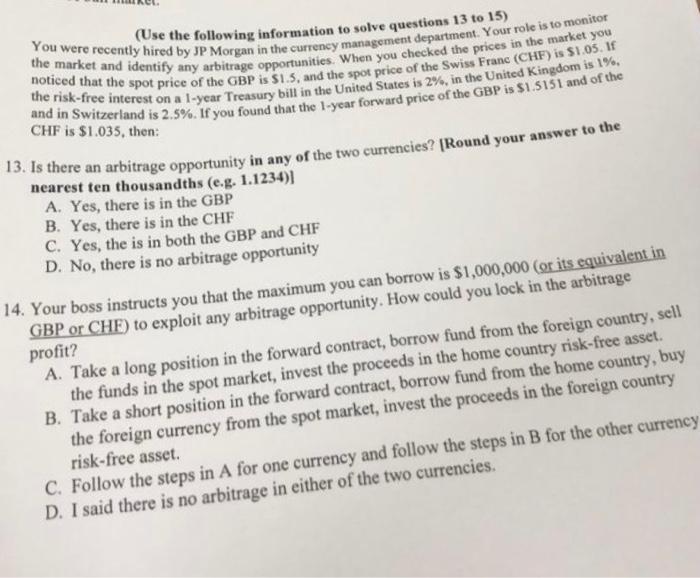

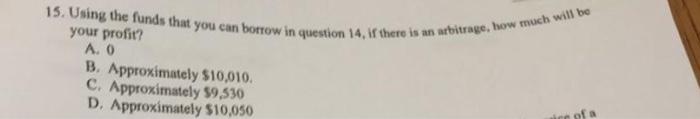

(Use the following information to solve questions 13 to 15) You were recently hired by JP Morgan in the currency management department. Your role is to monitor the market and identify any arbitrage opportunities. When you checked the prices in the market you noticed that the spot price of the GBP is $1.5, and the spot price of the Swiss Franc (CHF) is $1.05. If the risk-free interest on a 1-year Treasury bill in the United States is 2%, in the United Kingdom is 1%. and in Switzerland is 2.5%. If you found that the 1-year forward price of the GBP is $1.5151 and of the CHF is $1.035, then: 13. Is there an arbitrage opportunity in any of the two currencies? (Round your answer to the nearest ten thousandths (e.g. 1.1234) A. Yes, there is in the GBP B. Yes, there is in the CHF c. Yes, the is in both the GBP and CHF D. No, there is no arbitrage opportunity 14. Your boss instructs you that the maximum you can borrow is $1,000,000 (or its equivalent in GBP or CHF) to exploit any arbitrage opportunity. How could you lock in the arbitrage profit? A. Take a long position in the forward contract, borrow fund from the foreign country, sell the funds in the spot market, invest the proceeds in the home country risk-free asset. B. Take a short position in the forward contract, borrow fund from the home country, buy the foreign currency from the spot market, invest the proceeds in the foreign country risk-free asset. C. Follow the steps in A for one currency and follow the steps in B for the other currency D. I said there is no arbitrage in either of the two currencies. 15. Using the funds that you can borrow in question 14. If there is an arbitrage, how much will be your profit? A. O B. Approximately $10,010. C. Approximately 59,530 D. Approximately 510,050 (Use the following information to solve questions 13 to 15) You were recently hired by JP Morgan in the currency management department. Your role is to monitor the market and identify any arbitrage opportunities. When you checked the prices in the market you noticed that the spot price of the GBP is $1.5, and the spot price of the Swiss Franc (CHF) is $1.05. If the risk-free interest on a 1-year Treasury bill in the United States is 2%, in the United Kingdom is 1%. and in Switzerland is 2.5%. If you found that the 1-year forward price of the GBP is $1.5151 and of the CHF is $1.035, then: 13. Is there an arbitrage opportunity in any of the two currencies? (Round your answer to the nearest ten thousandths (e.g. 1.1234) A. Yes, there is in the GBP B. Yes, there is in the CHF c. Yes, the is in both the GBP and CHF D. No, there is no arbitrage opportunity 14. Your boss instructs you that the maximum you can borrow is $1,000,000 (or its equivalent in GBP or CHF) to exploit any arbitrage opportunity. How could you lock in the arbitrage profit? A. Take a long position in the forward contract, borrow fund from the foreign country, sell the funds in the spot market, invest the proceeds in the home country risk-free asset. B. Take a short position in the forward contract, borrow fund from the home country, buy the foreign currency from the spot market, invest the proceeds in the foreign country risk-free asset. C. Follow the steps in A for one currency and follow the steps in B for the other currency D. I said there is no arbitrage in either of the two currencies. 15. Using the funds that you can borrow in question 14. If there is an arbitrage, how much will be your profit? A. O B. Approximately $10,010. C. Approximately 59,530 D. Approximately 510,050