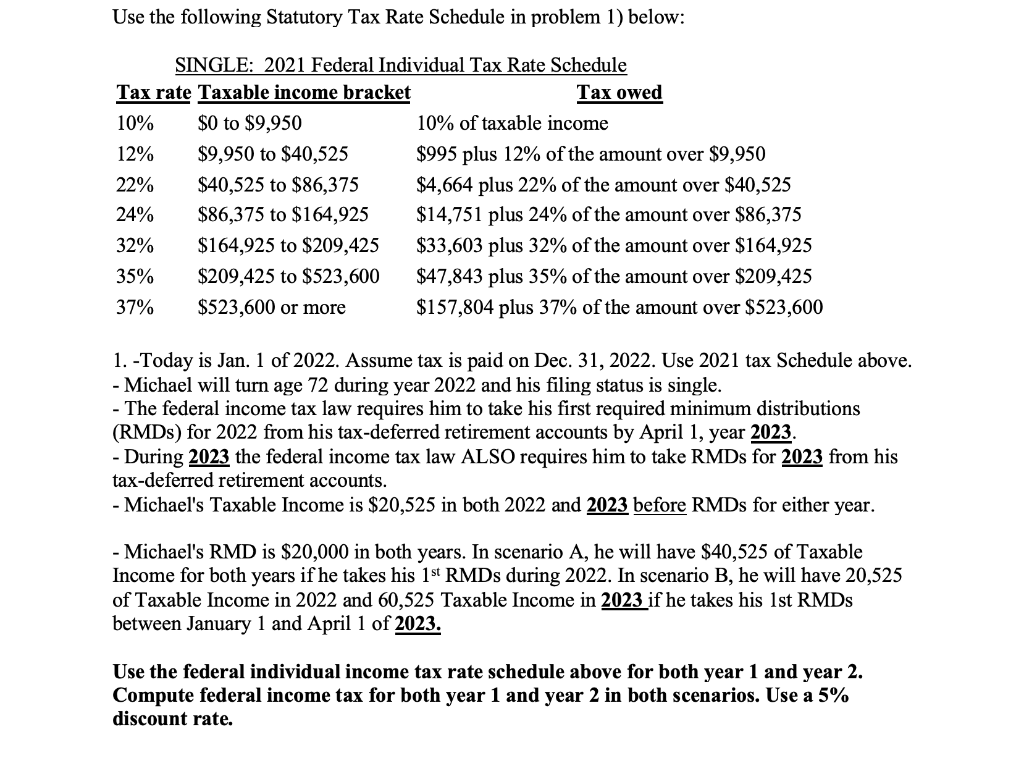

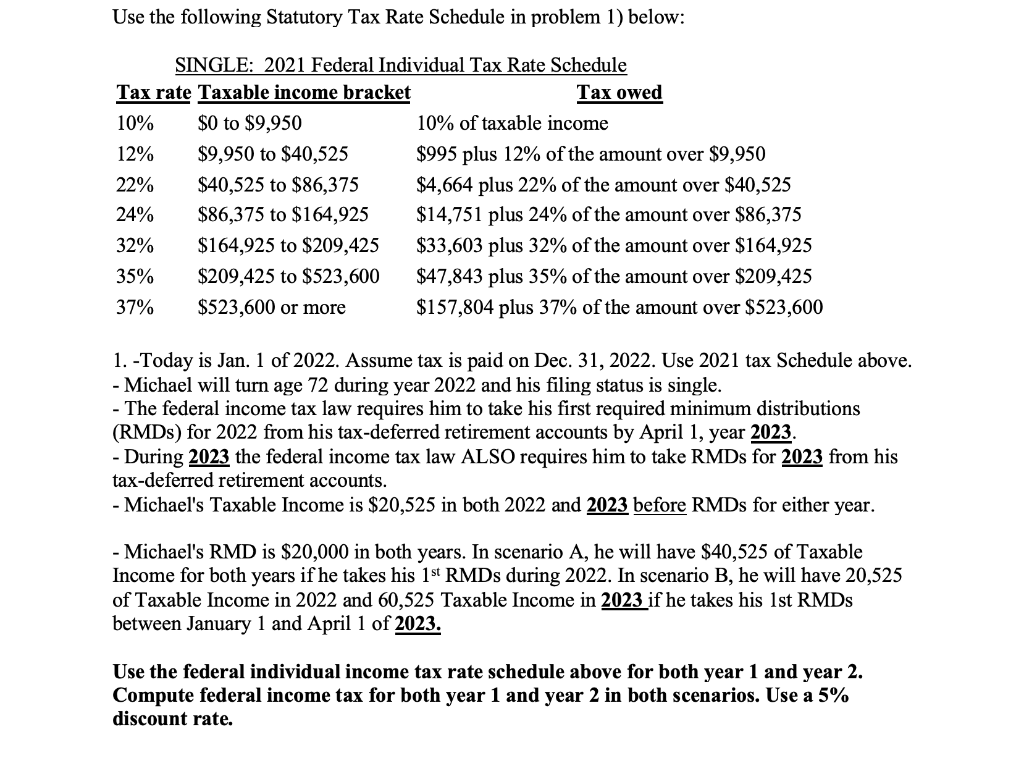

Use the following Statutory Tax Rate Schedule in problem 1) below: 12% SINGLE: 2021 Federal Individual Tax Rate Schedule Tax rate Taxable income bracket Tax owed 10% $0 to $9,950 10% of taxable income $9,950 to $40,525 $995 plus 12% of the amount over $9,950 22% $40,525 to $86,375 $4,664 plus 22% of the amount over $40,525 24% $86,375 to $164,925 $14,751 plus 24% of the amount over $86,375 32% $164,925 to $209,425 $33,603 plus 32% of the amount over $164,925 35% $209,425 to $523,600 $47,843 plus 35% of the amount over $209,425 37% $523,600 or more $157,804 plus 37% of the amount over $523,600 1. -Today is Jan. 1 of 2022. Assume tax is paid on Dec. 31, 2022. Use 2021 tax Schedule above. - Michael will turn age 72 during year 2022 and his filing status is single. - The federal income tax law requires him to take his first required minimum distributions (RMDs) for 2022 from his tax-deferred retirement accounts by April 1, year 2023. - During 2023 the federal income tax law ALSO requires him to take RMDs for 2023 from his tax-deferred retirement accounts. - Michael's Taxable Income is $20,525 in both 2022 and 2023 before RMDs for either year. - Michael's RMD is $20,000 in both years. In scenario A, he will have $40,525 of Taxable Income for both years if he takes his 1st RMDs during 2022. In scenario B, he will have 20,525 of Taxable Income in 2022 and 60,525 Taxable Income in 2023 if he takes his 1st RMDs between January 1 and April 1 of 2023. Use the federal individual income tax rate schedule above for both year 1 and year 2. Compute federal income tax for both year 1 and year 2 