Question

Use the horizontal model to record the payment of a one-year insurance premium of $9,720 on May 1, 2022. Prepare the journal entry to record

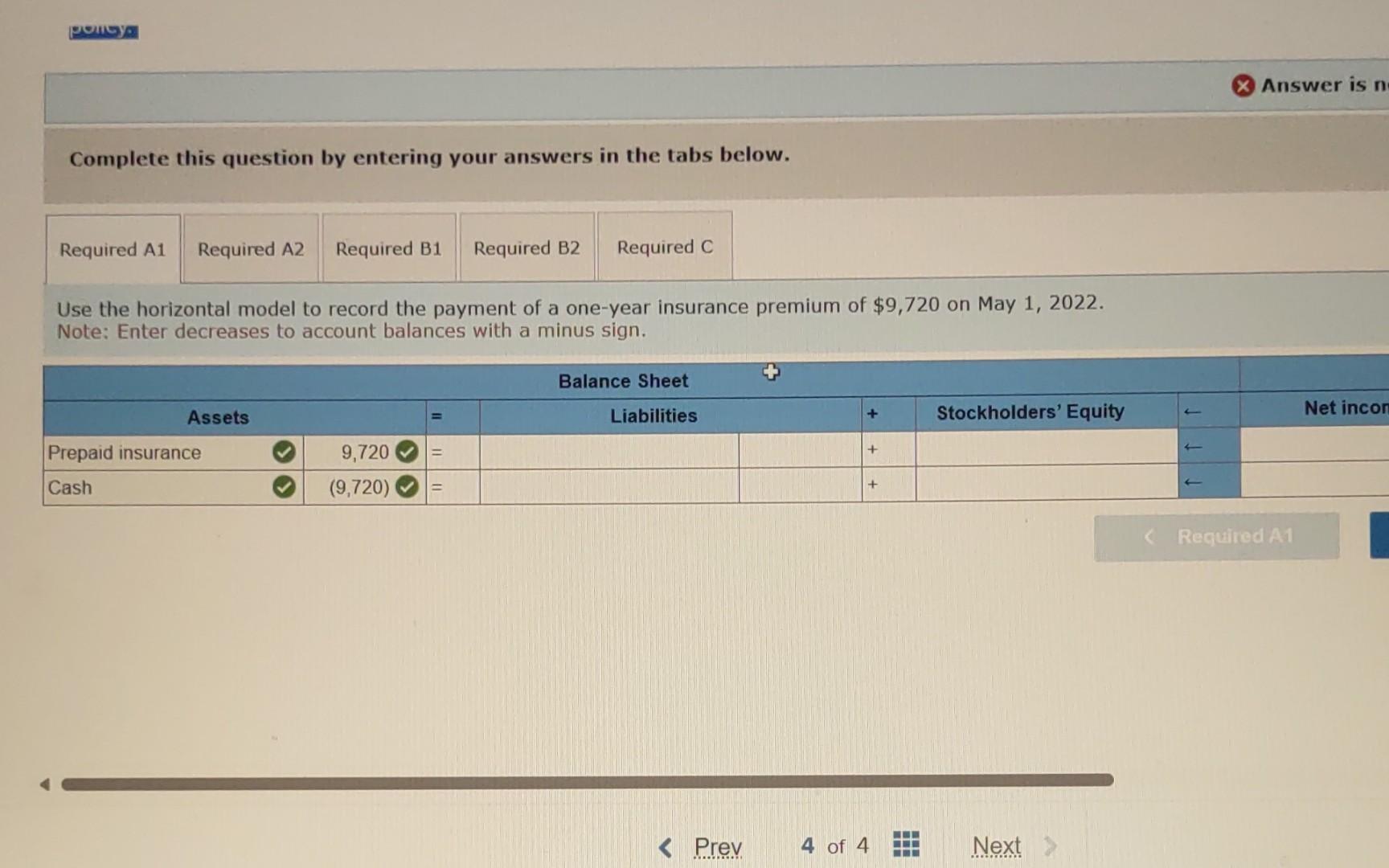

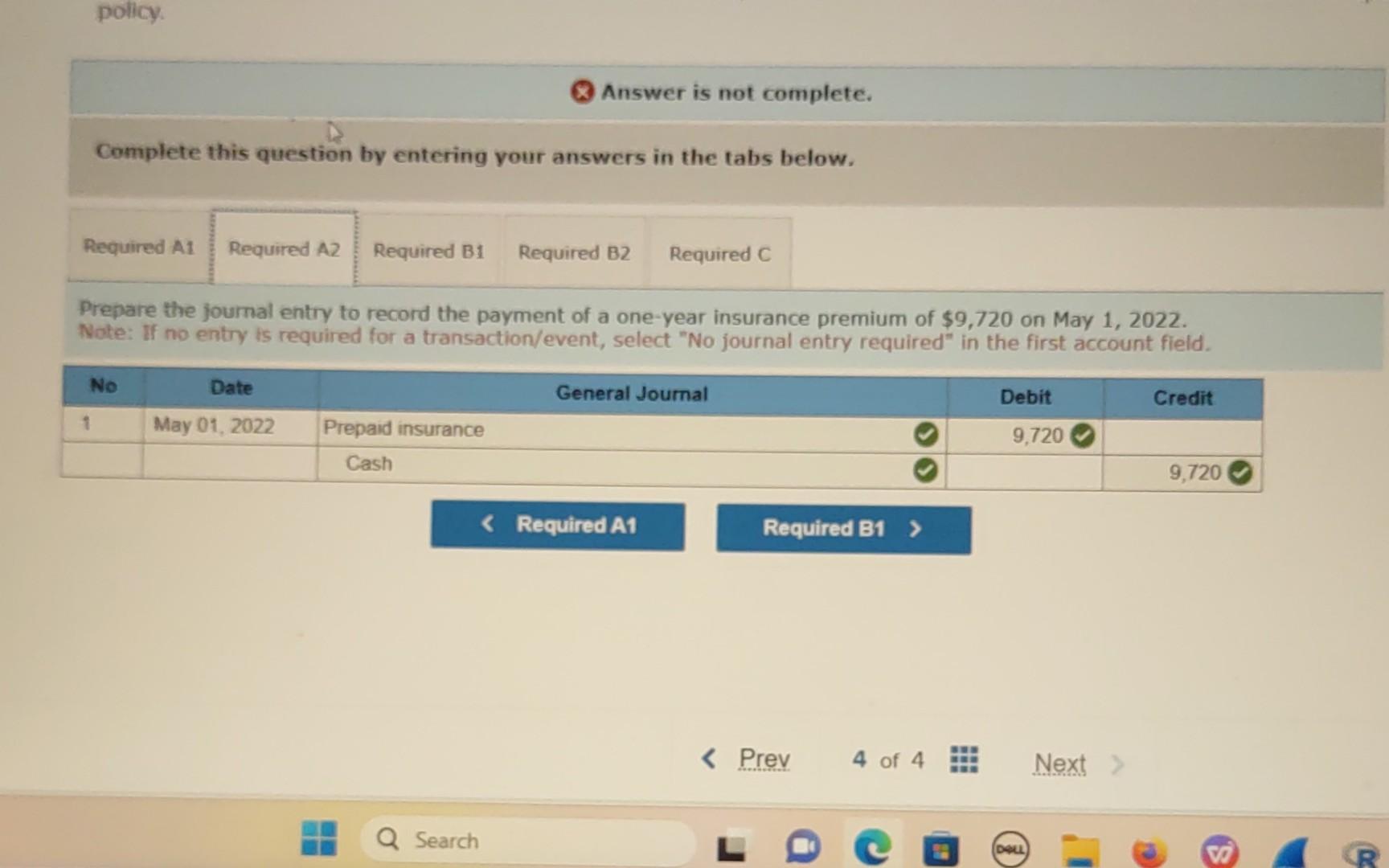

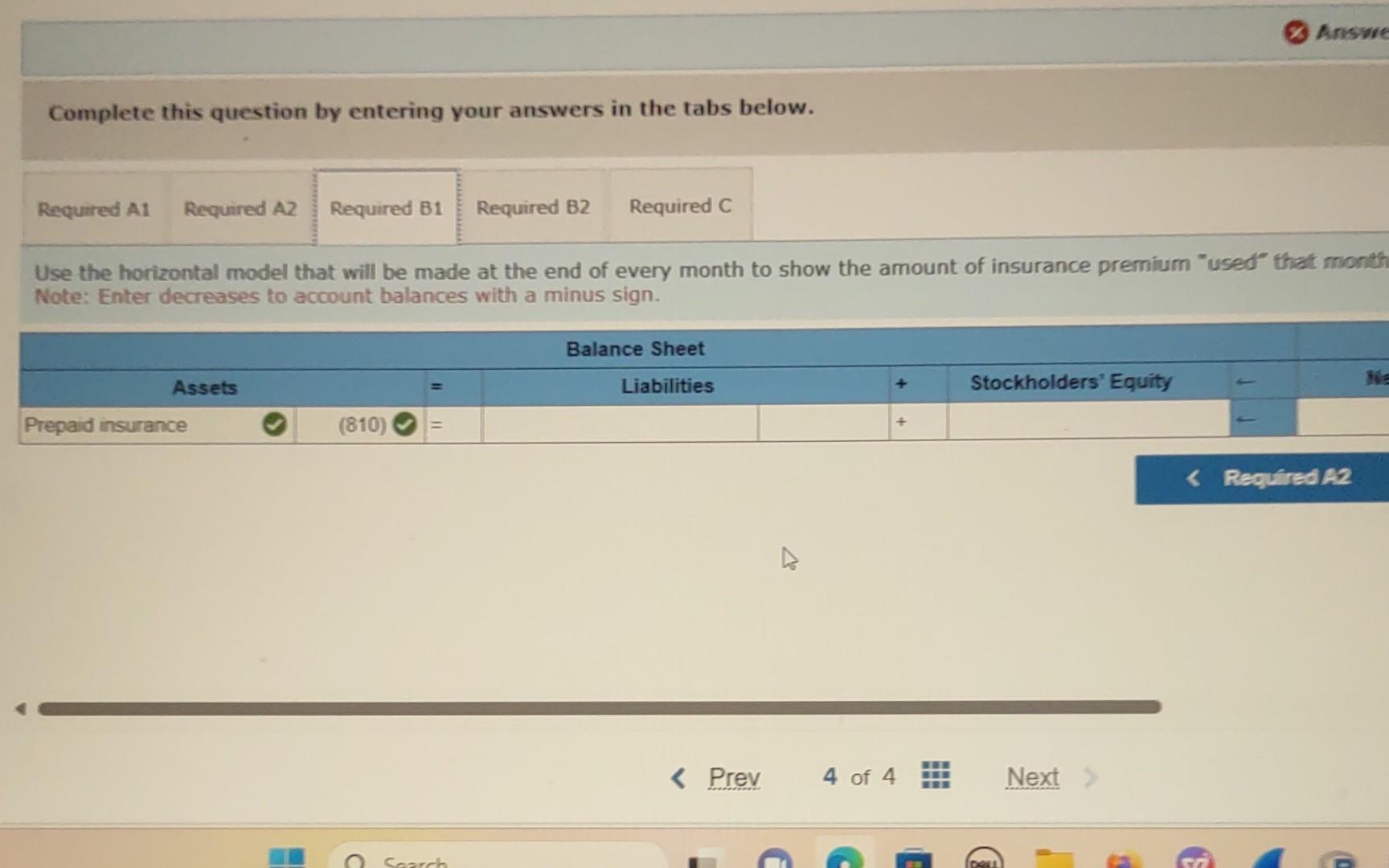

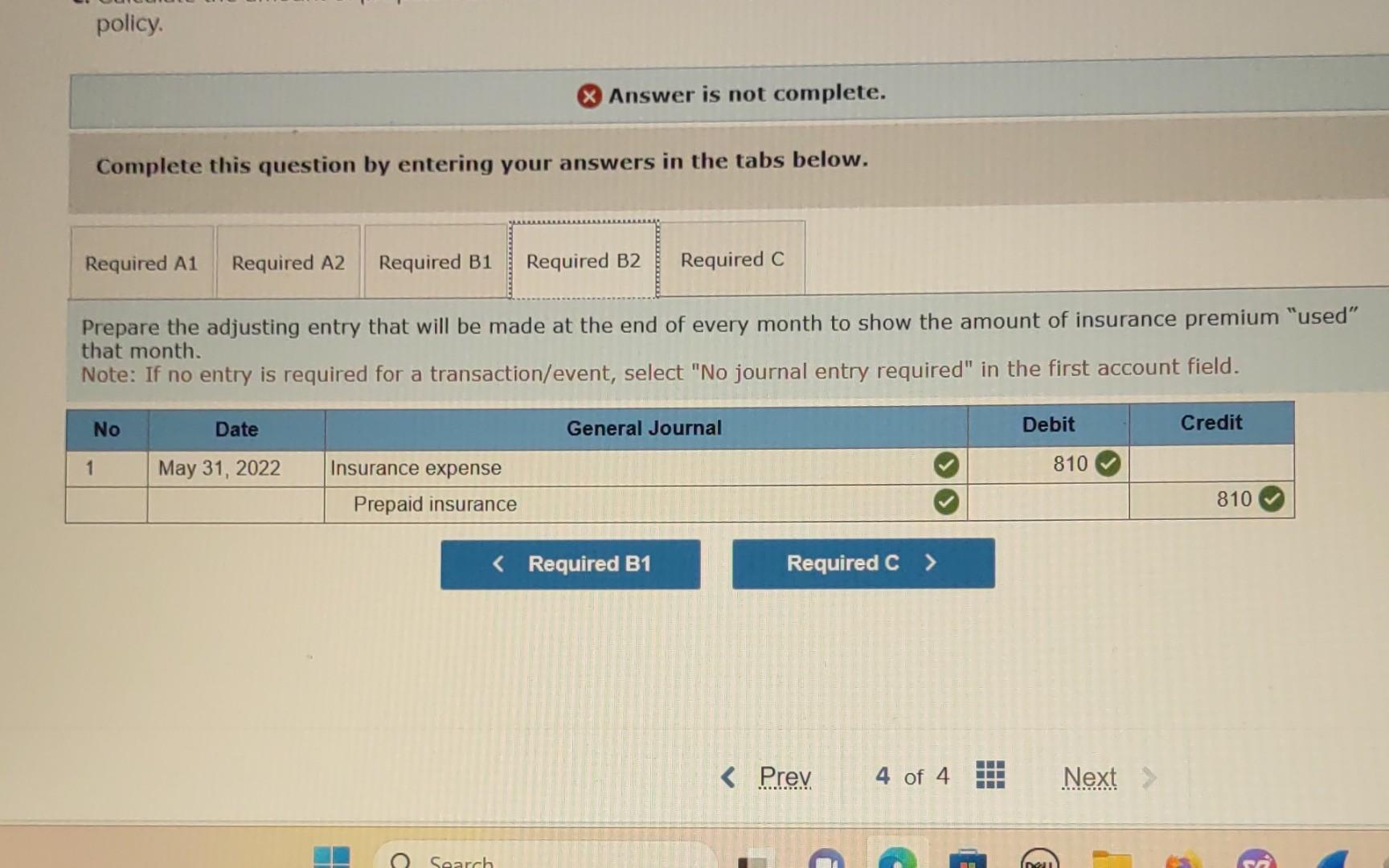

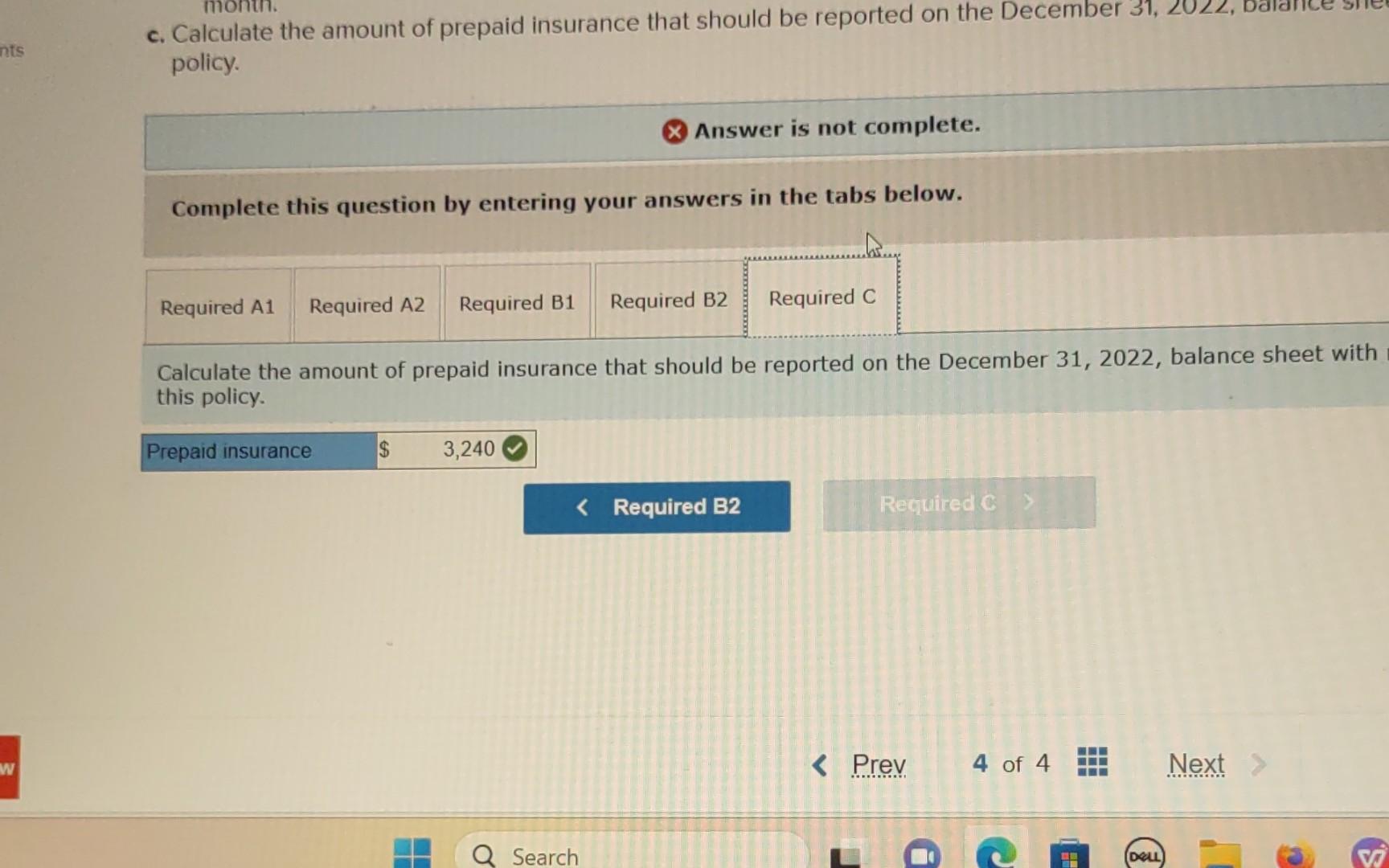

Use the horizontal model to record the payment of a one-year insurance premium of $9,720 on May 1, 2022. Prepare the journal entry to record the payment of a one-year insurance premium of $9,720 on May 1, 2022. Use the horizontal model that will be made at the end of every month to show the amount of insurance premium used that