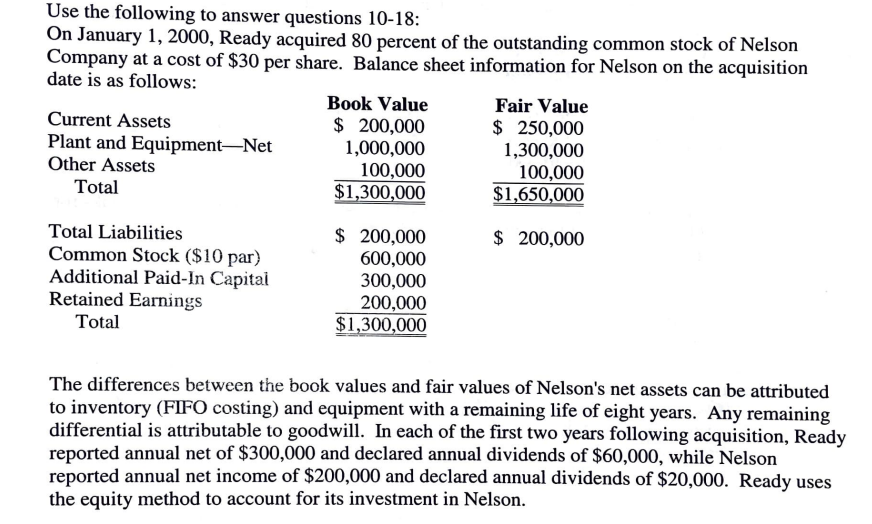

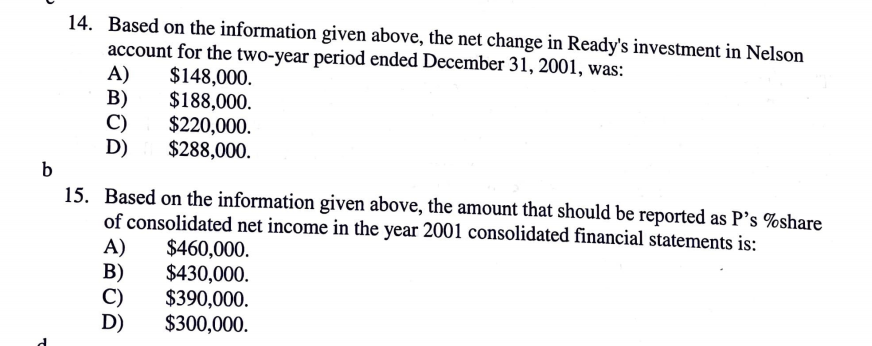

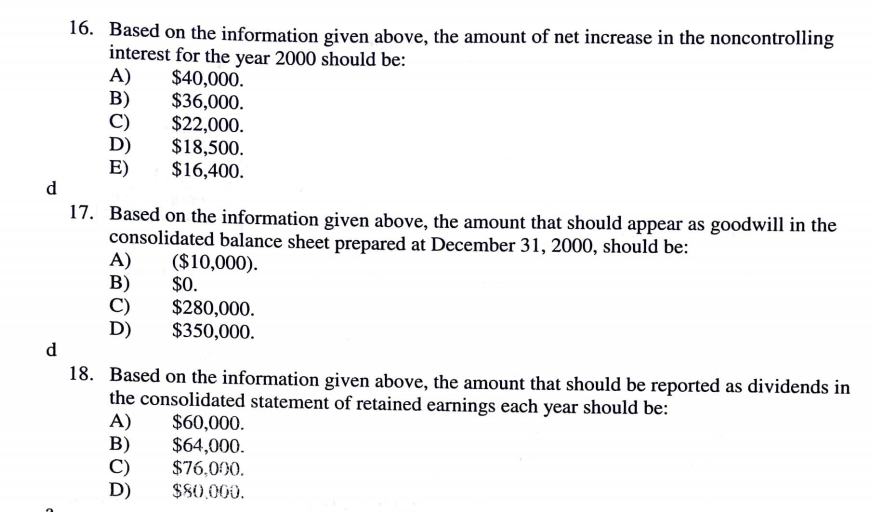

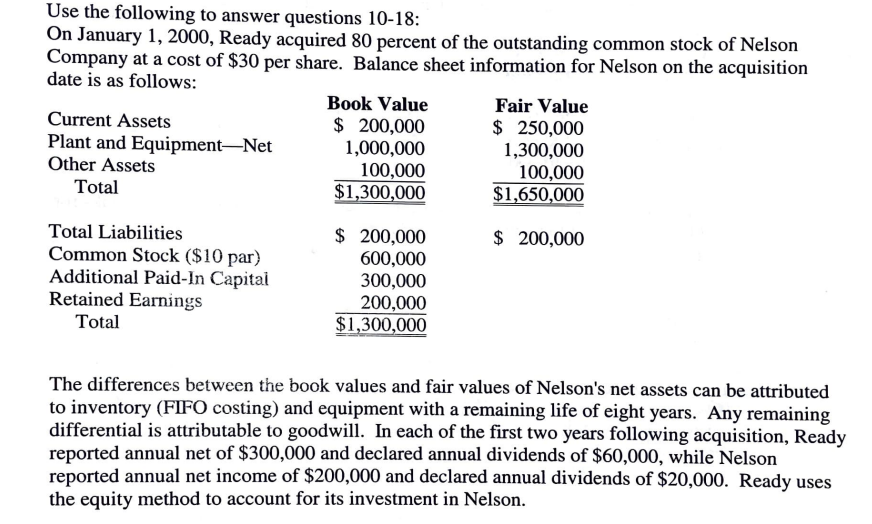

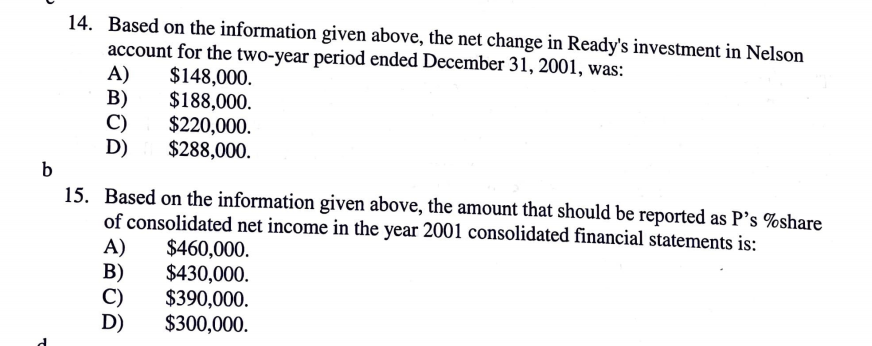

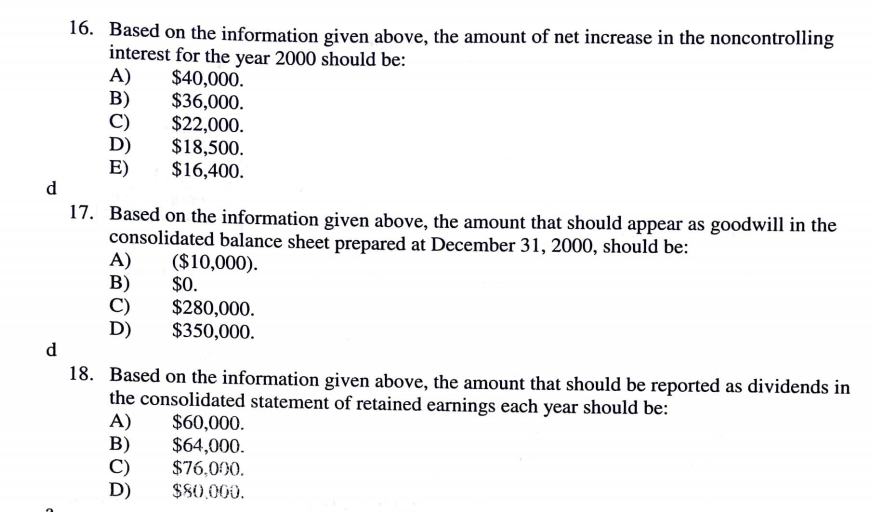

Use the following to answer questions 10-18: On January 1, 2000, Ready acquired 80 percent of the outstanding common stock of Nelson Company at a cost of $30 per share. Balance sheet information for Nelson on the acquisition date is as follows: Book Value Fair Value Current Assets $ 200,000 $ 250,000 Plant and EquipmentNet 1,000,000 1,300,000 Other Assets 100,000 100,000 Total $1,300,000 $1,650,000 $ 200,000 Total Liabilities Common Stock ($10 par) Additional Paid-In Capital Retained Earnings Total $ 200,000 600,000 300,000 200,000 $1,300,000 The differences between the book values and fair values of Nelson's net assets can be attributed to inventory (FIFO costing) and equipment with a remaining life of eight years. Any remaining differential is attributable to goodwill. In each of the first two years following acquisition, Ready reported annual net of $300,000 and declared annual dividends of $60,000, while Nelson reported annual net income of $200,000 and declared annual dividends of $20,000. Ready uses the equity method to account for its investment in Nelson. 14. Based on the information given above, the net change in Ready's investment in Nelson account for the two-year period ended December 31, 2001, was: A) $148,000. B) $188,000. C) $220,000. D) $288,000. b 15. Based on the information given above, the amount that should be reported as Ps %share of consolidated net income in the year 2001 consolidated financial statements is: A) $460,000. B) $430,000. C) $390,000. D) $300,000. d 16. Based on the information given above, the amount of net increase in the noncontrolling interest for the year 2000 should be: A) $40,000. B) $36,000. C) $22,000. $18,500. E) $16,400. d 17. Based on the information given above, the amount that should appear as goodwill in the consolidated balance sheet prepared at December 31, 2000, should be: A) ($10,000). B) $0. $280,000. $350,000. d 18. Based on the information given above, the amount that should be reported as dividends in the consolidated statement of retained earnings each year should be: A) $60,000 $64,000. $76,000. D) $80.000