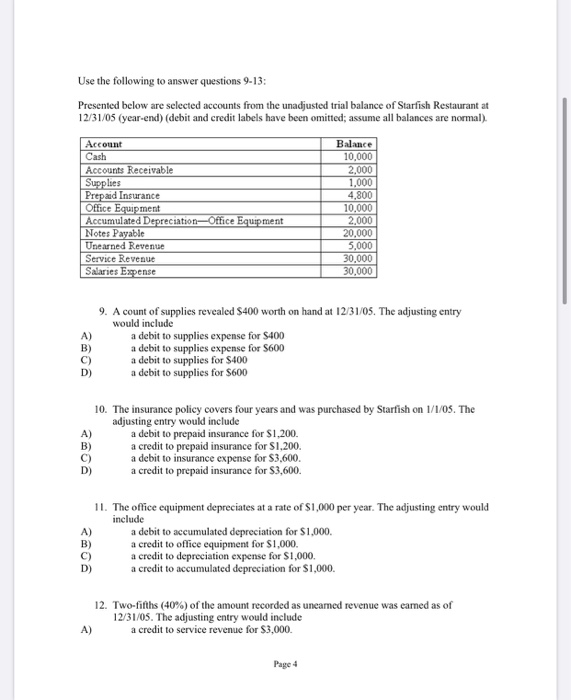

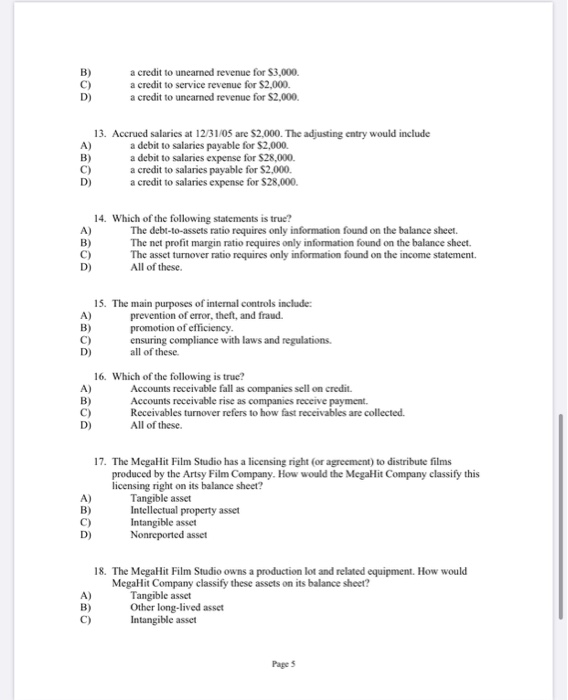

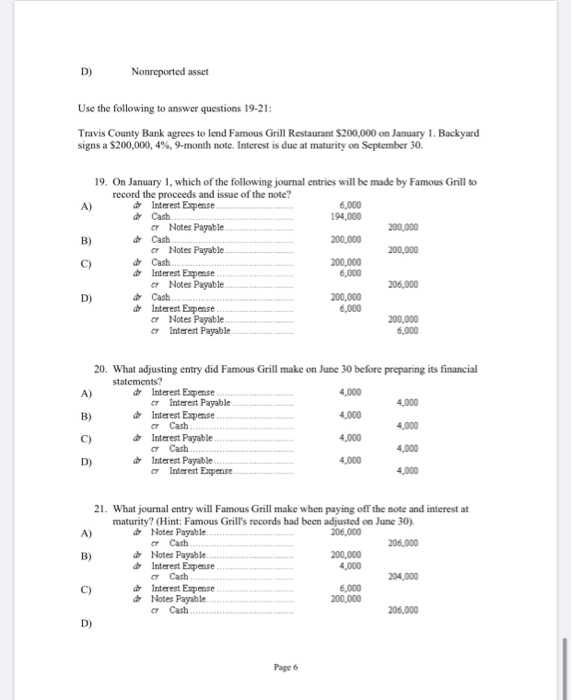

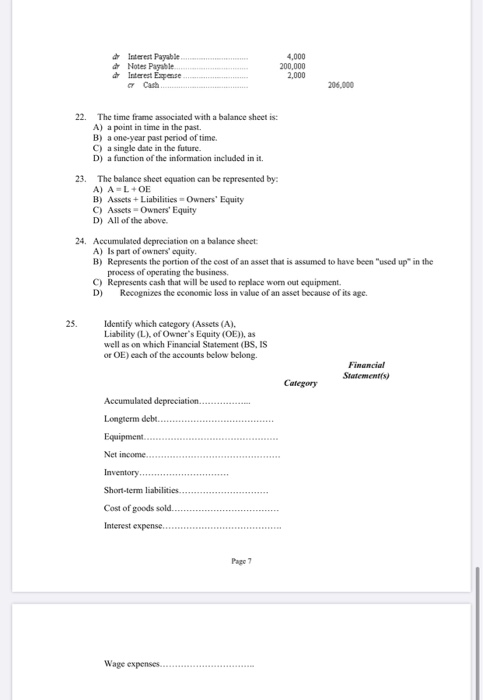

Use the following to answer questions 9-13: Presented below are selected accounts from the unadjusted trial balance of Starfish Restaurant at 12/31/05 (year-end) (debit and credit labels have been omitted; assume all balances are normal). Account Cash Accounts Receivable Supplies Prepaid Insurance Office Equipment Accumulated Depreciation-Office Equipment Notes Payable Unearned Revenue Service Revenue Salaries Expense Balance 10,000 2,000 1,000 4,800 10,000 2.000 20,000 5,000 30,000 30,000 9. A count of supplies revealed $400 worth on hand at 12/31/05. The adjusting entry would include a debit to supplies expense for $400 a debit to supplies expense for S600 a debit to supplies for $400 a debit to supplies for $600 B) 10. The insurance policy covers four years and was purchased by Starfish on 1/1/05. The adjusting entry would include a debit to prepaid insurance for $1,200. a credit to prepaid insurance for $1,200. a debit to insurance expense for $3,600. a credit to prepaid insurance for $3,600. 11. The office equipment depreciates at a rate of $1,000 per year. The adjusting entry would include a debit to accumulated depreciation for $1,000 a credit to office equipment for $1,000. a credit to depreciation expense for $1,000. a credit to accumulated depreciation for $1,000 B) 12. Two-fifths (40%) of the amount recorded as uneared revenue was cared as of 12/31/05. The adjusting entry would include A) a credit to service revenue for $3,000 Page 4 a credit to uncarned revenue for $3,000. a credit to service revenue for $2,000. a credit to unearned revenue for $2,000. B) 13. Accrued salaries at 12/31/05 are $2,000. The adjusting entry would include a debit to salaries payable for $2,000 a debit to salaries expense for $28,000 a credit to salaries payable for $2.000. a credit to salaries expense for $28,000. D) 14. Which of the following statements is true? A) The debt-to-assets ratio requires only information found on the balance sheet. B) The net profit margin ratio requires only information found on the balance sheet. The asset turnover ratio requires only information found on the income statement D) All of these 15. The main purposes of internal controls include: prevention of error, theft, and fraud. promotion of efficiency. ensuring compliance with laws and regulations. all of these. 16. Which of the following is true? A) Accounts receivable fall as companies sell on credit. B) Accounts receivable rise as companies receive payment. Receivables turnover refers to how fast receivables are collected. D) All of these. 