Answered step by step

Verified Expert Solution

Question

1 Approved Answer

USE THE FOLLOWING TO ANSWERS QUESTIONS 13 - 18. Rowan Manufacturing, Inc. and Martin Machinery Company are two small metal fabrication companies serving the

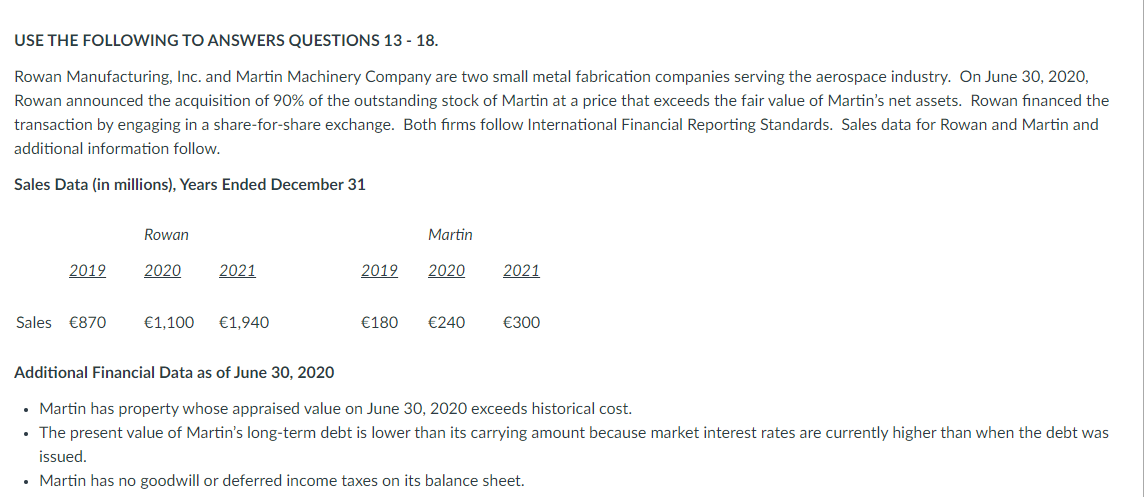

USE THE FOLLOWING TO ANSWERS QUESTIONS 13 - 18. Rowan Manufacturing, Inc. and Martin Machinery Company are two small metal fabrication companies serving the aerospace industry. On June 30, 2020, Rowan announced the acquisition of 90% of the outstanding stock of Martin at a price that exceeds the fair value of Martin's net assets. Rowan financed the transaction by engaging in a share-for-share exchange. Both firms follow International Financial Reporting Standards. Sales data for Rowan and Martin and additional information follow. Sales Data (in millions), Years Ended December 31 Rowan Martin 2019 2020 2021 2019 2020 2021 Sales 870 1,100 1,940 180 240 300 Additional Financial Data as of June 30, 2020 Martin has property whose appraised value on June 30, 2020 exceeds historical cost. The present value of Martin's long-term debt is lower than its carrying amount because market interest rates are currently higher than when the debt was issued. . Martin has no goodwill or deferred income taxes on its balance sheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started