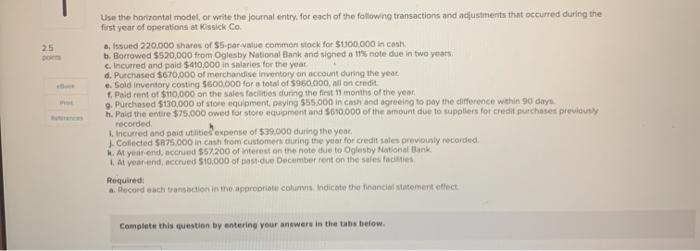

Question: Use the horizontal model or write the journal entry, for each of the following transactions and adjustments that occurred during the first year of operations

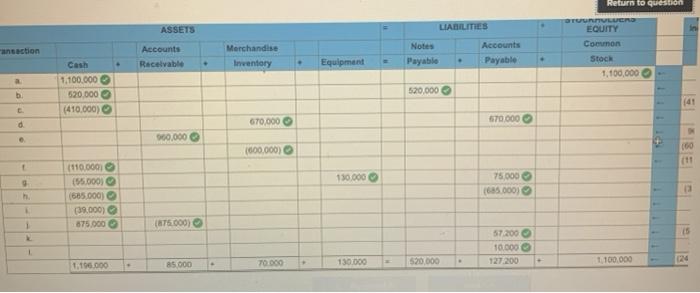

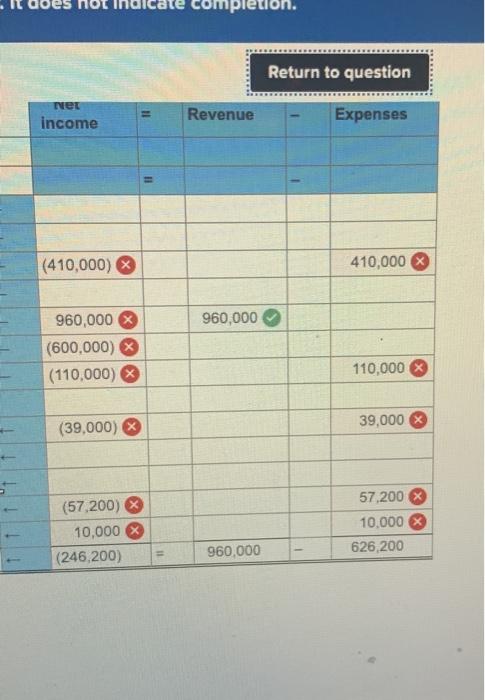

Use the horizontal model or write the journal entry, for each of the following transactions and adjustments that occurred during the first year of operations at issick Co. a, issued 220,000 shares of $5.parvative common stock for $1100,000 in cash b. Borrowed $520,000 from Oglesby National Bank and signed a note due in two years c. Incurred and paid $410,000 in salaries for the year d. Purchased $670,000 of merchandise inventory on account during the year, e. Sold inventory costing 5600,000 for a total of $960.000,all on credit 1. Paid rent of $110,000 on the sales facties during the first 11 months of the year 9. Purchased $130,000 of store equipment paying $55.000 in cash and agreeing to pay the difference within 90 days 1. Paid the entire $75.000 owed for store equipment and 5610.000 of the amount due to suppliers for credit purchases previously recorded I. Incurred and paid utilities expense of $39.000 during the year J. Collected $875.000 in cash from customers during the year for credit sales previously recorded L. At year end, accrued $52.200 of interest on the note due to Ogresby National Bank At year and accrued 510,000 of post.de December rent on the sales facies Required: a. Bocord each action in the appropriate columns indicate the Financial statement effect Complete this question by entering your answers in the tabs below. ASSETS LIABILITIES Return to question OTURERS EQUITY Common Stoch 1,100,000 ansaction Accounts Receivable Merchandise Inventory Notes Payabile Accounts Payable Equipment Cash 1.100.000 520.000 (410.000) 520.000 b (40 670,000 670.000 d 900.000 (600.000) 160 (11 130.000 (110.000 (55.000 (665.000) (39.000) 175.000 75.000 85.000) 00 1 (875.000) 57200 10.000 127.200 1 16.000 520.000 85.000 70 000 130.000 024 1.100.000 completion. Return to question Net 11 Revenue income Expenses 11 (410,000) 410,000 960,000 960,000 (600.000) (110,000) 110,000 39,000 (39,000) X x x (57,200) X 10,000 X (246,200) 57,200 10.000 626,200 960,000 Use the horizontal model or write the journal entry, for each of the following transactions and adjustments that occurred during the first year of operations at issick Co. a, issued 220,000 shares of $5.parvative common stock for $1100,000 in cash b. Borrowed $520,000 from Oglesby National Bank and signed a note due in two years c. Incurred and paid $410,000 in salaries for the year d. Purchased $670,000 of merchandise inventory on account during the year, e. Sold inventory costing 5600,000 for a total of $960.000,all on credit 1. Paid rent of $110,000 on the sales facties during the first 11 months of the year 9. Purchased $130,000 of store equipment paying $55.000 in cash and agreeing to pay the difference within 90 days 1. Paid the entire $75.000 owed for store equipment and 5610.000 of the amount due to suppliers for credit purchases previously recorded I. Incurred and paid utilities expense of $39.000 during the year J. Collected $875.000 in cash from customers during the year for credit sales previously recorded L. At year end, accrued $52.200 of interest on the note due to Ogresby National Bank At year and accrued 510,000 of post.de December rent on the sales facies Required: a. Bocord each action in the appropriate columns indicate the Financial statement effect Complete this question by entering your answers in the tabs below. ASSETS LIABILITIES Return to question OTURERS EQUITY Common Stoch 1,100,000 ansaction Accounts Receivable Merchandise Inventory Notes Payabile Accounts Payable Equipment Cash 1.100.000 520.000 (410.000) 520.000 b (40 670,000 670.000 d 900.000 (600.000) 160 (11 130.000 (110.000 (55.000 (665.000) (39.000) 175.000 75.000 85.000) 00 1 (875.000) 57200 10.000 127.200 1 16.000 520.000 85.000 70 000 130.000 024 1.100.000 completion. Return to question Net 11 Revenue income Expenses 11 (410,000) 410,000 960,000 960,000 (600.000) (110,000) 110,000 39,000 (39,000) X x x (57,200) X 10,000 X (246,200) 57,200 10.000 626,200 960,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts