Answered step by step

Verified Expert Solution

Question

1 Approved Answer

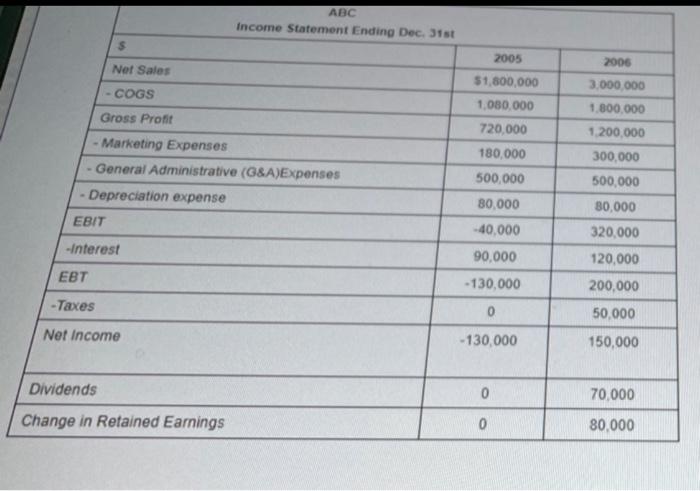

use the following IS and balance sheets for ABC to calculate the total debt to total assets ratio for the year 2006 A- 0.213 B-

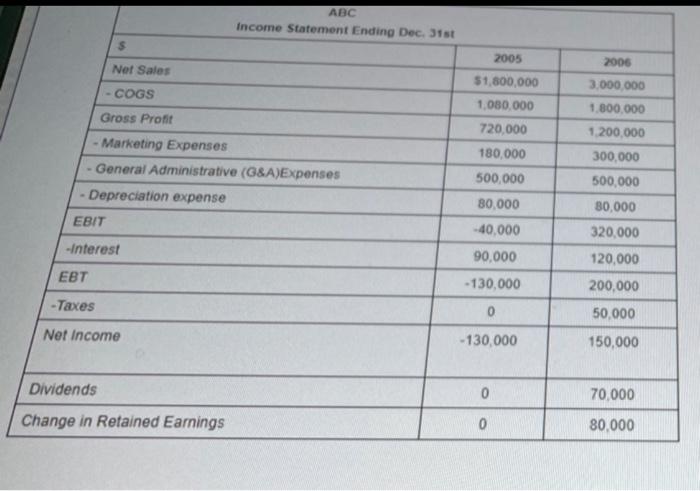

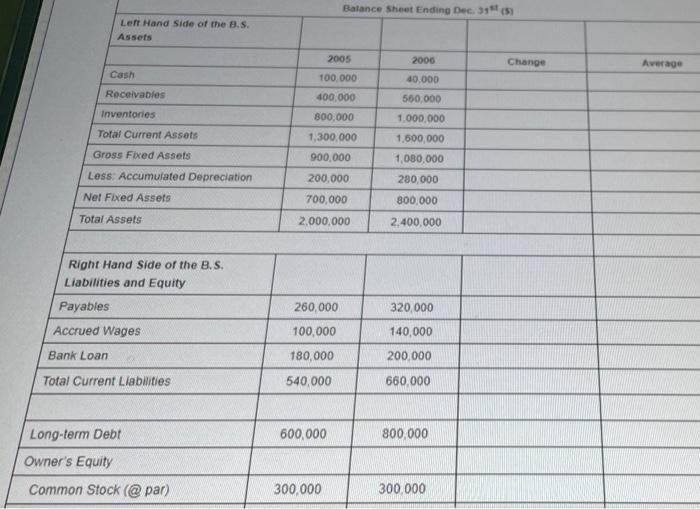

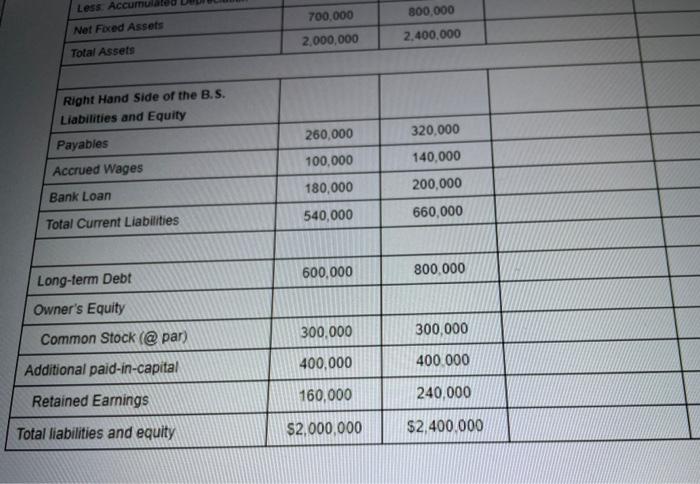

use the following IS and balance sheets for ABC to calculate the total debt to total assets ratio for the year 2006

