Answered step by step

Verified Expert Solution

Question

1 Approved Answer

USE THE FOLLOWING TO ANSWER QUESTIONS 1-6. At the beginning of 2020, Red Corporation purchased a 30% interest in Black Company for $125,000. On

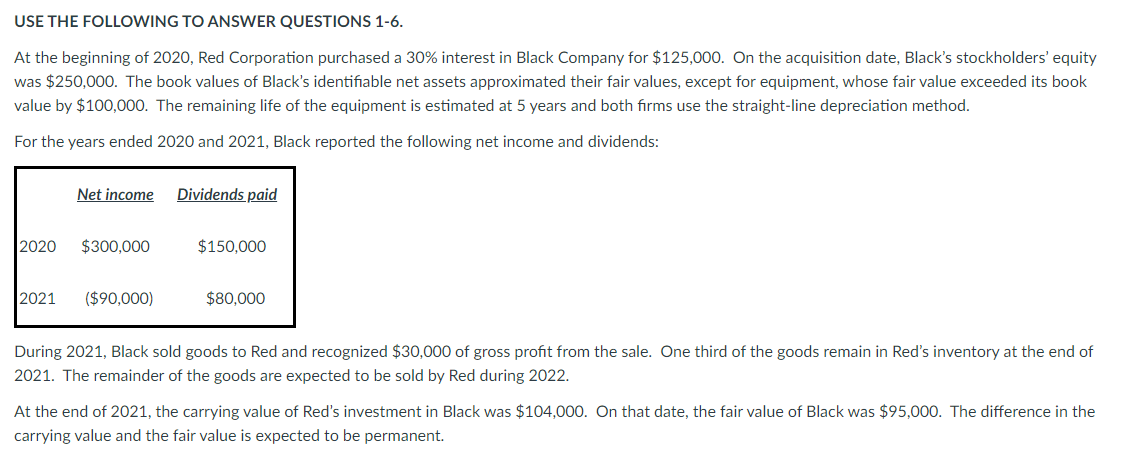

USE THE FOLLOWING TO ANSWER QUESTIONS 1-6. At the beginning of 2020, Red Corporation purchased a 30% interest in Black Company for $125,000. On the acquisition date, Black's stockholders' equity was $250,000. The book values of Black's identifiable net assets approximated their fair values, except for equipment, whose fair value exceeded its book value by $100,000. The remaining life of the equipment is estimated at 5 years and both firms use the straight-line depreciation method. For the years ended 2020 and 2021, Black reported the following net income and dividends: Net income Dividends paid 2020 $300,000 $150,000 2021 ($90,000) $80,000 During 2021, Black sold goods to Red and recognized $30,000 of gross profit from the sale. One third of the goods remain in Red's inventory at the end of 2021. The remainder of the goods are expected to be sold by Red during 2022. At the end of 2021, the carrying value of Red's investment in Black was $104,000. On that date, the fair value of Black was $95,000. The difference in the carrying value and the fair value is expected to be permanent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started