Answered step by step

Verified Expert Solution

Question

1 Approved Answer

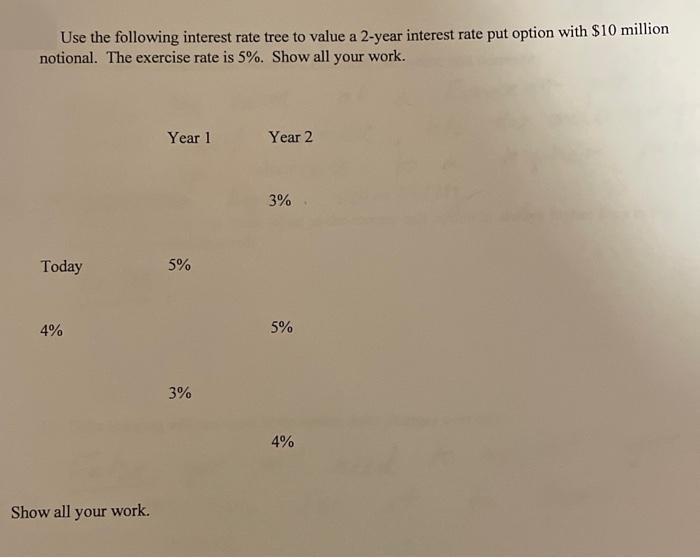

Use the following interest rate tree to value a 2-year interest rate put option with $10 million notional. The exercise rate is 5%. Show

Use the following interest rate tree to value a 2-year interest rate put option with $10 million notional. The exercise rate is 5%. Show all your work. Today 4% Show all your work. Year 1 5% 3% Year 2 3% 5% 4%

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Y Important points Loan cost choices are monetary subsidiaries that permit financial backers to support or conjecture on the directional moves in financing costs A call choice permits financial backers to benefit when rates rise and put choices permit financial backers to benefit when rates fall Financing cost choices are cashsettled which is the distinction between the activity strike cost of the choice and the activity not entirely set in stone by the common spot yield Financing cost choices have Europeanstyle practice arrangements and that implies the holder can practice their choices at termination Explanation for step 1 Similarly as with value choices a loan fee choice has a premium joined to it or an expense to go into the agreement A call choice gives the holder the right however not the commitment to profit from increasing financing costs The financial backer ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started