosed that fro January 2 (the date of purchase) through December 31, he drove his own automobile 29,151 miles, of which 14,525 were work-related. Frank's average roundtrip commuting distance is miles, and his commuting miles total 1,440 for the year. Sandra belongs to a car pool and drives The family uses her car on vacations. Since Frank dislikes kee records, he uses the standard mileage rate to determine his car expense deduction. His substantiat business expenses are as follows: Travel expenses, excluding meals, entertainment, and car expenses $2,168 210 560 91 Parking fees Meals and entertainment eous In August, Sandra earned $400 of interest when she cashed in a certificate of deposit from State Bank. The Middleton Farmers Bank credited $300 of interest to the Andersons' joint savings account during the year. The Andersons overpaid their 2017 state income taxes by $142. They received their refund in June. The Andersons' itemized deductions exceeded the standard deduction by $2,300 last year. Since they both work outside the home, they are unable to be there when their children return home from school. This year the Andersons paid a neighbor, Gloria Dryden (SSN 992-31-4270) $4,100 to care for Mandy and Charles in her home after school hours and during the summer vacation period while the Andersons were at work. Gloria's address is 2132 Century Avenue, Middleton, CA 92657