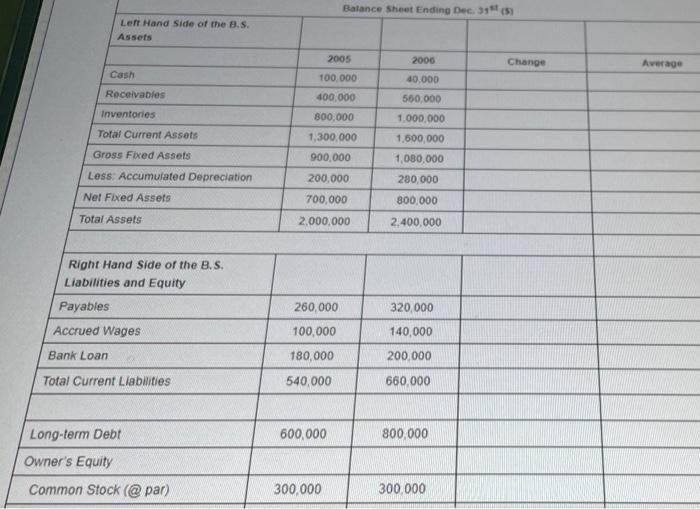

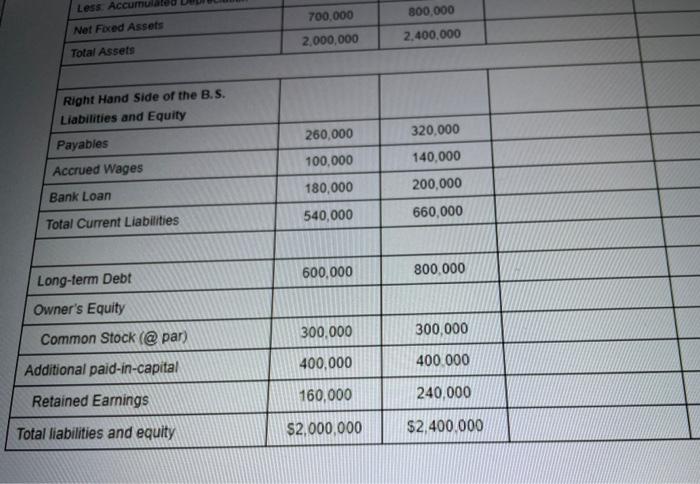

ABC Income Statement Ending Dec. 31st $ 2005 2006 Net Sales - COGS $1,800,000 1.080.000 720,000 180,000 Gross Profit Marketing Expenses General Administrative (G&A)Expenses Depreciation expense EBIT 3.000.000 1.800.000 1.200,000 300,000 500,000 500.000 80,000 80,000 -40.000 -Interest 90.000 EBT 320,000 120,000 200,000 50,000 -130,000 -Taxes 0 Net Income -130,000 150,000 Dividends 0 70,000 Change in Retained Earnings 0 80,000 Balance Sheet Ending Dec 31 (5) Left Hand Side of the B.S. Assets 2005 Change Average Cash 100 000 400.000 2006 40.000 500,000 Receivables Inventories 800.000 1.000.000 Total Current Assets Gross Fixed Assets Less Accumulated Depreciation 1,300,000 900.000 200.000 700,000 2,000,000 1,500,000 1,080,000 280,000 800,000 2.400.000 Nel Fixed Assets Total Assets Right Hand Side of the B.S. Liabilities and Equity 320,000 Payables Accrued Wages 260,000 100,000 180,000 540,000 Bank Loan 140,000 200.000 660,000 Total Current Liabilities 600,000 800,000 Long-term Debt Owner's Equity Common Stock (@par) 300,000 300.000 Less Accumulated Net Foxed Assets Total Assets 700.000 2,000,000 800,000 2.400.000 Right Hand Side of the B.S. Liabilities and Equity Payables Accrued Wages 260,000 100,000 180,000 540,000 320,000 140,000 200,000 660,000 Bank Loan Total Current Liabilities 600,000 800.000 Long-term Debt Owner's Equity 300,000 300,000 Common Stock (@par) 400,000 400 000 Additional paid-in-capital Retained Earnings 160,000 240,000 Total liabilities and equity $2,000,000 $2,400,000

A- 0.213

B- 0.986

C- 0.591

D- 0.432

E- 0.115

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started