Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the following operational concept for the operational phase of the ATM to develop an IDEF0 system diagram (full external). Please explain your deliverables and

Use the following operational concept for the operational phase of the ATM to develop an IDEF0 system diagram (full external). Please explain your deliverables and process in details and diagram neess to be clear (preferably computerized)

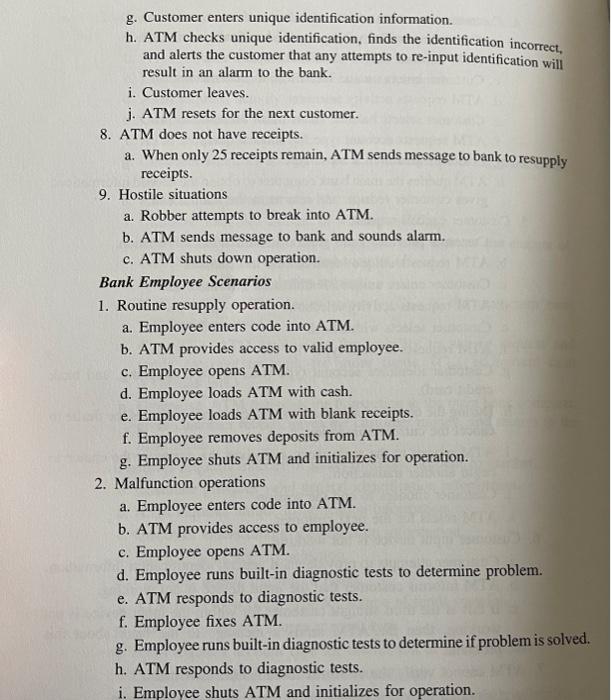

the systems engineering faculty will maintain the accuracy of the courses and prerequisites. Assume the information system can obtain schedule information over a network from the registrar's office. Assume that the information system produces a written plan of study for each student. 6.2 Use the following openational concept for the operational phase of the ATM to i. create one additional scenario for the operational concepc. ii. develop an external system diagram using IDEFO. ii. create an objectives hierarchy for the ATM system. iv. develop a set of stakeholders' requirements. Use the format of the Stakeholders' Requirements Document and the taxonomy of four types of requirements from this chapter. Make every effort to develop as complete and unambiguous a set of stakeholders' requirements for the operational phase as possible using only the information provided in the following scenarios. Then add three system-wide requirements and four qualification requirements. Automatic Teller Machine (ATM) for Money Mart Corporation. The ATM system is to provide a cost-effective service to bank customers, that is, convenient, safe, and secure 24h access to a common set of banking transactions and reduce the cost of providing these basic transactions. The ATM system shall provide a number of the most common banking transactions (deposit, withdraw, transfer of funds, balance query) without involvement of bank personnel. The operational concept is comprised of a group of scenarios that are based upon the stakeholders' requirements and relates to both the bank's customers and employees. Customer Scenarios 1. Customer makes deposits. a. Customer provides valid general identification information. b. ATM requests unique identification information. c. Customer enters unique identification information. d. ATM requests activity selection. e. Customer selects deposit. f. ATM requests account type. g. Customer identifies account type (i.c., savings, checking, bank credit card). h. ATM requests type of deposit (cash versus check). i. Customer identifies type of deposit - cash/check. j. ATM provides a means to physically insert cash/check into ATM. k. Customer enters deposit. ATM transmits the transaction to the main bank computer, gives customer receipt, and then retums to main menu. 2. Customer requests cash to be withdrawn from an account. a. Customer provides valid general identification information. b. ATM requests unique identification information. c. Customer enters unique identification information. d. ATM requests activity selection. e. Customer selects withdrawal. f. ATM requests account type. g. Customer identifies account type (i.e., savings, checking, bank credit card). h. ATM requests amount of withdrawal. i. Customer identifies amount of withdrawal (Crequ). j. ATM contacts the main bank computer and requests the amount of available funds for the selected account (Fmax). k. If Creq>Fmax. ATM denies request. 1. If Creq>Clim. ATM denies request. ( Clim is the maximum cash withdrawal allowed.) m. Creq>Cleft ATM apologizes for inability to satisfy request and sends message to bank for more funds. ( Cleft is amount cash ATM has left.) n. Otherwise, ATM transmits the transaction to the main bank computer, gives customer receipt, gives the customer money, and returns to the main menu. 3. Customer requests transfer of funds from one account to another. a. Customer provides valid general identification information. b. ATM requests unique identification information. c. Customer enters unique identification information. d. ATM requests activity selection. e. Customer selects transfer of funds. f. ATM requests account type for source of funds transfer. g. Customer identifies source account type. h. ATM requests account type for destination of funds transfer. i. Customer identifies destination account type. j. ATM queries the main bank computer to determine the availability of funds for the source account (Fmax). k. ATM requests the amount of the funds transfer. 