in both scenarios. Use a 5% discount rate. Use the following Statutory Tax Rate Schedule in problem 1) below: 12% SINGLE: 2021 Federal Individual Tax Rate Schedule Tax rate Taxable income bracket Tax owed 10% $0 to $9,950 10% of taxable income $9,950 to $40,525 $995 plus 12% of the amount over $9,950 22% $40,525 to $86,375 $4,664 plus 22% of the amount over $40,525 24% $86,375 to $164,925 $14,751 plus 24% of the amount over $86,375 32% $164,925 to $209,425 $33,603 plus 32% of the amount over $164,925 35% $209,425 to $523,600 $47,843 plus 35% of the amount over $209,425 37% $523,600 or more $157,804 plus 37% of the amount over $523,600 1. -Today is Jan. 1 of 2022. Assume tax is paid on Dec. 31, 2022. Use 2021 tax Schedule above. - Michael will turn age 72 during year 2022 and his filing status is single. - The federal income tax law requires him to take his first required minimum distributions (RMDs) for 2022 from his tax-deferred retirement accounts by April 1, year 2023. - During 2023 the federal income tax law ALSO requires him to take RMDs for 2023 from his tax-deferred retirement accounts. - Michael's Taxable Income is $20,525 in both 2022 and 2023 before RMDs for either year. - Michael's RMD is $20,000 in both years. In scenario A, he will have $40,525 of Taxable Income for both years if he takes his 1st RMDs during 2022. In scenario B, he will have 20,525 of Taxable Income in 2022 and 60,525 Taxable Income in 2023 if he takes his 1st RMDs between January 1 and April 1 of 2023. Use the federal individual income tax rate schedule above for both year 1 and year 2. Compute federal income tax for both year 1 and year 2 in both scenarios. Use a 5% discount rate