Question

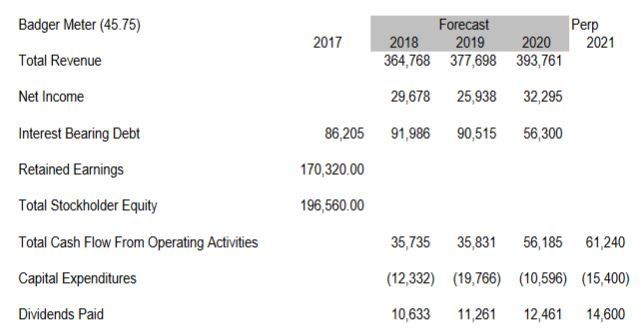

Use the following information to value Badger-Meter Corp. using the discounted residual income model. The observed share price on December 1, 2017 was $45.75 per

Use the following information to value Badger-Meter Corp. using the discounted residual income model. The observed share price on December 1, 2017 was $45.75 per share. The most recent 10-k was dated Nov. 30, 2017. WACC (after-tax) is 8% and the estimated cost of equity is 11% for Badger Meter. All dollar amount items are stated in thousands of dollars. Shares of Common Stock outstanding (in thousands) is 28,820 The Terminal Value perpetuity begins in 2021 and dividends are assumed to grow at 3.4% annually. Residual income in 2021 is expected to be 5% greater than the amount forecast in 2020.

Value the shares as at Nov. 30, 2017 using the Discounted Residual Income Model

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started