1. Customer identifies the amount of funds to be transferred (Ftra). m. If Ftms>Fmax, the ATM denies the request. n. Otherwise, the funds are transferred, ATM transmits the transaction to the main bank computer, gives the receipt, and returns to the main menu. 4. Customer requests the status of balance of an account. a. Customer provides valid general identification information. b. ATM requests unique identification information. c. Customer enters unique identification information. d. ATM requests activity selection. e. Customer selects balance starus of an account. f. ATM requests account type for balance query. g. Customer identifies account type. h. ATM queries the main bank computer to obtain the needed information, gives customer receipt, and returns to the main menu. 5. Customer cancels request. a. Customer provides valid general identification information. b. ATM requests unique identification information. c. Customer enters unique identification information. d. ATM requests activity selection. c. Customer selects withdrawal. f. ATM requests account type. g. Customer identifies account type (i.e., savings, checking. and bank credit card). h. During the course of a transaction, the customer indicates the desire to cancel the current transaction. i. ATM returns to the main menu and gives the customer the choice to: begin another transaction. j. Customer chooses to end the session. k. ATM resets for the next customer. 6. Customer input device is not working. a. Customer attempts to provide valid general identification information. b. ATM informs customer that the input device is not working. c. If this is the third straight customer for whom the input device is not working. then the ATM sends a message to the bank about this problem. 7. ATM cannot verify the customer identification scheme. a. Customer provides valid general identification information. b. ATM requests unique identification information. c. Customer enters unique identification information. d. ATM checks unique identification, finds the identification incorrect, and requests customer to re-input identification. e. Customer enters unique identification information. f. ATM checks unique identification, finds the identification incorrect, and requests the customer to re-input identification. g. Customer enters unique identification information. h. ATM checks unique identification, finds the identification incorrect, and alerts the customer that any attempts to re-input identification will result in an alarm to the bank. i. Customer leaves. j. ATM resets for the next customer. 8. ATM does not have receipts. a. When only 25 receipts remain, ATM sends message to bank to resupply receipts. 9. Hostile situations a. Robber attempts to break into ATM. b. ATM sends message to bank and sounds alarm. c. ATM shuts down operation. Bank Employee Scenarios 1. Routine resupply operation. a. Employee enters code into ATM. b. ATM provides access to valid employee. c. Employee opens ATM. d. Employee loads ATM with cash. e. Employee loads ATM with blank receipts. f. Employee removes deposits from ATM. g. Employee shuts ATM and initializes for operation. 2. Malfunction operations a. Employee enters code into ATM. b. ATM provides access to employee. c. Employee opens ATM. d. Employee runs built-in diagnostic tests to determine problem. e. ATM responds to diagnostic tests. f. Employee fixes ATM. g. Employee runs built-in diagnostic tests to determine if problem is solved. h. ATM responds to diagnostic tests. i. Employee shuts ATM and initializes for operation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started