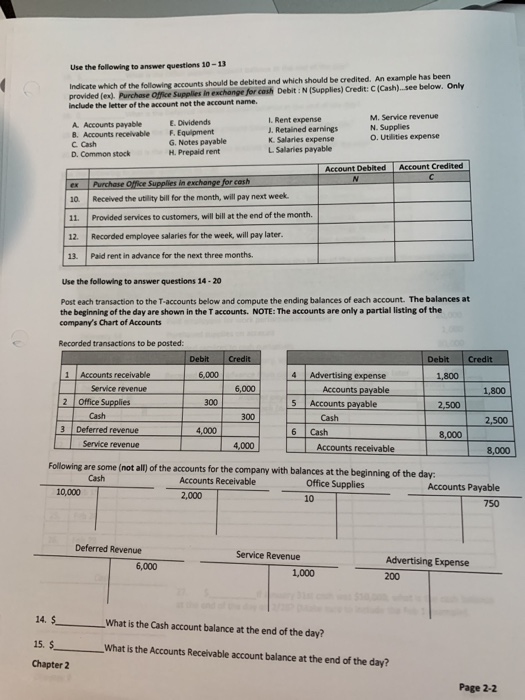

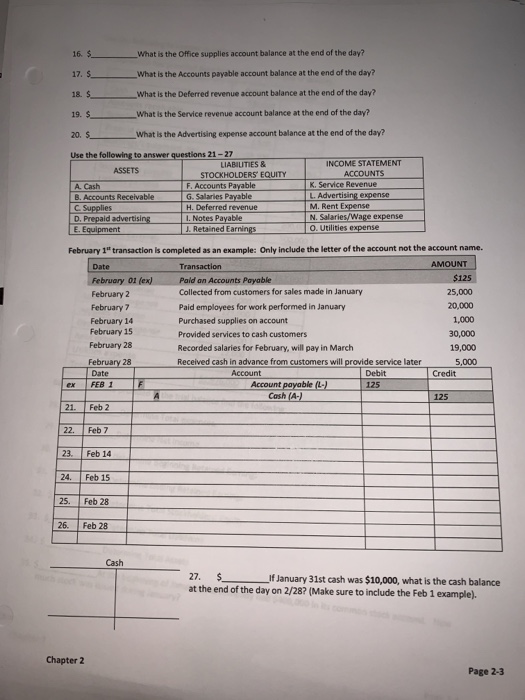

Use the following to answer questions 10-13 Indicate which of the following accounts should be debited and which should be credited. An example has been provided (ex). Purchase Office Supplies in exchange for cash Debit : N (Supplies) Credit: C (Cash)...See below. Only include the letter of the account not the account name. A Accounts payable B. Accounts receivable C Cash D. Common stock E. Dividends F. Equipment G. Notes payable H. Prepaid rent L. Rent expense J. Retained earnings K. Salaries expense L Salaries payable M. Service revenue N. Supplies o. Utilities expense Account Debited Account Credited ex 10. Purchase Office Supplies in exchange for cash Received the utility bill for the month, will pay next week. Provided services to customers, will bill at the end of the month. 11. 12. 13. Recorded employee salaries for the week, will pay later. Paid rent in advance for the next three months. Use the following to answer questions 14-20 Post each transaction to the T-accounts below and compute the ending balances of each account. The balances at the beginning of the day are shown in the Taccounts. NOTE: The accounts are only a partial listing of the company's Chart of Accounts Recorded transactions to be posted: Debit Credit Debit Credit 1 Accounts receivable 6,000 Advertising expense 1,800 Service revenue 6,000 Accounts payable 1,800 2 Office Supplies 300 5 Accounts payable 2,500 300 Cash 2,500 3 Deferred revenue 4,000 6 Cash 8,000 Service revenue 4,000 Accounts receivable 8,000 Following are some (not all) of the accounts for the company with balances at the beginning of the day: Accounts Receivable Office Supplies Accounts Payable 10,000 2,000 10 Deferred Revenue 6,000 Service Revenue 1,000 Advertising Expense 200 14.$__ _What is the Cash account balance at the end of the day? 15. S_ Chapter 2 _What is the Accounts Receivable account balance at the end of the day? Page 2-2 16. $ What is the office supplies account balance at the end of the day? 17. $_ What is the Accounts payable account balance at the end of the day? 18. $ What is the Deferred revenue account balance at the end of the day? 19. $_ What is the Service revenue account balance at the end of the day? 20. S What is the Advertising expense account balance at the end of the day? Use the following to answer questions 21 - 27 LIABILITIES & ASSETS STOCKHOLDERS EQUITY A. Cash F, Accounts Payable B. Accounts Receivable G. Salaries Payable C. Supplies H. Deferred revenue D. Prepaid advertising 1. Notes Payable E. Equipment Retained Earnings INCOME STATEMENT ACCOUNTS K. Service Revenue L. Advertising expense M. Rent Expense N. Salaries/Wage expense O. Utilities expense February 1"transaction is completed as an example: Only include the letter of the account not the account name. Date Transaction AMOUNT February 01 (ex] Pald an Accounts Payable $125 February 2 Collected from customers for sales made in January 25,000 February 7 Paid employees for work performed in January 20,000 February 14 Purchased supplies on account 1,000 February 15 Provided services to cash customers 30,000 February 28 Recorded salaries for February, will pay in March 19,000 February 28 Received cash in advance from customers will provide service later 5,000 Date Account Debit Credit ex FEB 1 F Account payable (L.) 125 Cash (A) 125 21. Feb 2 22. Feb 7 23. Feb 14 24. Feb 15 5. Feb 28 26. Feb 28 Cash 27. $ If January 31st cash was $10,000, what is the cash balance at the end of the day on 2/28? (Make sure to include the Feb 1 example) Chapter 2 Page 2-3