Answered step by step

Verified Expert Solution

Question

1 Approved Answer

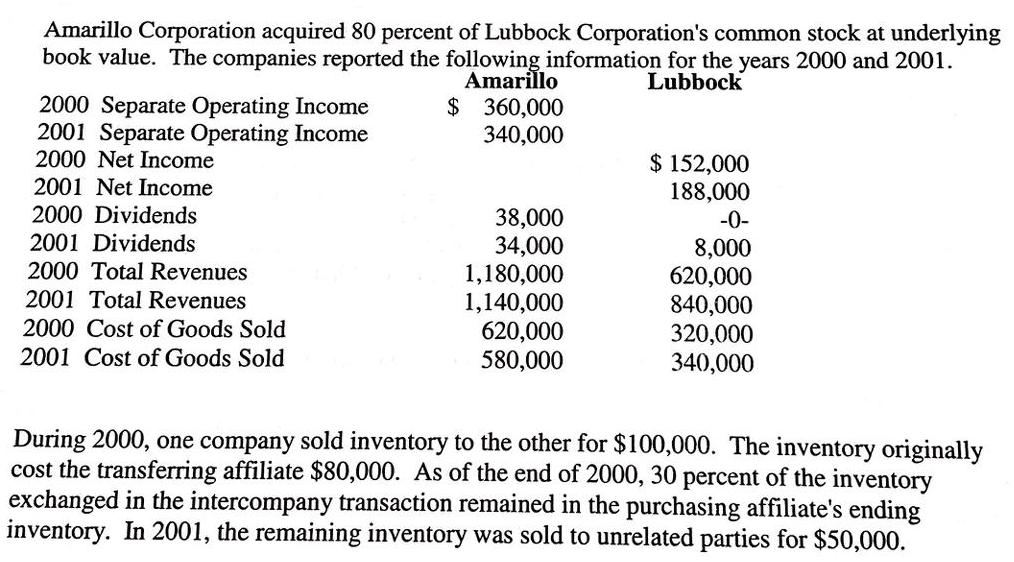

Amarillo Corporation acquired 80 percent of Lubbock Corporation's common stock at underlying book value. The companies reported the following information for the years 2000

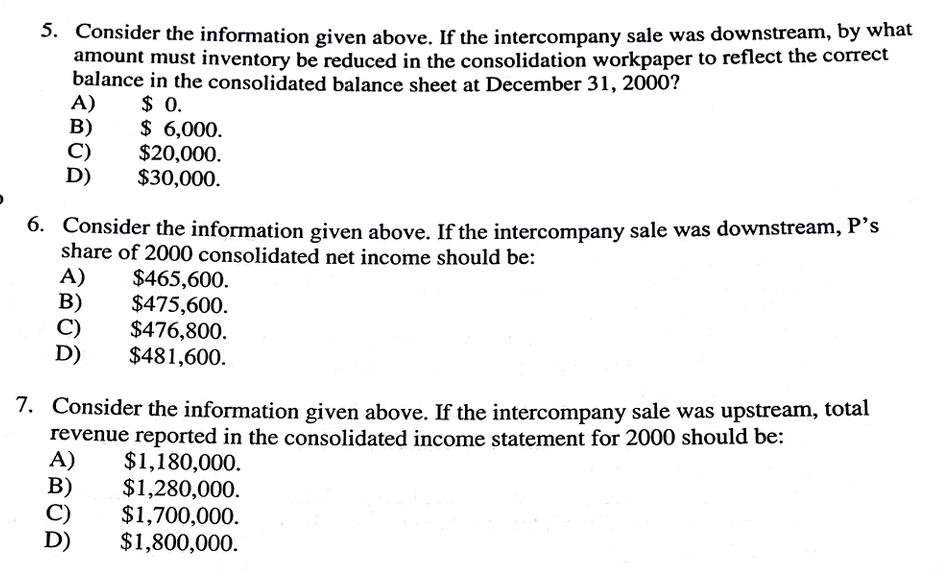

Amarillo Corporation acquired 80 percent of Lubbock Corporation's common stock at underlying book value. The companies reported the following information for the years 2000 and 2001. Amarillo Lubbock $360,000 340,000 2000 Separate Operating Income 2001 Separate Operating Income 2000 Net Income 2001 Net Income 2000 Dividends 2001 Dividends 2000 Total Revenues 2001 Total Revenues 2000 Cost of Goods Sold 2001 Cost of Goods Sold 38,000 34,000 1,180,000 1,140,000 620,000 580,000 $152,000 188,000 -0- 8,000 620,000 840,000 320,000 340,000 During 2000, one company sold inventory to the other for $100,000. The inventory originally cost the transferring affiliate $80,000. As of the end of 2000, 30 percent of the inventory exchanged in the intercompany transaction remained in the purchasing affiliate's ending inventory. In 2001, the remaining inventory was sold to unrelated parties for $50,000. 5. Consider the information given above. If the intercompany sale was downstream, by what amount must inventory be reduced in the consolidation workpaper to reflect the correct balance in the consolidated balance sheet at December 31, 2000? $0. A) B) D) 6. Consider the information given above. If the intercompany sale was downstream, P's share of 2000 consolidated net income should be: A) B) D) $ 6,000. $20,000. $30,000. A) B) D) $465,600. $475,600. $476,800. $481,600. 7. Consider the information given above. If the intercompany sale was upstream, total revenue reported in the consolidated income statement for 2000 should be: $1,180,000. $1,280,000. $1,700,000. $1,800,000.

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Consider the information given above If the intercompany sale was downstream by what amount must inv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started