month. Prepare the adjusting entry that will be made at the end of every month to show the amount of insurance premium used that month. Calculate the amount of prepaid insurance that should be reported on the December 31, 2022, balance sheet with respect to this policy.

Complete this question by entering your answers in the tabs below. Use the horizontal model to record the payment of a one-year insurance premium of $9,720 on May 1, 2022. Note: Enter decreases to account balances with a minus sign. Complete this question by entering your answers in the tabs below. Use the horizontal model that will be made at the end of every month to show the amount of insurance premium "used" that monh Note: Enter decreases to account balances with a minus sign. c. Calculate the amount of prepaid insurance that should be reported on the December 31 , policy. Answer is not complete. Complete this question by entering your answers in the tabs below. Calculate the amount of prepaid insurance that should be reported on the December 31,2022 , balance sheet with this policy. Q Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare the journal entry to record the payment of a one-year insurance premium of $9,720 on May 1,2022. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. policy. Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare the adjusting entry that will be made at the end of every month to show the amount of insurance premium "used" that month. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Complete this question by entering your answers in the tabs below. Use the horizontal model to record the payment of a one-year insurance premium of $9,720 on May 1, 2022. Note: Enter decreases to account balances with a minus sign. Complete this question by entering your answers in the tabs below. Use the horizontal model that will be made at the end of every month to show the amount of insurance premium "used" that monh Note: Enter decreases to account balances with a minus sign. c. Calculate the amount of prepaid insurance that should be reported on the December 31 , policy. Answer is not complete. Complete this question by entering your answers in the tabs below. Calculate the amount of prepaid insurance that should be reported on the December 31,2022 , balance sheet with this policy. Q Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare the journal entry to record the payment of a one-year insurance premium of $9,720 on May 1,2022. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. policy. Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare the adjusting entry that will be made at the end of every month to show the amount of insurance premium "used" that month. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started