Question

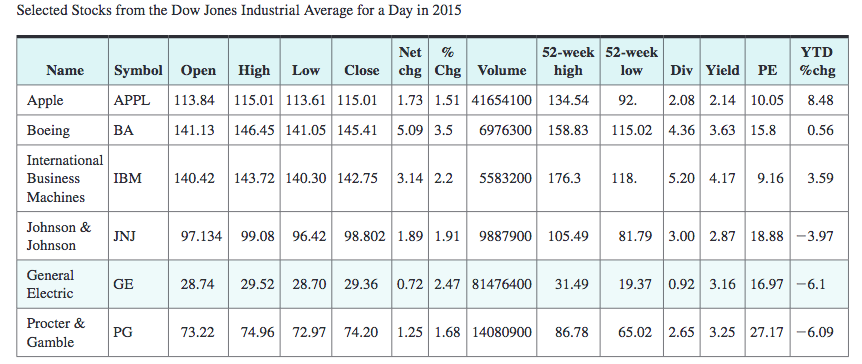

Use the given partial stock table. Round dollar amounts to the nearest cent when necessary. PART 1 Consider the following for Boeing (BA). (a) What

Use the given partial stock table. Round dollar amounts to the nearest cent when necessary.

PART 1

Consider the following for Boeing (BA).

(a) What is the difference between the highest and lowest prices paid for this stock during the last 52 weeks?

(b) Suppose that you own 850 shares of this stock. What dividend do you receive this year?

(c) How many shares of this stock were sold during the trading day?

(d) Did the price of a share of this stock increase or decrease during the day shown in the table?

(e) What was the price of a share of this stock at the start of the trading day?

PART 2

Gary Walters owned 500 shares of stock in General Electric (GE). He purchased the shares at a price of $38.08 per share and sold them at the closing price of the stock given in the table.

(a) Ignoring dividends, what was Gary's profit or loss on the sale of the stock?

(b) If his broker charges 2.5% of the total sale price, what was the broker's commission?

Selected Stocks from the Dow Jones Industrial Average for a Day in 2015 Name YTD %chg Net % High Low Close chg Chg Volume 115.01 113.61 115.01 1.73 1.51 41654100 146.45 141.05 145.41 5.09 3.5 6976300 Symbol Open APPL 113.84 BA 141.13 52-week 52-week high low 134.54 92. 158.83 115.02 Apple Div Yield PE 2.08 2.14 10.05 4.36 3.63 15.8 8.48 0.56 Boeing International Business Machines IBM 140.42 143.72 140.30 142.75 3.14 2.2 5583200 176.3 118. 5.20 4.17 9.16 3.59 Johnson & Johnson JNJ 97.134 99,08 96.42 98.802 1.89 1.91 9887900 105.49 8 1.79 3.00 2.87 18.88 -3.97 General Electric 28.74 29.52 28.70 29.36 0.72 2.47 81476400 31.49 19.37 0.92 3.16 16.97 -6.1 Procter & Gamble PG 74.96 72.97 74.20 1.25 1.68 14080900 86.78 65.02 2.65 3.25 27.17 -6.09Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started