Answered step by step

Verified Expert Solution

Question

1 Approved Answer

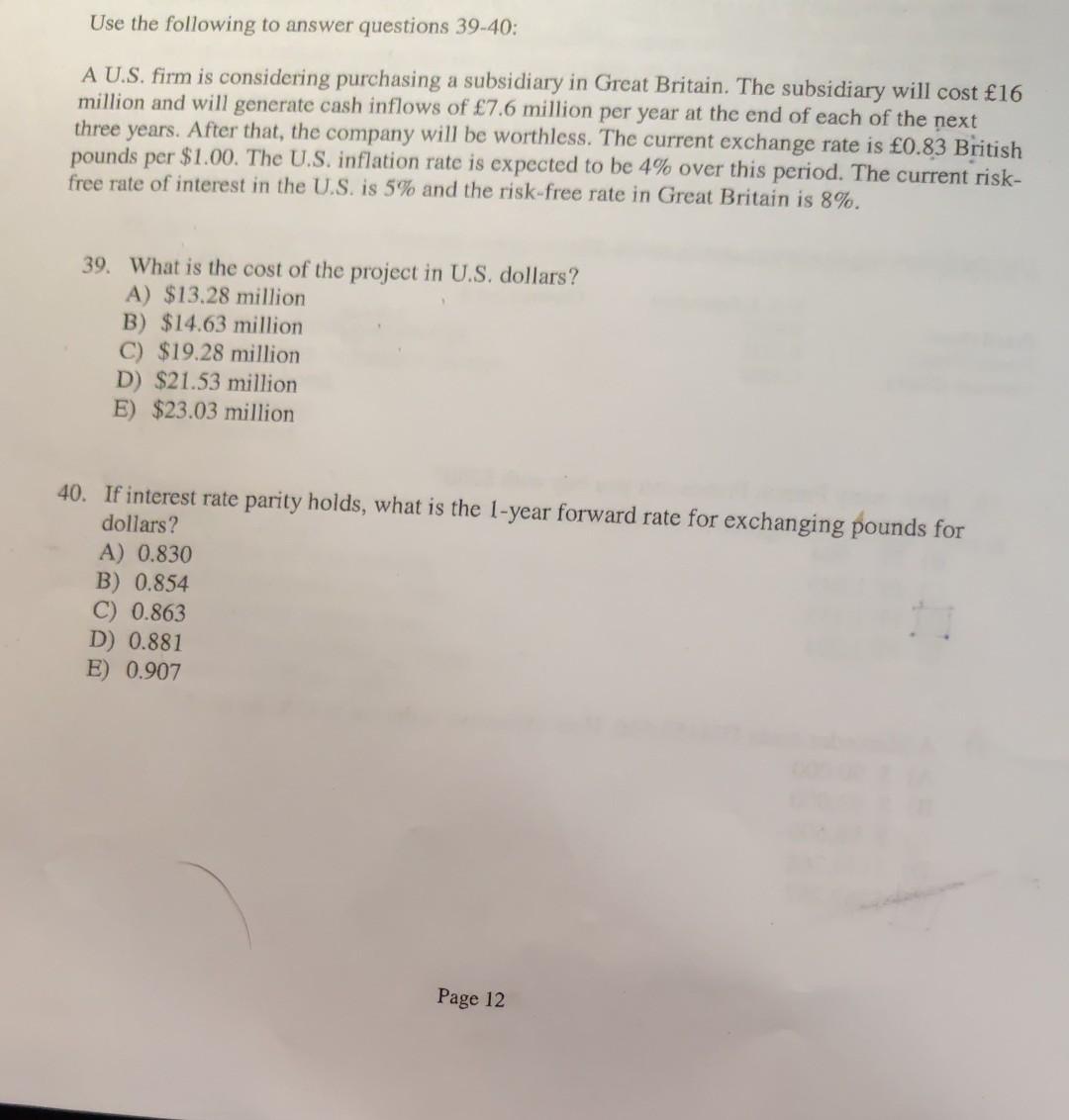

Use the following to answer questions 39-40: A U.S. firm is considering purchasing a subsidiary in Great Britain. The subsidiary will cost 16 million and