17. The MegaHit Film Studio has a licensing right (or agreement) to distribute films produced by the Artsy Film Company. How would the MegaHit Company classify this licensing right on its balance sheet? Tangible asset Intellectual property asset Intangible asset Nonreported asset 18. The MegaHit Film Studio owns a production lot and related equipment. How would MegaHit Company classify these assets on its balance sheet? Tangible asset Other long-lived asset Intangible asset B) C) Page 5 D) Nonreported asset Use the following to answer questions 19-21: Travis County Bank agrees to lend Famous Grill Restaurant S200,000 on January 1. Backyard signs a $200,000, 4%, 9-month note. Interest is due at maturity on September 30. A) 19. On January 1, which of the following journal entries will be made by Famous Grill to record the proceeds and issue of the note? Interest Expense 6,000 Cash 194,000 c Notes Payable 200,000 B) dy Cash 200.000 CF Notes Payable 200,000 C) dy Cash 200.000 Interest Expense 6,000 c Notes Payable 206,000 D) dy Cash 200,000 de Interest Expense 6,000 c Notes Payable 200.000 e Interest Payable 6,000 20. What adjusting entry did Famous Grill make on June 30 before preparing its financial statements? A) de Interest Expense 4,000 CT Interest Payable 4.000 B) de Interest Expense 4,000 CF Cash 4,000 C) Interest Payable 4,000 C Cash 4,000 D) Interest Payable 4,000 c Interest Expense 4,000 21. What journal entry will Famous Grill make when paying off the note and interest at maturity? (Hint: Famous Grill's records had been adjusted on June 30). A) Notes Payable 206.000 cy Cash 206,000 B) d Notes Payable 200.000 de Interest Expense 4,000 C Cash 204,000 C) Interest Expense 6,000 d Notes Payable 200,000 cy Cash 206.000 D) Page 6 Interest Payable Notes Payable Interest Expense 4.000 200,000 2.000 206,000 22. The time frame associated with a balance sheet is: A) a point in time in the past B) a one-year past period of time. C) a single date in the future. D) a function of the information included in it. 23. The balance sheet equation can be represented by: A) ALOE B) Assets + Liabilities = Owners' Equity C) Assets Owners' Equity D) All of the above. 24. Accumulated depreciation on a balance sheet: A) Is part of owners' equity B) Represents the portion of the cost of an asset that is assumed to have been used up in the process of operating the business C) Represents cash that will be used to replace wom out equipment D) Recognizes the economic loss in value of an asset because of its age. 25. Identify which category (Assets (A). Liability (L) of Owner's Equity (OE)), as well as on which Financial Statement (BS, IS or OE) each of the accounts below belong. Financial Statements) Category Accumulated depreciation. Longterm debt. Equipment Net income. Inventory Short-term liabilities Cost of goods sold.. Interest expense... Page 7 Wage expenses