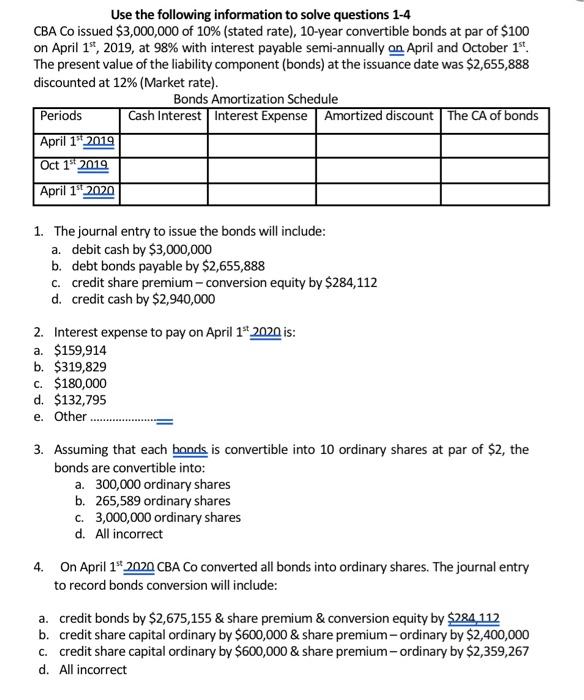

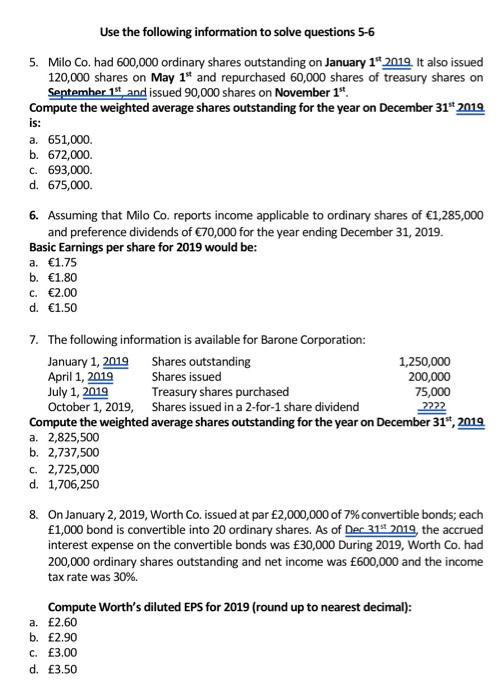

Use the following information to solve questions 1-4 CBA Co issued $3,000,000 of 10% (stated rate), 10-year convertible bonds at par of $100 on April 1st,2019, at 98% with interest payable semi-annually on April and October 1st. The present value of the liability component (bonds) at the issuance date was $2,655,888 discounted at 12% (Market rate). Bonds Amortization Schedule 1. The journal entry to issue the bonds will include: a. debit cash by $3,000,000 b. debt bonds payable by $2,655,888 c. credit share premium - conversion equity by $284,112 d. credit cash by $2,940,000 2. Interest expense to pay on April 1st2020 is: a. $159,914 b. $319,829 c. $180,000 d. $132,795 e. Other 3. Assuming that each bands is convertible into 10 ordinary shares at par of $2, the bonds are convertible into: a. 300,000 ordinary shares b. 265,589 ordinary shares c. 3,000,000 ordinary shares d. All incorrect 4. On April 1st2020 CBA Co converted all bonds into ordinary shares. The journal entry to record bonds conversion will include: a. credit bonds by $2,675,155 \& share premium \& conversion equity by $284,112 b. credit share capital ordinary by $600,000 \& share premium - ordinary by $2,400,000 c. credit share capital ordinary by $600,000 \& share premium - ordinary by $2,359,267 d. All incorrect Use the following information to solve questions 5-6 5. Milo Co. had 600,000 ordinary shares outstanding on January 1tt2019. It also issued 120,000 shares on May 1st and repurchased 60,000 shares of treasury shares on Septemher 1st, and issued 90,000 shares on November 1st. Compute the weighted average shares outstanding for the year on December 31st 2019 is: a. 651,000 . b. 672,000 . c. 693,000 . d. 675,000 . 6. Assuming that Milo Co. reports income applicable to ordinary shares of 1,285,000 and preference dividends of 70,000 for the year ending December 31, 2019. Basic Earnings per share for 2019 would be: a. 1.75 b. 1.80 c. 2.00 d. 1.50 7. The followine information is available for Barone Corporation: Compute the weighted average shares outstanding for the year on December 31st,2019 a. 2,825,500 b. 2,737,500 c. 2,725,000 d. 1,706,250 8. On January 2, 2019, Worth Co. issued at par 2,000,000 of 7% convertible bonds; each 1,000 bond is convertible into 20 ordinary shares. As of the accrued interest expense on the convertible bonds was 30,000 During 2019, Worth Co. had 200,000 ordinary shares outstanding and net income was 600,000 and the income tax rate was 30%. Compute Worth's diluted EPS for 2019 (round up to nearest decimal): a. 2.60 b. 2.90 c. 3.00 d. 3.50