Answered step by step

Verified Expert Solution

Question

1 Approved Answer

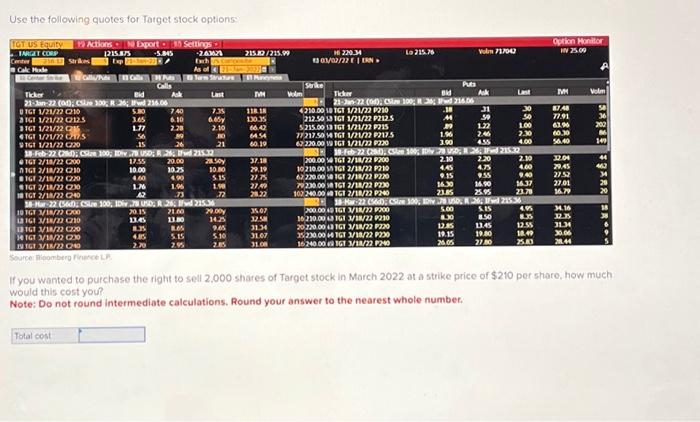

Use the following quotes for Target stock options: TGT US Equity 99 Actions 90 Export90 Settings TARGET CORP -5.845 Strikes Center 216.12 Calc Mode 10

Use the following quotes for Target stock options: TGT US Equity 99 Actions 90 Export90 Settings TARGET CORP -5.845 Strikes Center 216.12 Calc Mode 10 Center Strike DTGT 1/21/22 (210 2 TGT 1/21/22 C212.5 Ticker Bid 21-Jan-22 (0d); CSize 100; R 26; IFwd 216.06 5.80 3.65 1.77 TGT 1/21/22 C215 TGT 1/21/22 C217.5 9TGT 1/21/22 C220 TGT 2/18/22 C200 TGT 2/18/22 C210 TGT 2/18/22 C220 1215.875 Calls/Puts Calls 80 Puts Calls TGT 2/18/22 C230 100 TGT 2/18/22 C240 Exp 21-Jan-22- 1 TGT 3/18/22 C220 14 TGT 3/18/22 C230 19 TGT 3/18/22 C240 Source: Bloomberg Finance L.P. Total cost Ask 7.40 6.10 2.28 56 89 15 26 18-Feb-22 (28d); CSize 100; IDiv .78 USD; R.26; IFwd 215.32 17.55 10.00 4.60 1.76 .62 8.35 4.85 2.70 20.00 10.25 4.90 1.96 .73 -2.6362% Exch US Composite As of 21.60 13.80 8.65 5.15 2.95 19 Term Structure Last 18-Mar-22 (56d); CSize 100; IDiv .78 USD; R.26; IFwd 215.36 10 TGT 3/18/22 C200 20.15 12 IGI 3/18/22 C210 13.45 21-Jan-2022 7.35 6.65y 2.10 80 21 28.50y 10.80 5.15 1.98 .72 215.82/215.99 29.00y 14.25 9.65 5.10 2.85 Moneyness IVM 118.18 130.35 66.42 64.54 60.19 37.18 29.19 27.75 27.49 28.22 35.07 32.58 31.34 31.07 31.08 Volm Hi 220.34 93 03/02/22 E | ERN > Strike Lo 215.76 Puts Ticker Bid 21-Jan-22 (0d); Csize 100; R 26; IFwd 216.06 .18 .44 .89 1.96 3.90 4210.00 SD TGT 1/21/22 P210 212.50 53 TGT 1/21/22 P212.S 5215.00 SD TGT 1/21/22 P215 77217.50 50 TGT 1/21/22 P217.5 62 220.00 59 TGT 1/21/22 P220 2.10 4.45 9.15 16.30 23.85 Volm 717042 5.00 8.30 Ask 18-Feb-22 (28d); CSize 100; IDiv .78 USD; R.26; IFwd 215.32 200.00 50 TGT 2/18/22 P200 10210.00 57 TGT 2/18/22 P210 62 220.00 50 TGT 2/18/22 P220 79 230.00 5TGT 2/18/22 P230 102 240.00 60 TGT 2/18/22 P240 12.85 19.15 26.05 31 59 1.22 2.46 4.55 2.20 4.75 9.55 16.90 25.95 Last 18-Mar-22 (56d); CSize 100; IDiv.78 USD; R .26; IFwd 215.36 200.00 60 TGT 3/18/22 P200 16210.00 60 TGT 3/18/22 P210 20 220.00 63 TGT 3/18/22 P220 35 230.00 60 TGT 3/18/22 P230 16240.00 69 TGT 3/18/22 P240 5.15 8.50 30 50 1.00 2.30 4.00 13.45 19.80 27.80 2.10 4.60 9.40 16.37 23.78 4.95 8.35 12.55 18.49 25.83 Option Monitor HV 25.09 IVM 87.48 77.91 63.96 60.30 56.40 32.04 29.45 27.52 27.01 16.79 34.16 32.35 31.34 30.06 28.44 9 Volm 58 36 202 86 149 44 462 34 28 20 18 38 5 If you wanted to purchase the right to sell 2,000 shares of Target stock in March 2022 at a strike price of $210 per share, how much would this cost you? Note: Do not round intermediate calculations. Round your answer to the nearest whole number.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started