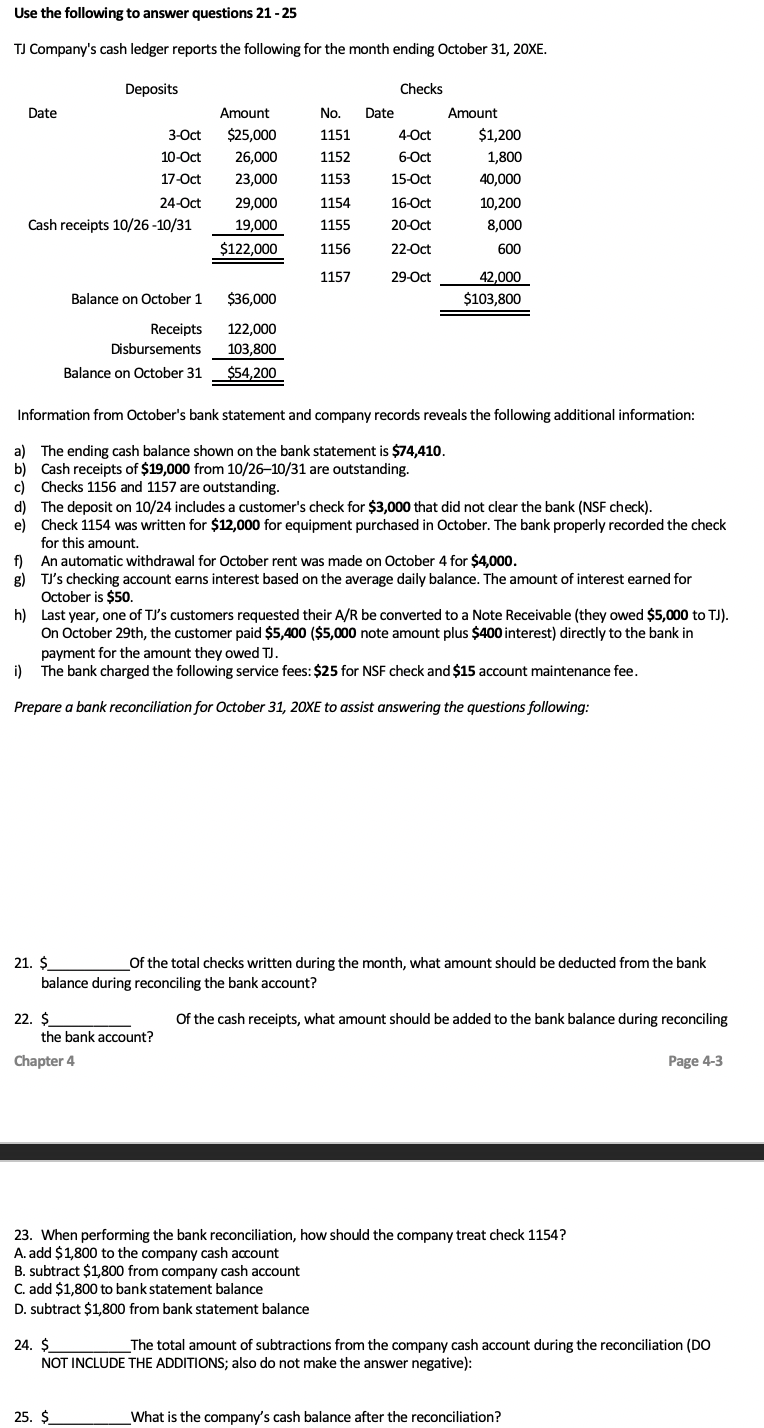

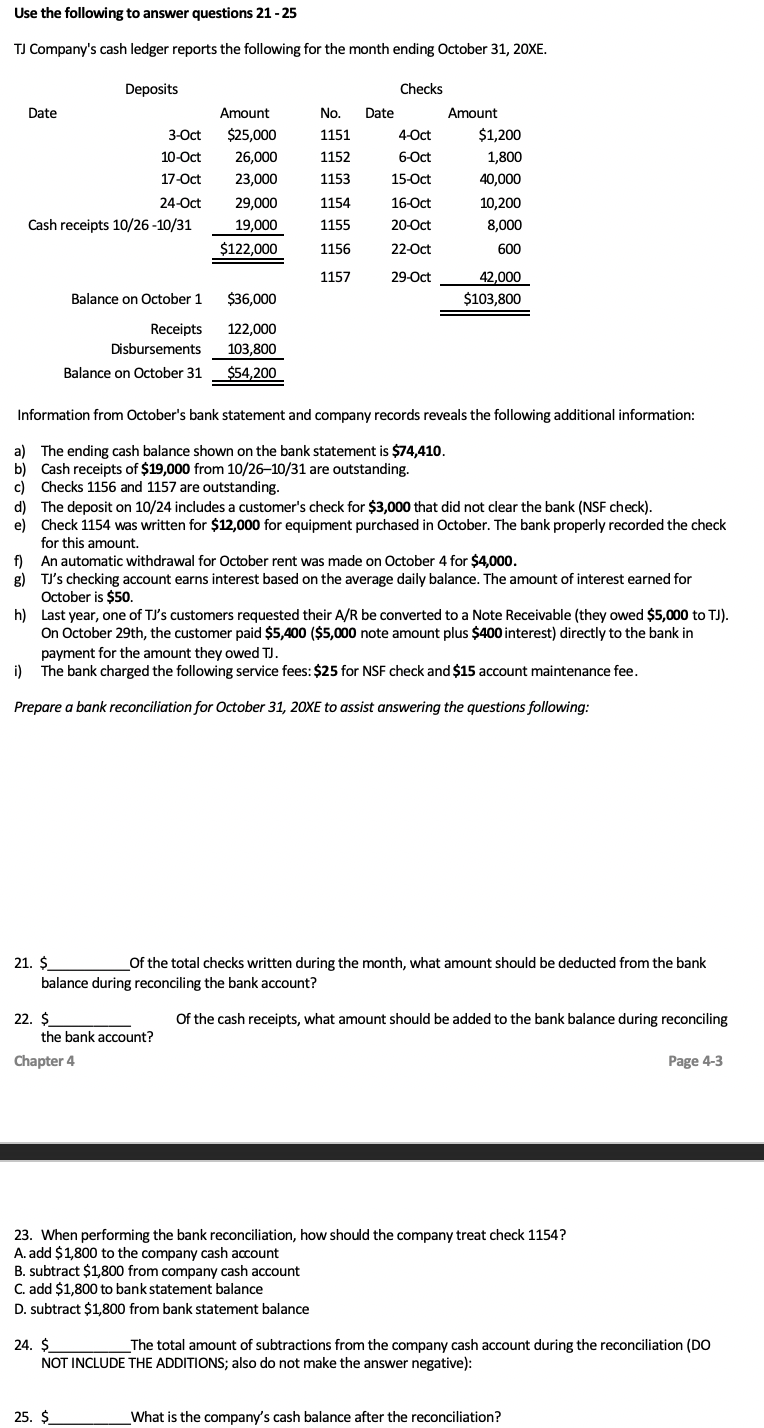

Use the following to answer questions 21-25 TJ Company's cash ledger reports the following for the month ending October 31, 20XE. Deposits Date 3-Oct 10-Oct 17-Oct 24-Oct Cash receipts 10/26-10/31 Amount $25,000 26,000 23,000 29,000 19,000 $122,000 Checks No. Date Amount 1151 4-Oct $1,200 11526-Oct 1,800 1153 15-Oct 40,000 1154 16-Oct 10,200 1155 20-Oct 8,000 1156 22 Oct 600 1157 29-Oct 42,000 $103,800 Balance on October 1 Receipts Disbursements Balance on October 31 $36,000 122,000 103,800 $54,200 Information from October's bank statement and company records reveals the following additional information: a) The ending cash balance shown on the bank statement is $74,410. b) Cash receipts of $19,000 from 10/26-10/31 are outstanding. c) Checks 1156 and 1157 are outstanding. d) The deposit on 10/24 includes a customer's check for $3,000 that did not clear the bank (NSF check). e) Check 1154 was written for $12,000 for equipment purchased in October. The bank properly recorded the check for this amount. f) An automatic withdrawal for October rent was made on October 4 for $4,000. g) TJ's checking account earns interest based on the average daily balance. The amount of interest earned for October is $50. h) Last year, one of Ty's customers requested their A/R be converted to a Note Receivable (they owed $5,000 to TJ). On October 29th, the customer paid $5,400 ($5,000 note amount plus $400 interest) directly to the bank in payment for the amount they owed TJ. i) The bank charged the following service fees: $25 for NSF check and $15 account maintenance fee. Prepare a bank reconciliation for October 31, 20XE to assist answering the questions following: 21. $ Of the total checks written during the month, what amount should be deducted from the bank balance during reconciling the bank account? Of the cash receipts, what amount should be added to the bank balance during reconciling 22. $ the bank account? Chapter 4 Page 4-3 23. When performing the bank reconciliation, how should the company treat check 1154? A. add $1,800 to the company cash account B. subtract $1,800 from company cash account C. add $1,800 to bank statement balance D. subtract $1,800 from bank statement balance 24. $__ The total amount of subtractions from the company cash account during the reconciliation (DO NOT INCLUDE THE ADDITIONS; also do not make the answer negative): 25. $ What is the company's cash balance after the reconciliation