Question

Use the forecast final sales volume of 25,000 (base case) and analyze the possible outcomes relative to the zero impact scenario for the following three

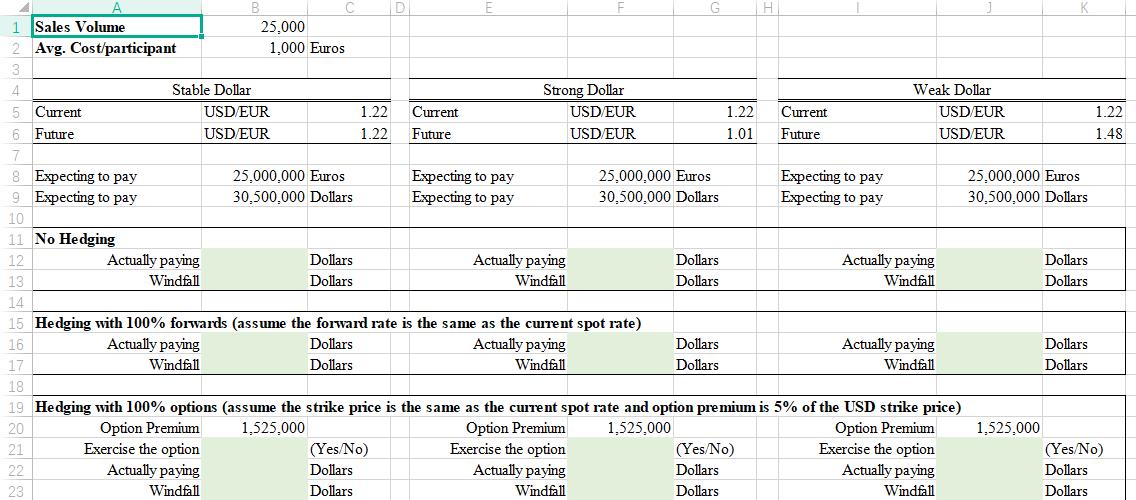

Use the forecast final sales volume of 25,000 (base case) and analyze the possible outcomes relative to the "zero impact" scenario for the following three hedging strategies:

- No hedge

- 100% hedge with forwards

- 100% hedge with options.

You can use the Excel template "Hedging Currency Risks at AIFS Base Case Template.xlsx" to answer this question.

Hint: The company forecasts its expected costs in dollars, using the current USD/EUR exchange rate, and these forecast costs provide a benchmark. If actual dollar costs are the same as forecast costs, there is “zero impact” on the company’s forecast cash flow. Actual dollar costs may be higher or lower than the benchmark costs because of fluctuations in the USD/EUR exchange. The impact of each hedging strategy is measured relative to the benchmark costs, or by comparing actual dollar costs using the hedge to the benchmark (“zero impact”) costs.

Current 1 Sales Volume 2 Avg. Cost/participant 3 4 5 6 Future 7 8 Expecting to pay 9 Expecting to pay 10 11 No Hedging 12 13 14 15 Hedging with 100% forwards (assume the forward rate is the same as the current spot rate) 16 Dollars Dollars Actually paying Windfall 17 Stable Dollar Actually paying Windfall Actually paying Windfall 25,000 C 1,000 Euros USD/EUR USD/EUR 25,000,000 Euros 30,500,000 Dollars Dollars Dollars 1.22 1.22 D (Yes/No) Dollars Dollars Current Future Expecting to pay Expecting to pay Strong Dollar USD/EUR USD/EUR Actually paying Windfall G Exercise the option Actually paying Windfall 25,000,000 Euros 30,500,000 Dollars Dollars Dollars Dollars Dollars 1.22 1.01 | H (Yes/No) Dollars Dollars Current Future Expecting to pay Expecting to pay Weak Dollar Actually paying Windfall 18 19 Hedging with 100% options (assume the strike price is the same as the current spot rate and option premium is 5% of the USD strike price) 20 Option Premium 1,525,000 Option Premium 1,525,000 Option Premium 21 Exercise the option Exercise the option 22 Actually paying Actually paying 23 Windfall Windfall Actually paying Windfall USD/EUR USD/EUR 25,000,000 Euros 30,500,000 Dollars 1,525,000 Dollars Dollars Dollars Dollars 1.22 1.48 (Yes/No) Dollars Dollars

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The analysis of the possible outcomes relative to the zero impact scenario for the following three hedging strategies Scenario Actual Costs WindfallLo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started