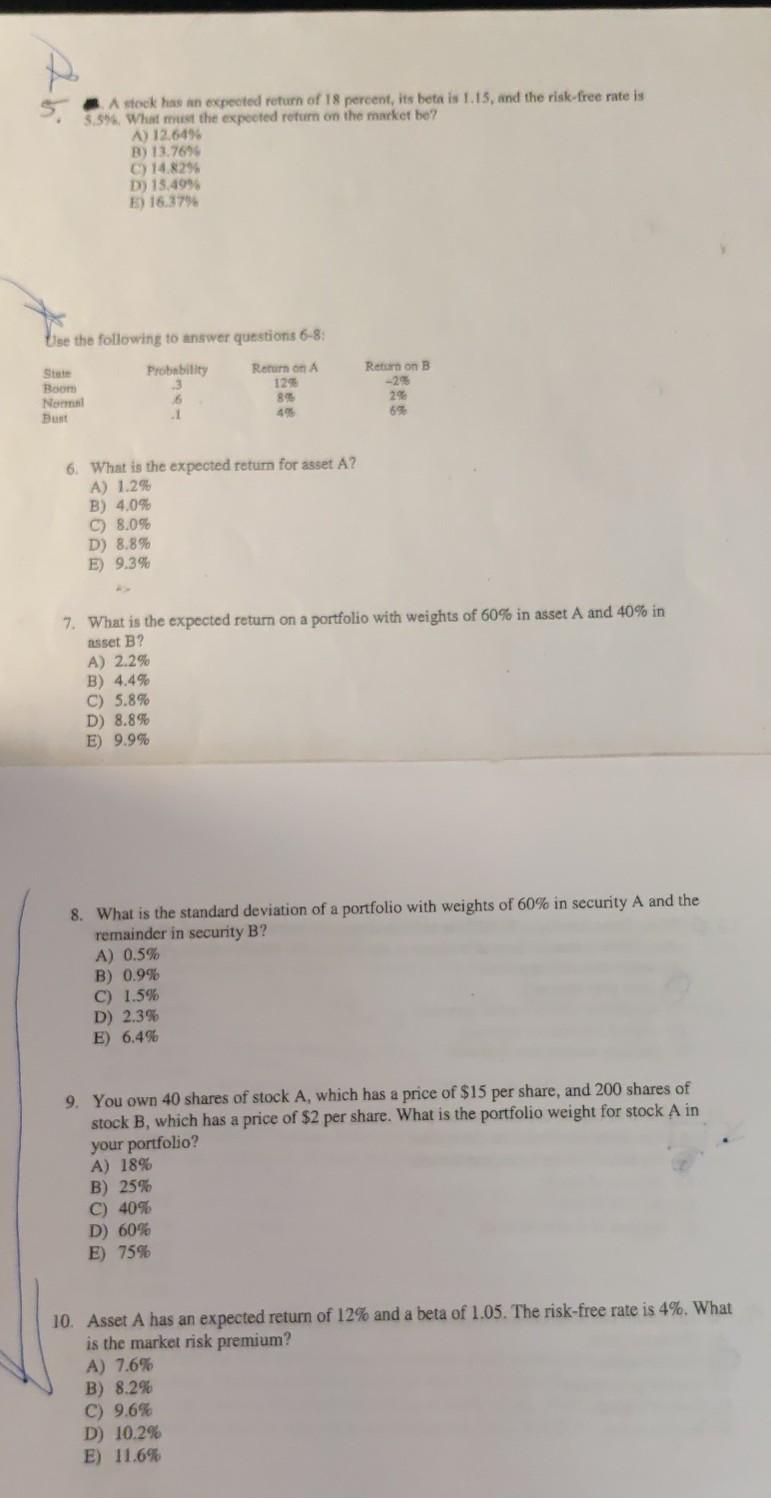

Use the following to answer questions 39-40: A U.S. firm is considering purchasing a subsidiary in Great Britain. The subsidiary will cost 16 million and will generate cash inflows of 7.6 million per year at the end of each of the next three years. After that, the company will be worthless. The current exchange rate is 0.83 British pounds per $1.00. The U.S. inflation rate is expected to be 4% over this period. The current risk- free rate of interest in the U.S. is 5% and the risk-free rate in Great Britain is 8%. 39. What is the cost of the project in U.S. dollars? A) $13.28 million B) $14.63 million C) $19.28 million D) $21.53 million E) $23.03 million 40. If interest rate parity holds, what is the 1-year forward rate for exchanging pounds for dollars? A) 0.830 B) 0.854 C) 0.863 D) 0.881 E) 0.907 Page 12 - A stock has an expected return of 18 percent, its bota is 1.15, and the risk-free rate is 3.5" What must the expected return on the market be? A) 12.6496 B) 13.7695 C) 14.829 D) 15.49% 55) 16.37% Use the following to answer questions 6-8: Probability Return on B Stot Boom Noel Return on A 1296 6 . 23 693 6. What is the expected return for asset A? A) 1.2 B) 4.0% C) 8.0% D) 8.8% E) 9.39 7. What is the expected return on a portfolio with weights of 60% in asset A and 40% in asset B? A) 2.2% B) 4.49 C) 5.8% D) 8.8% E) 9.99 8. What is the standard deviation of a portfolio with weights of 60% in security A and the remainder in security B? A) 0.5% B) 0.9% C) 1.5% D) 2.3% E) 6.4% 9. You own 40 shares of stock A, which has a price of $15 per share, and 200 shares of stock B, which has a price of $2 per share. What is the portfolio weight for stock A in your portfolio? A) 18% B) 25% C) 40% D) 60% E) 75% 10. Asset A has an expected return of 12% and a beta of 1.05. The risk-free rate is 4%. What is the market risk premium? A) 7.6% B) 8.2% C) 9.6% D) 10.2% E) 11.6%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started