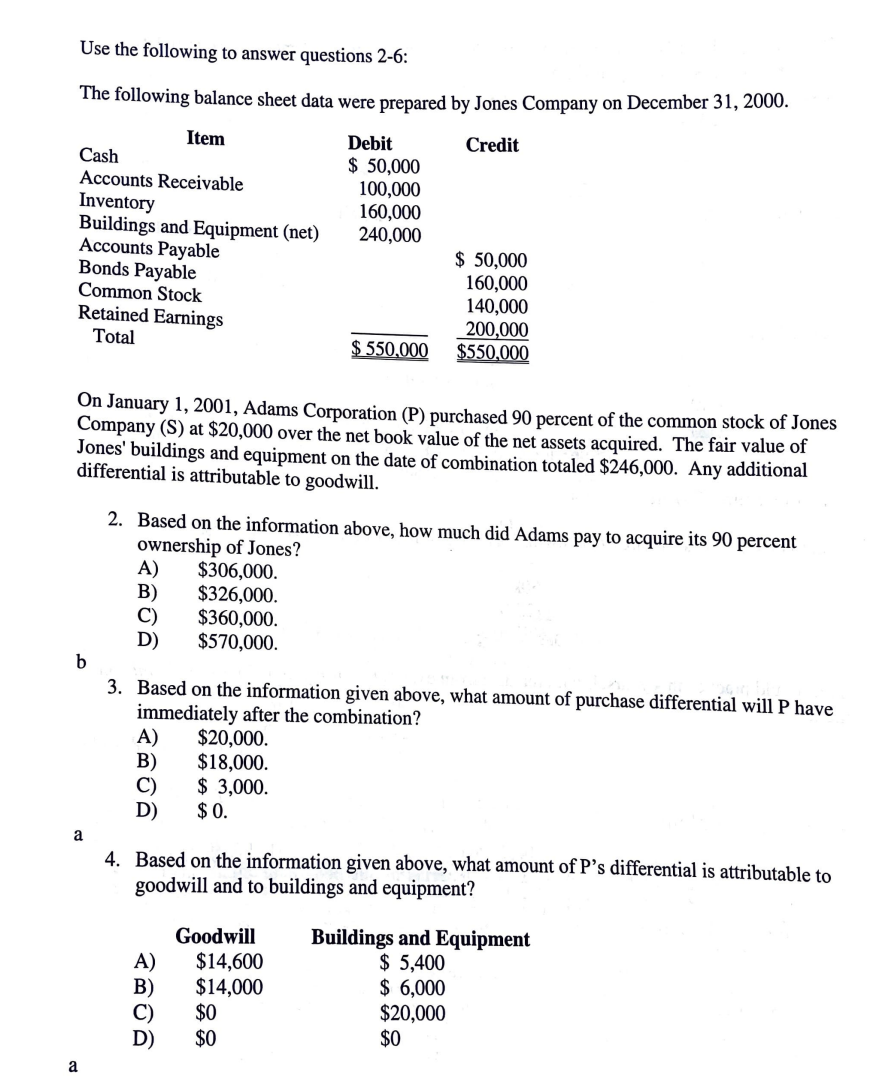

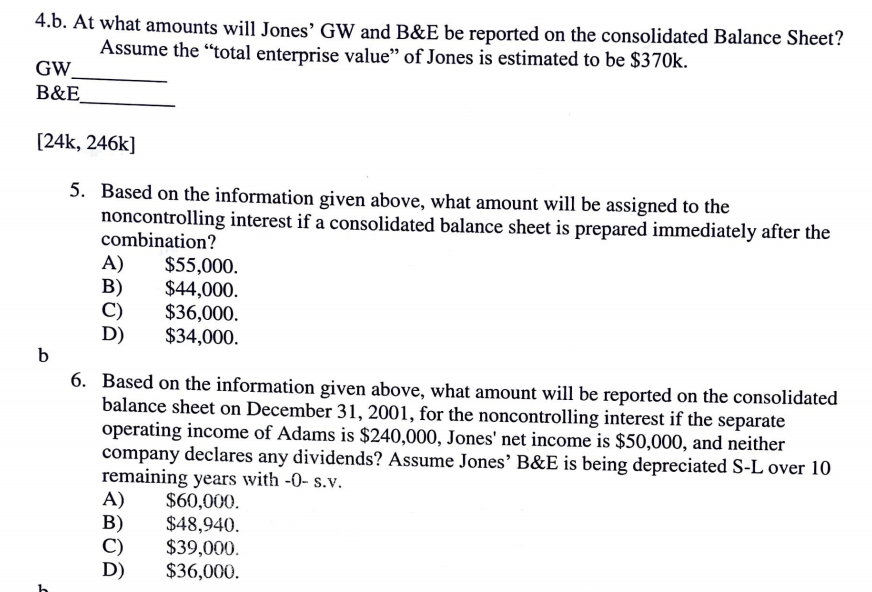

Use the following to answer questions 2-6: The following balance sheet data were prepared by Jones Company on December 31, 2000. Credit Item Cash Accounts Receivable Inventory Buildings and Equipment (net) Accounts Payable Bonds Payable Common Stock Retained Earnings Total Debit $ 50,000 100,000 160,000 240,000 $ 50,000 160,000 140,000 200,000 $550,000 $ 550,000 On January 1, 2001, Adams Corporation (P) purchased 90 percent of the common stock of Jones Company (S) at $20,000 over the net book value of the net assets acquired. The fair value of Jones' buildings and equipment on the date of combination totaled $246,000. Any additional differential is attributable to goodwill. 2. Based on the information above, how much did Adams pay to acquire its 90 percent ownership of Jones? A) $306,000. B) $326,000. C) $360,000. D) $570,000. b 3. Based on the information given above, what amount of purchase differential will have immediately after the combination? A) $20,000. B) $18,000. C) $ 3,000. D) $ 0. a 4. Based on the information given above, what amount of P's differential is attributable to goodwill and to buildings and equipment? A) B) C) D) Goodwill $14,600 $14,000 $0 $0 Buildings and Equipment $ 5,400 $ 6,000 $20,000 $0 a 4.b. At what amounts will Jones' GW and B&E be reported on the consolidated Balance Sheet? Assume the total enterprise value of Jones is estimated to be $370k. GW B&E [24k, 246k] 5. Based on the information given above, what amount will be assigned to the noncontrolling interest if a consolidated balance sheet is prepared immediately after the combination? A) $55,000. $44,000. $36,000. D) $34,000. b 6. Based on the information given above, what amount will be reported on the consolidated balance sheet on December 31, 2001, for the noncontrolling interest if the separate operating income of Adams is $240,000, Jones' net income is $50,000, and neither company declares any dividends? Assume Jones' B&E is being depreciated S-L over 10 remaining years with -o- s.v. A) $60,000. B) $48,940. C) $39,000 D) $36,000