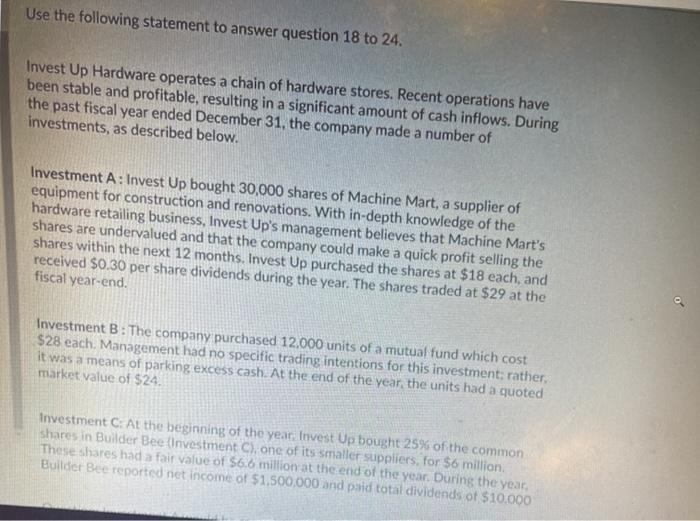

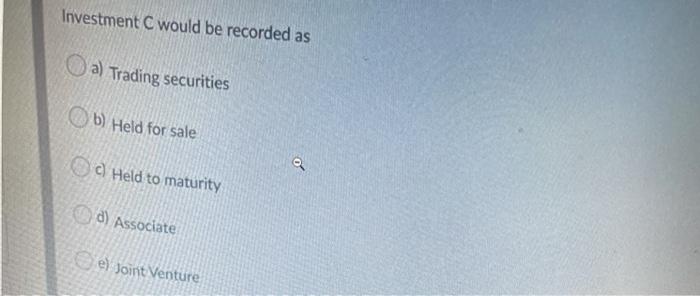

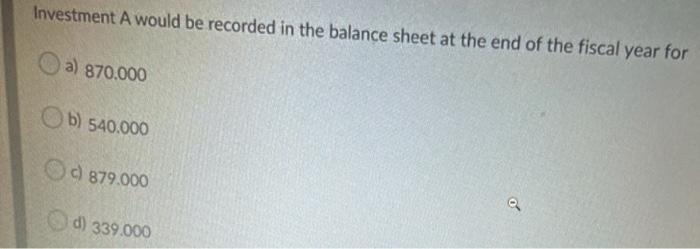

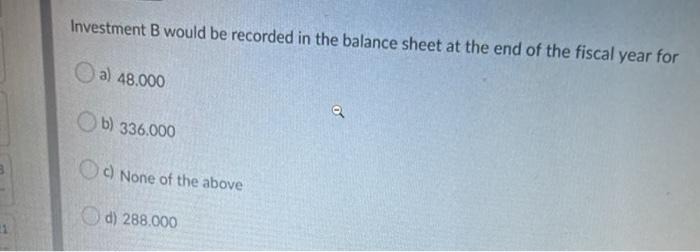

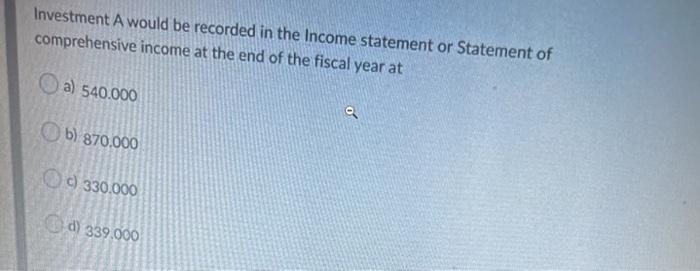

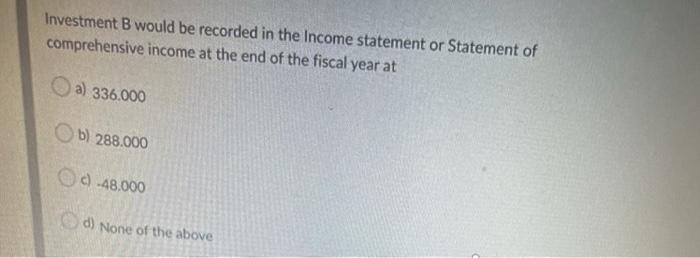

Use the following statement to answer question 18 to 24. Invest Up Hardware operates a chain of hardware stores. Recent operations have been stable and profitable, resulting in a significant amount of cash inflows. During the past fiscal year ended December 31, the company made a number of investments, as described below. Investment A: Invest Up bought 30,000 shares of Machine Mart, a supplier of equipment for construction and renovations. With in-depth knowledge of the hardware retailing business, Invest Up's management believes that Machine Mart's shares are undervalued and that the company could make a quick profit selling the shares within the next 12 months. Invest Up purchased the shares at $18 each, and received $0.30 per share dividends during the year. The shares traded at $29 at the fiscal year-end. Investment B: The company purchased 12,000 units of a mutual fund which cost $28 each. Management had no specific trading intentions for this investment: rather. it was a means of parking excess cash. At the end of the year, the units had a quoted market value of $24. Investment C. At the beginning of the year Invest Up bought 25% of the common shares in Builder Bee Investment C), one of its smaller suppliers, for $6 million, These shares had a fair value of $6.6 million at the end of the year. During the year Builder Bee reported net income of $1.500.000 and paid total dividends of $10,000 Question: Investment A would be recorded as a) Trading securities b) Held for sale 2 c) Joint Venture d) Associate e) Held to maturity Question 19 (2 points) Listen Investment B would be recorded as a) Trading securities b) Held for sale c) Held to maturity a d) Associate e) Joint Venture Investment C would be recorded as a) Trading securities b) Held for sale Held to maturity a a) Associate e) Joint Venture Investment A would be recorded in the balance sheet at the end of the fiscal year for a) 870.000 b) 540.000 Od 879.000 d) 339.000 Investment B would be recorded in the balance sheet at the end of the fiscal year for a) 48.000 b) 336.000 c) None of the above d) 288.000 Investment A would be recorded in the Income statement or Statement of comprehensive income at the end of the fiscal year at a) 540.000 b) 870.000 0 330.000 d) 339.000 Investment B would be recorded in the Income statement or Statement of comprehensive income at the end of the fiscal year at a) 336.000 b) 288.000 0.48.000 d) None of the above