Answered step by step

Verified Expert Solution

Question

1 Approved Answer

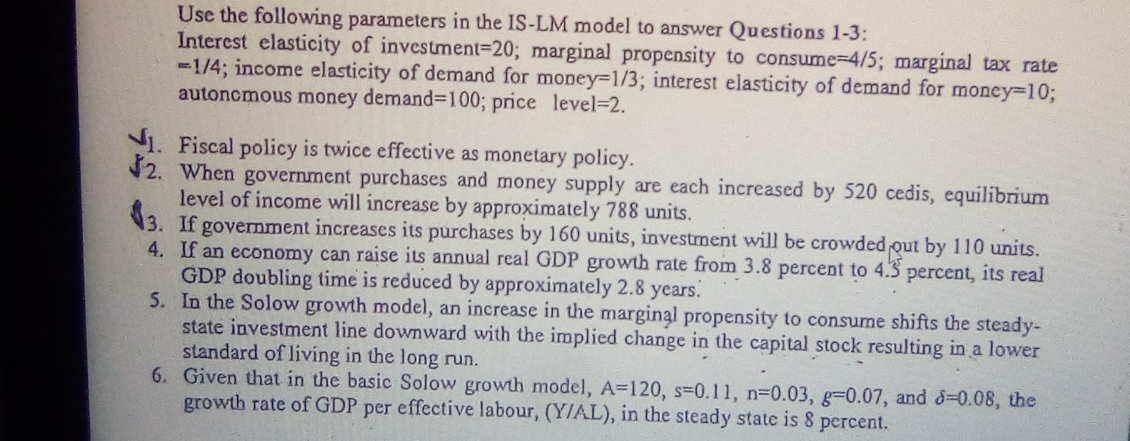

Use the following parameters in the IS - LM model to answer Questions 1 - 3 : Interest elasticity of investment = 2 0 ;

Use the following parameters in the ISLM model to answer Questions :

Interest elasticity of investment ; marginal propensity to consume ; marginal tax rate ; income elasticity of demand for money ; interest elasticity of demand for moncy; autoncmous money demand ; price level

Fiscal policy is twice effective as monetary policy.

$ When government purchases and money supply are each increased by cedis, equilibrium level of income will increase by approximately units.

If government increases its purchases by units, investment will be crowded out by units.

If an economy can raise its annual real GDP growth rate from percent to percent, its real GDP doubling time is reduced by approximately years.

In the Solow growth model, an increase in the marginal propensity to consume shifts the steadystate investment line downward with the implied change in the capital stock resulting in a lower standard of living in the long run.

Given that in the basic Solow growth model, and the growth rate of GDP per effective labour, YAL in the steady state is percent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started