Question

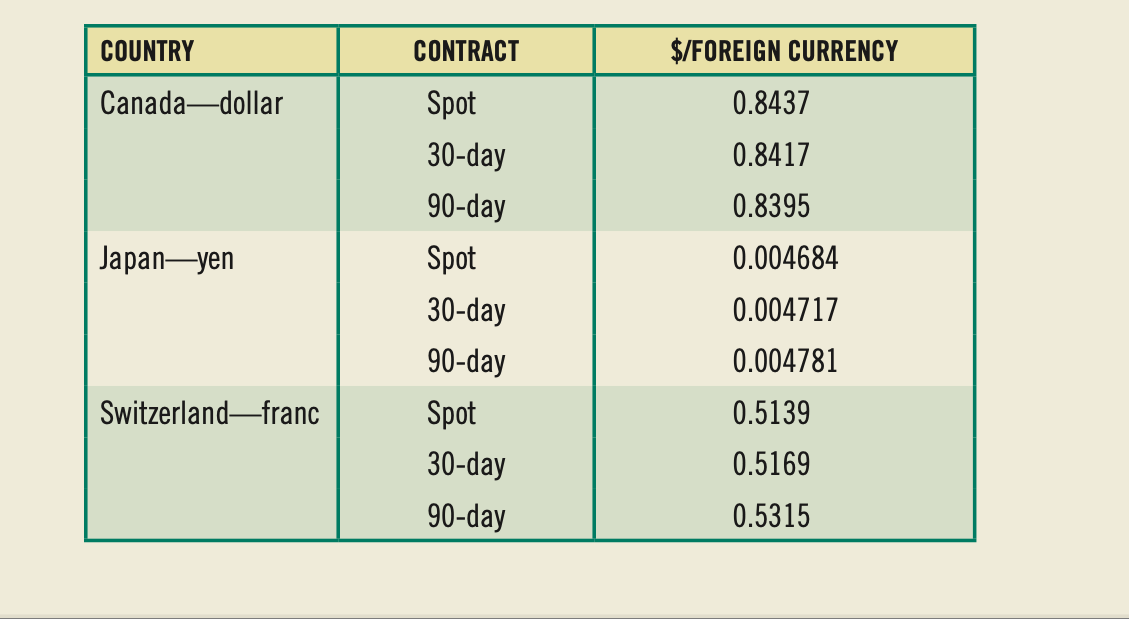

USE THE GIVEN TABLE TO ASNWER QUESTIONS 16-1 THROUGH 16-4 16-1. (Spot exchange rates) A U.S. firm needs to pay 10,000 Swiss francs to a

USE THE GIVEN TABLE TO ASNWER QUESTIONS 16-1 THROUGH 16-4

16-1. (Spot exchange rates) A U.S. firm needs to pay 10,000 Swiss francs to a firm in Switzerland, how much is this in U.S. dollars?

16-2. (Spot exchange rates) An American business needs to pay (a) 10,000 Canadian dollars, (b) 2 million yen, and (c) 50,000 Swiss francs to businesses abroad. What are the dollar payments to the respective countries?

16-3. (Spot exchange rates) An American business pays $10,000, $15,000, and $20,000 to suppliers in Japan, Switzerland, and Canada, respectively. How much, in local currencies, do the suppliers receive?

16-4. (Indirect quotes) Compute the indirect quote for the spot and forward Canadian dollar, yen, and Swiss franc contracts.

COUNTRY CONTRACT $/FOREIGN CURRENCY 0.8437 Canadadollar 0.8417 0.8395 Japanyen Spot 30-day 90-day Spot 30-day 90-day Spot 30-day 90-day 0.004684 0.004717 0.004781 0.5139 Switzerland-franc 0.5169 0.5315Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started