Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the following selected data from Business Solutions's income statement for the three months ended March 31, 2018, an from its March 31, 2018, balance

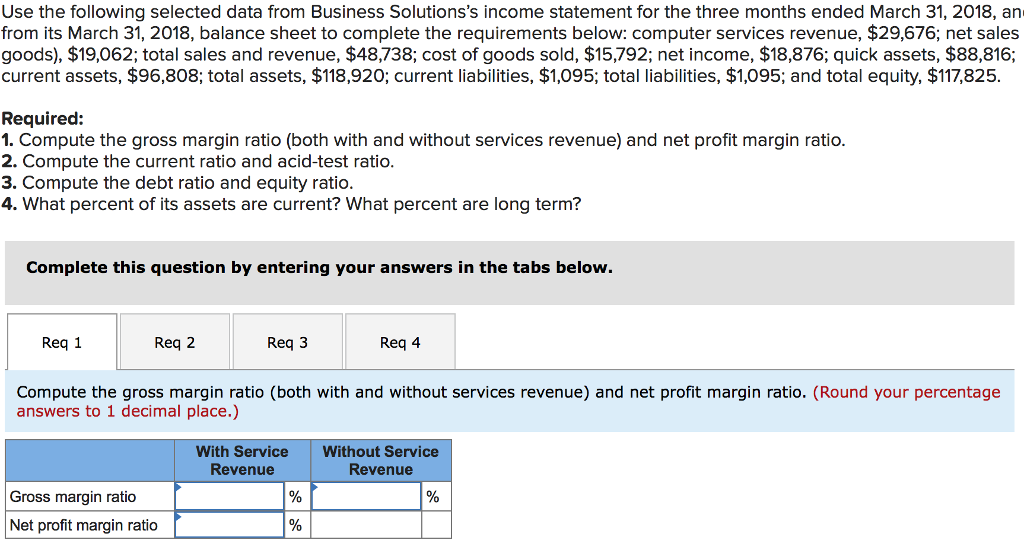

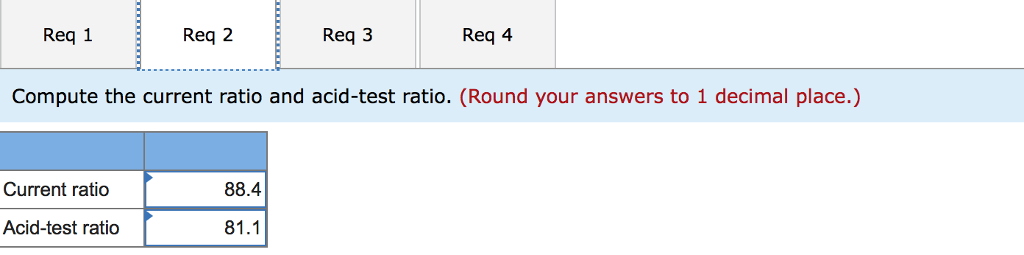

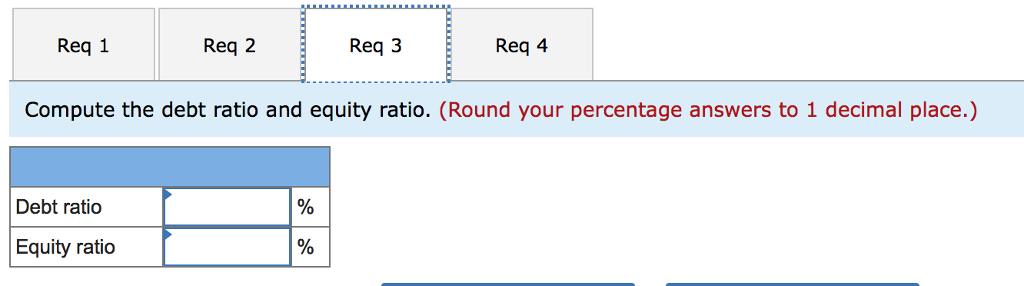

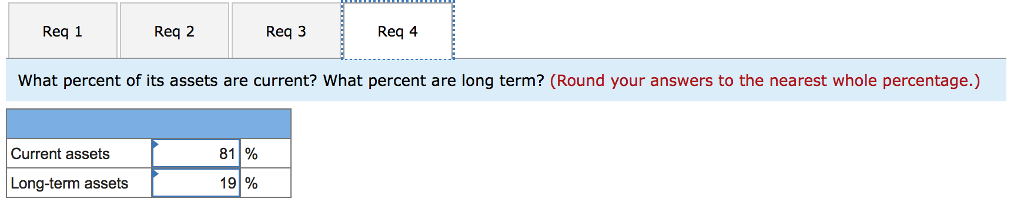

Use the following selected data from Business Solutions's income statement for the three months ended March 31, 2018, an from its March 31, 2018, balance sheet to complete the requirements below: computer services revenue, $29,676; net sales goods), $19,062; total sales and revenue, $48,738; cost of goods sold, $15,792; net income, $18,876; quick assets, $88,816; current assets, $96,808; total assets, $118,920; current liabilities, $1,095; total liabilities, $1,095; and total equity, $117,825 Required: 1. Compute the gross margin ratio (both with and without services revenue) and net profit margin ratio. 2. Compute the current ratio and acid-test ratio. 3. Compute the debt ratio and equity ratio. 4. What percent of its assets are current? What percent are long term? Complete this question by entering your answers in the tabs below. Req 1 Req 2 Req 3 Req 4 Compute the gross margin ratio (both with and without services revenue) and net profit margin ratio. (Round your percentage answers to 1 decimal place.) With Service Revenue Without Service Revenue Gross margin ratio Net profit margin ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started