Question

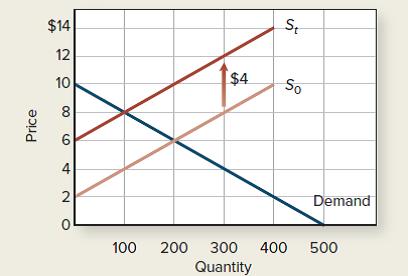

Use the graph below that shows the effect of a $4 per-unit tax on suppliers to answer the following questions: a. What are equilibrium price

a. What are equilibrium price and quantity before the tax? After the tax?

b. What is producer surplus when the market is in equilibrium before the tax? After the tax?

c. What is consumer surplus when the market is in equilibrium before the tax? After the tax?

d. What is total tax revenue collected after the tax is implemented?

$14 12 10 $4 So 8 6 4 2 Demand 100 200 300 400 500 Quantity Price

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answers a The equilibrium price before the tax 6 where S0 equals de...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Economics

Authors: Robert Frank, Ben Bernanke

5th edition

73511404, 978-0073511405

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App