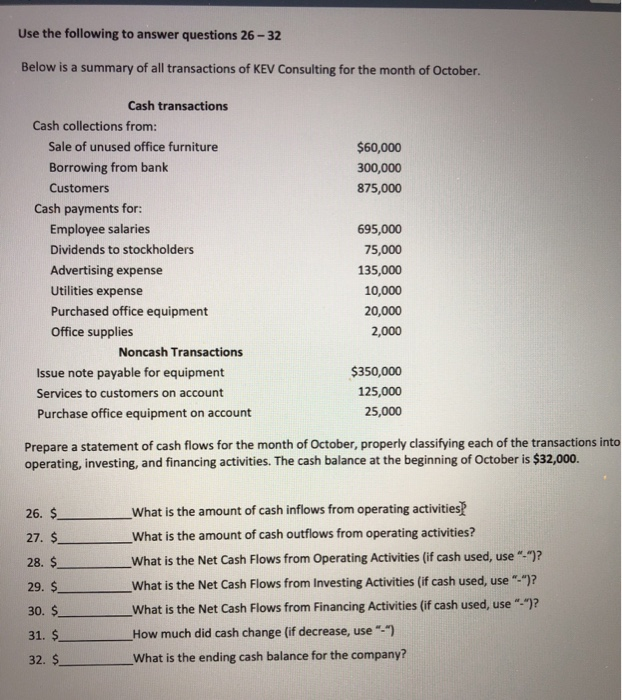

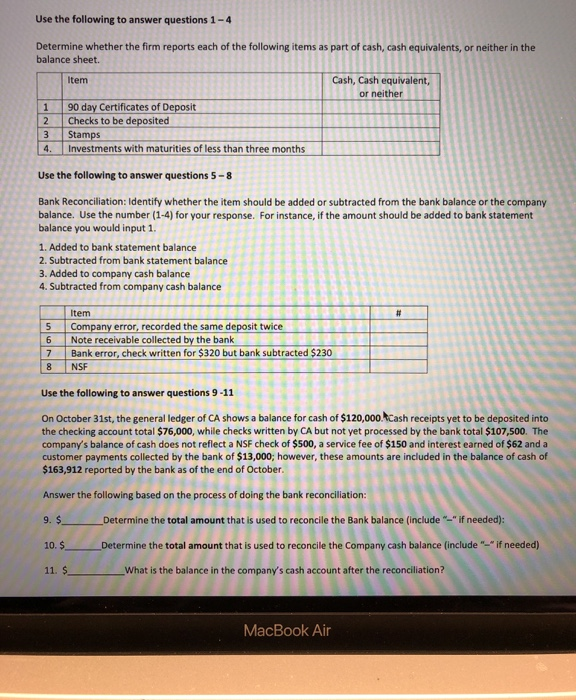

Use the following to answer questions 26 - 32 Below is a summary of all transactions of KEV Consulting for the month of October $60,000 300,000 875,000 Cash transactions Cash collections from: Sale of unused office furniture Borrowing from bank Customers Cash payments for: Employee salaries Dividends to stockholders Advertising expense Utilities expense Purchased office equipment Office supplies Noncash Transactions Issue note payable for equipment Services to customers on account Purchase office equipment on account 695,000 75,000 135,000 10,000 20,000 2,000 $350,000 125,000 25,000 Prepare a statement of cash flows for the month of October, properly classifying each of the transactions into operating, investing, and financing activities. The cash balance at the beginning of October is $32,000. 26. $_ 27. $ 28. $ 29. $. 30. $. What is the amount of cash inflows from operating activities What is the amount of cash outflows from operating activities? _What is the Net Cash Flows from Operating Activities (if cash used, use "-")? What is the Net Cash Flows from Investing Activities (if cash used, use "-")? What is the Net Cash Flows from Financing Activities (if cash used, use "-")? How much did cash change (if decrease, use"-"). _What is the ending cash balance for the company? 32. $ Use the following to answer questions 1-4 Determine whether the firm reports each of the following items as part of cash, cash equivalents, or neither in the balance sheet. Item Cash, Cash equivalent, or neither 1 90 day Certificates of Deposit 2 Checks to be deposited 3 Stamps 4. Investments with maturities of less than three months Use the following to answer questions 5- added or subtracted from the bank balance or the company the amount should be added to bank statement Bank Reconciliation: Identify whether the item should balance. Use the number (1-4) for your response. balance you would input 1. 1. Added to bank statement balance 2. Subtracted from bank statement balance 3. Added to company cash balance 4. Subtracted from company cash balance 99 DI 5 6 7 8 Item Company error, recorded the same deposit twice Note receivable collected by the bank Bank error, check written for $320 but bank subtracted $230 NSF Use the following to answer questions 9-11 On October 31st, the general ledger of CA shows a balance for cash of $120,000 cash receipts yet to be deposited into the checking account total $76,000, while checks written by CA but not yet processed by the bank total $107,500. The company's balance of cash does not reflect a NSF check of $500, a service fee of $150 and interest earned of $62 and a customer payments collected by the bank of $13,000; however, these amounts are included in the balance of cash of $163,912 reported by the bank as of the end of October. Answer the following based on the process of doing the bank reconciliation: 9.$ 10.$_ _Determine the total amount that is used to reconcile the Bank balance (include "if needed): Determine the total amount that is used to reconcile the Company cash balance (include if needed) 11 S What is the balance in the company's cash account after the reconciliation? MacBook Air