Question

Use the forecasted financial statements attached to calculate the IRR, for this project. Pretend that you are planning on building a plant that produces soybean

Use the forecasted financial statements attached to calculate the IRR, for this project.

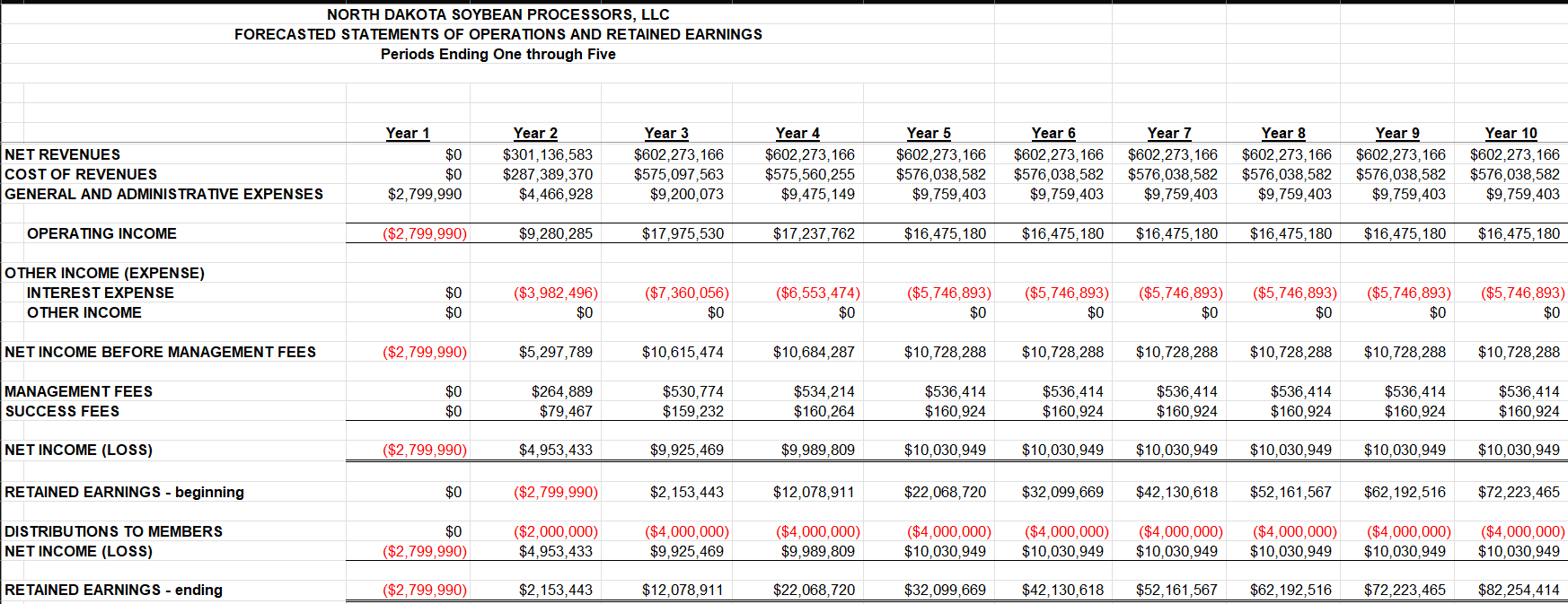

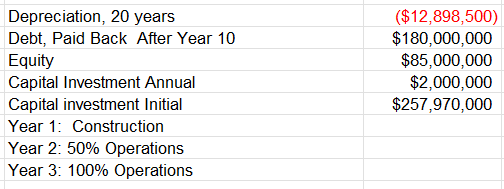

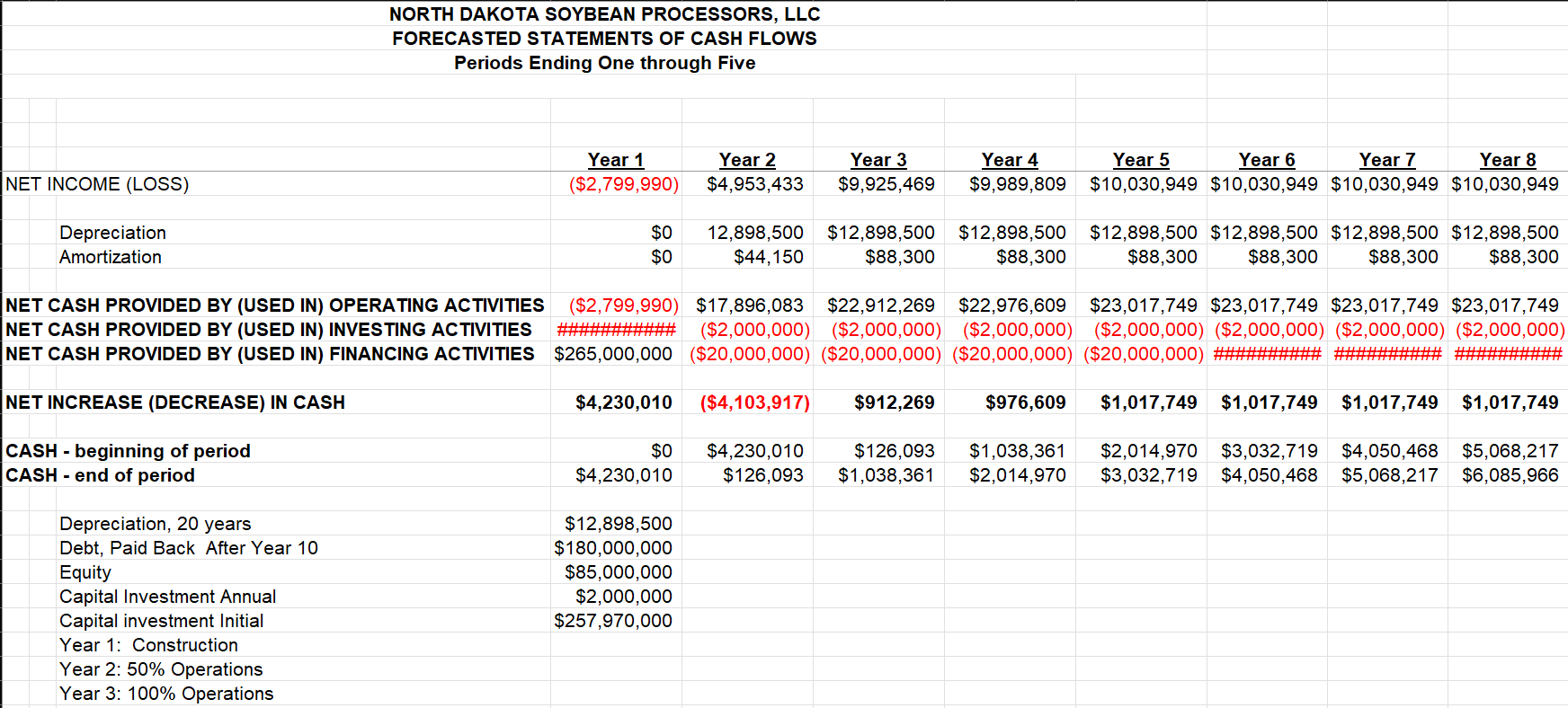

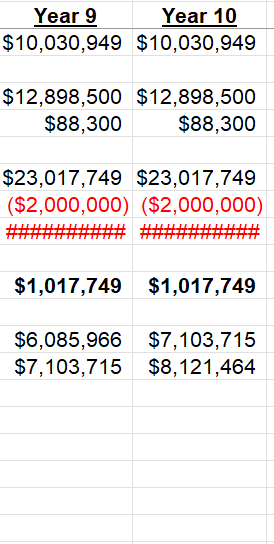

Pretend that you are planning on building a plant that produces soybean meal and oil. It will take 12 months to construct costing $257.97 million. You are going to finance this with $85 million in equity, and $180 million in debt. This debt will be over 10 years at $20 million a year plus interest. The life of this plant will be 30 years.

Use the forecasted financial statements attached to calculate the IRR. (You need to account for the 30-year life even with only 10 years of cash flow statements and income statements)

NORTH DAKOTA SOYBEAN PROCESSORS, LLC \begin{tabular}{l|r} \hline Depreciation, 20 years & ($12,898,500) \\ \hline Debt, Paid Back After Year 10 & $180,000,000 \\ \hline Equity & $85,000,000 \\ \hline Capital Investment Annual & $2,000,000 \\ \hline Capital investment Initial & $257,970,000 \\ \hline Year 1: Construction & \\ \hline Year 2: 50% Operations & \end{tabular} \begin{tabular}{r|r} \multicolumn{1}{|c|}{ Year 9 } & \multicolumn{1}{c}{ Year 10 } \\ \hline$10,030,949 & $10,030,949 \\ & \\ \hline$12,898,500 & $12,898,500 \\ $88,300 & $88,300 \\ & \\ \hline$23,017,749 & $23,017,749 \\ \hline($2,000,000) & ($2,000,000) \\ \hline####### & ####### \\ \hline$1,017,749 & $1,017,749 \\ & \\ \hline$6,085,966 & $7,103,715 \\ $7,103,715 & $8,121,464 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started